China News Services | China News Services | Getty Images

The Trump administration’s trade ceasefire with China, which suspended the steepest tariffs on Chinese goods, has given many importers little reprieve. The stacking of multiple tariff layers already underway during the trade war has boosted the costs of importing retail goods, which are far higher than the 30% associated with the interim contract.

“While companies are relieved to see a temporary suspension from the incredibly high tariffs on goods from China, retailers are still facing extremely high tariffs affecting prices and supply,” said Josh Teitelbaum, senior adviser at Akin.

“Multiple tariffs are a big problem for basic items like children’s backpacks, which are primarily coming from China,” said Dan Anthony, president of Worldwide’s trading partnership. “You’re talking about 70% or more charges,” he said.

This includes the existing 17.6% tariffs and 25% tiering of Section 301 tariffs (related to unfair trade practices), and 30% of tariffs on Chinese products are not included in the suspension – 20% fentanyl-related tariffs and 10% mutual tariffs.

Walmart CFO John David Rainey said in an interview with CNBC that tariffs could raise prices for items including food, toys and electronics after revenue this week. “We’re trying to do this the best we can,” he said in an interview with CNBC. “But this is a bit unprecedented in terms of the speed and magnitude of price increases coming,” he added.

Panjiva data shows that from January to May 12, 2025, the top three countries with freight from China (34.1%), followed by India (26.3%) and Hong Kong (10.6%).

For many importers, the true tariff tax on Chinese products currently ranges from 40% to 70%.

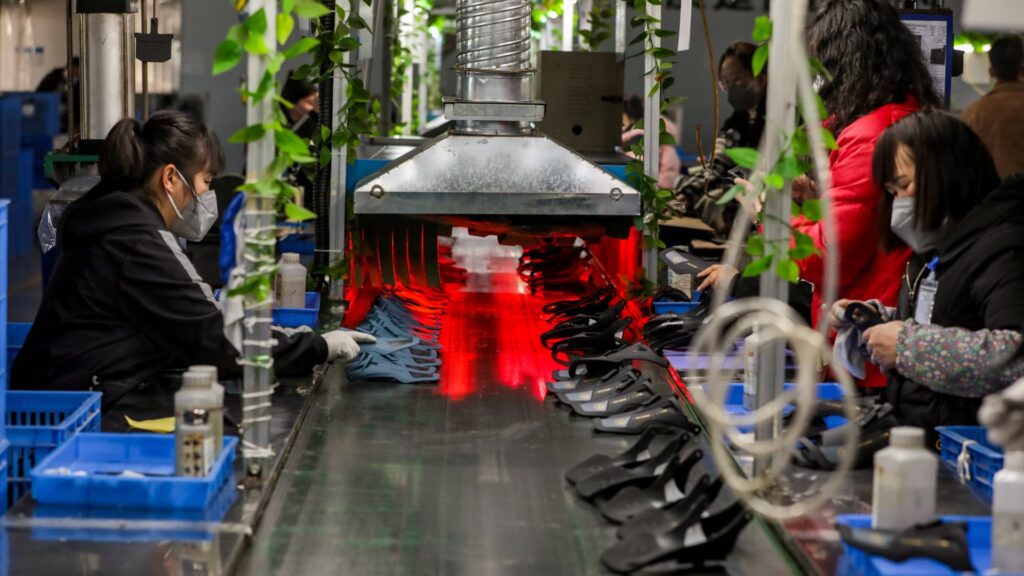

Teitelbaum provided footwear as an example. Children and women’s sneakers have leather uppers facing 40% tariffs when imported from China today, and factor 30% with fentanyl and restro department tariffs, in addition to standard rates for “most favorable countries” based on the WTO regulations of 10%.

The accumulation of tariffs drives the true cost of many other retail products well above 30%, including:

China’s cotton sweaters face 46.5% tariffs (16.5% supportive countries and mutual tariffs with fentanyl). Women’s swimsuits from China face a tariff of 54.9% (Faced with 24.9% of mutual tariffs with fentanyl and fentanyl. Mutual tariffs).

Matt Priest, president and CEO of The Footwear Distributors & Retailers of America, told CNBC that the 40% tariffs in the most popular category of imported women’s and children’s leather shoes are simply unsustainable for American families and footwear companies.

“These are not luxurious items, they are everyday shoes, and applying compound tariffs on them only increases the cost at the cash register,” the priest said. “It’s clear that almost $650 million worth of shoes from these shoes imported from China last year will disproportionately affect working-class consumers. Now is the time for a serious, bipartisan conversation about tariff reform that puts American families first.”

This accumulation of tariffs has led some small businesses to cut their product lines as a way to reduce financial tensions. Anjali Bhargava, founder of Spice Company’s Anjali’s Cup, says her company will be discontinuing the product as a special vacuum seal can that has been sold out.

Even before the 30% tariff was hit, she was paying 25% in tariffs. “These cans were more expensive than they could already afford, but even if they could absorb the 30% tariff, they can’t afford to add additional stress to uncertainty about how the story will change between the months involved in production and shipping the cans, as SMEs own handled them,” says Bhargava. “The past few months have been very unstable,” she added.

Bhargava said it is important to maximize the working capital potential she has available and minimize unnecessary risks, given how expensive the debt has become. Bhargava’s credit line saw interest rates increase to 23%, with another 2% withdrawing money.

“All my credit card rates are in my 20s, so interest is a big issue and ordering cans five or six months before I could sell was a big bottleneck,” Balgava said. “I used what I could to buy the materials and packaging that are essential to those products. Now we need to focus on building a stronger foundation for them and the company.”

Rick Woldenberg, CEO of Learning Resources, a family-owned company that manufactures educational toys and sues the Trump administration at a scheduled May 27th hearing, said it faces 30% tariffs, but the jump from zero to 30% is steep. Even if the suspension puts his company in a position to import some items again, it comes at a high price.

“The 30% obligation rate when we previously paid zero is a significant change in costs and will force a significant price increase to cover it,” Woldenberg said. “I think this tax is very inflationary. I don’t like the idea of participating in promoting inflation, so I rarely ecstatic with the news.”

He said that the book on finished products and work in China, part of the production order, is part of the production order, is part of the production order, after 45-60 days after Trump’s April 2 global tariff announcement is likely to be imported from Chinese factory partners. “We can now ease them from this inventory and try to sell here. We will selectively resume production of particularly sensitive products for a variety of reasons, but resources will continue and the transition from China will remain active,” Waldenburg said.

All small business owners say that tariffs are hurting their businesses and they have their trust in the process.

“We still don’t know what our costs will be or whether we will be. We assume that future decisions by this administration will be the last minute without prior notice, causing further pain and confusion.

Rick Muscat, president of Deer Staggs, a family-run shoe retailer who imports goods from China and sells them at major retailers such as Macy’s, Coles, JCPenney and Amazon, said that even lower prices in China have led to an increase in all existing tariffs.

“Even at a ‘down’ level, this will cause serious cash flow issues,” Muscat said. “We were paying $60,000 a month. Now we pay $360,000 a month. We need to cover this and cut our costs to find pay savings. We also need to raise the prices for future delivery,” he said.

“The losses from the past few weeks can’t be reversed and can only be addressed with some kind of long-term guarantee and stability that will allow you to make the best decisions about how to spend your money today, next week, next month, and set yourself up for future success,” Balgaba said. “I survived, and I’m pretty optimistic about business and business, but the stress to understand that was ravaging and it took a toll on me. I really needed to slow it down, not panic, but I’m going my way.”