The US dollar slipped on Friday as Donald Trump’s unstable tariff system increased global economic uncertainty and caused flights to gold and other heavenly assets.

The US dollar index was below the critical threshold of 100 due to fist time since July 2023 trading in Asia. The euro rose 0.8% to $1.13, while Sterling rose 0.3% to $1.30. The yen was 143.9 yen per dollar, reaching six months’ high.

“You’ve grown and inflation worries and worry about liquidity and market functioning,” said Mithul Koteka, head of Barclays’ emerging market macro strategy.

Gold prices hit record highs, with the Swiss franc rising sharply as investors moved to Heaven assets. Bullion prices jumped 1.4%, with the troy ounces reaching $3,218, and the Swiss franc climbing 1.2% against the dollar against SFR 0.814. We then reduced profits to trade mainly at SFR 0.82.

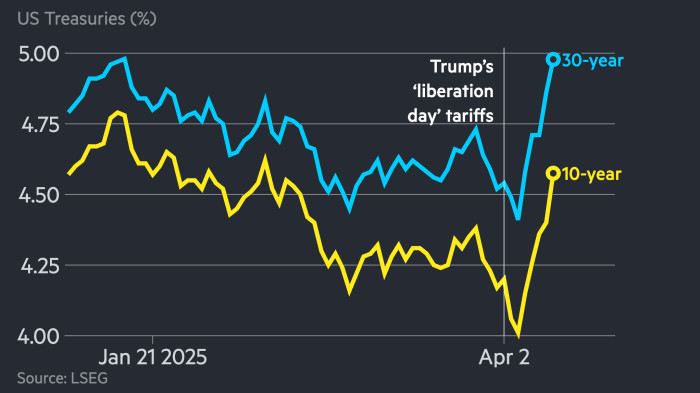

On Thursday, the S&P 500 fell 3.5% and the Nasdaq fell 4.3%, but the Treasury Department was sold due to concerns over a US recession and a trade war with China. Treasury yields for 2010 on Friday remained flat at 4.42% after rising 0.09% the previous day. Bond yields move inversely to the price.

Asian stocks fell 2.9% with Japan’s Topix, while Taiwan and India rose 2.8% and 2.3% respectively. Hong Kong’s Hang Sen index rose 1.1% and China’s CSI 300 rose 0.3%.