Blackstone is an American alternative asset manager with a major interest in rental housing. In recent years, the company has spent billions of dollars on acquisitions of brands such as Tricon Residential, American Campus Communities and Air Communities.

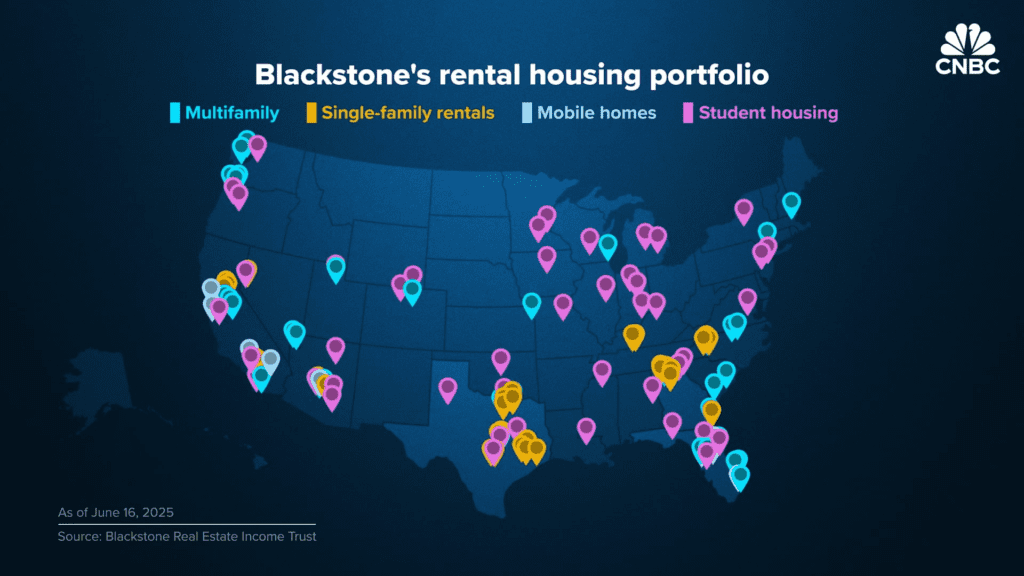

Blackstone’s rental home portfolio includes rental properties for apartments, student housing, mobile home parks, and detached homes. Much of the US assets are concentrated in major cities such as New York and in Sunbelt states such as Texas, Georgia and Florida.

The map displays the approximate locations of Blackstone Real Estate Income Trust Rental Housing Assets in the United States as of June 16, 2025.

“There’s a tendency to be highly consistent across our various capital pools,” said Kathleen McCarthy, global co-head of Blackstone Real Estate, in an interview with CNBC. “What we try to follow around the world is growing jobs and population.”

Blackstone says it owns less than 1% of the 46 million rental homes scattered around the country.

The Blackstone Real Estate Income Trust currently owns home rentals of at least 274,859 people. But this is a narrow slice of the overall portfolio.

“Of the $315 billion real estate, only about $55 billion in BREIT products sold to retail investors,” said Craig McCann, principal at SLCG Economic Consulting.

The Blackstone Real Estate was launched in 1991 with funds raised from accredited and institutional investors. The parent company, Blackstone Group, began as a private equity company that used techniques such as leveraged buyouts to acquire and improve bad assets.

“They recognized the value of diversification early,” said Gregory Warren, senior equity analyst at Morningstar.

Blackstone could potentially benefit from recent acquisitions over the next few years.

“It’s still cheaper than construction in many markets, as typical at the start of a new cycle.

Watch the video above to learn more about the rise of blackstone in the US housing rental market.