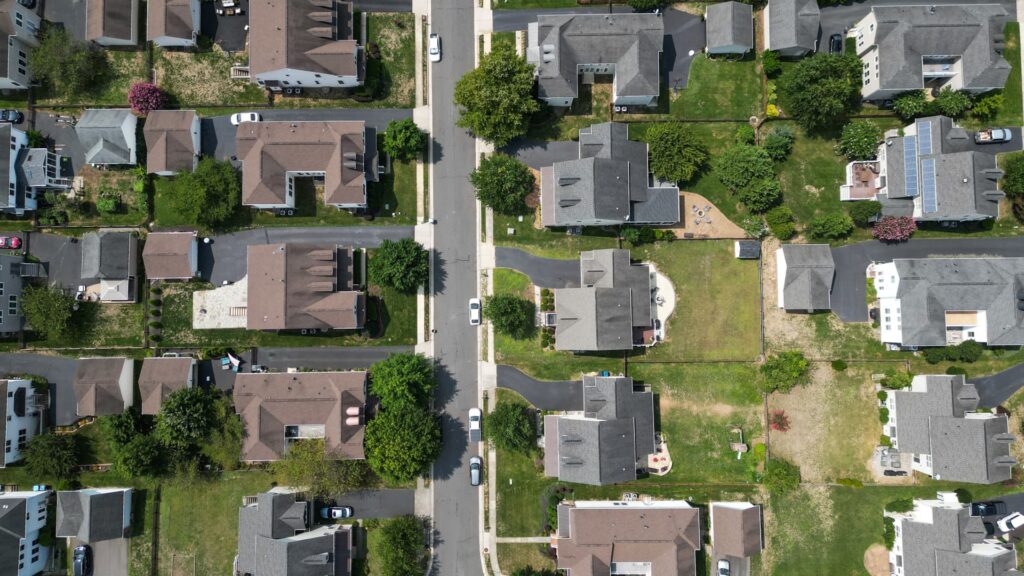

The development completed in Ashburn, Virginia on August 14th, 2024.

Andrew Caballero-Reynolds | AFP | Getty Images

Mortgage rates have fallen to their lowest level since last April, with current homeowners hoping to save.

Mortgage refinance applications rose 7% compared to last week, according to the Mortgage Association’s seasonally adjusted index. Demand was 40% higher than the same week a year ago.

The average contract interest rate for a 30-year fixed-rate mortgage with conforming loan balances fell from 6.88% to 6.79%, below $806,500, and fell from 0.62 to 0.62, including the departure fee for a 20% down payment loan. That rate is 24 basis points lower than the same week a year ago.

“We’re committed to providing a great opportunity to help you,” said Joel Kang, vice president and vice-chief economist at MBA. “Because borrowers with higher loans tend to be sensitive to rate changes, the average loan size for refinance applications has increased to $313,700 after an average of less than $300,000 over the past six weeks.”

However, home buyers were not driven much by lower rates. Mortgage applications to buy homes increased by just 0.1% in a week, 16% higher than the same week a year ago.

“Purchase activities have been essentially flat over the week as overall uncertainty continues to drive home buyers out of the market,” Kan added.

Mortgage rates have dropped even further to start this week, according to another survey with Mortgage News Daily. They were then flat on Tuesday, showing another increase after job posting data was released.

“If the job posting is higher than expected and everything else is equal, the rates usually go up,” wrote Mathew Graham, chief operating officer of Mortgage News, adding that this data-driven volatility has not been compared to what is seen on Thursday after the government’s monthly employment report has been released.