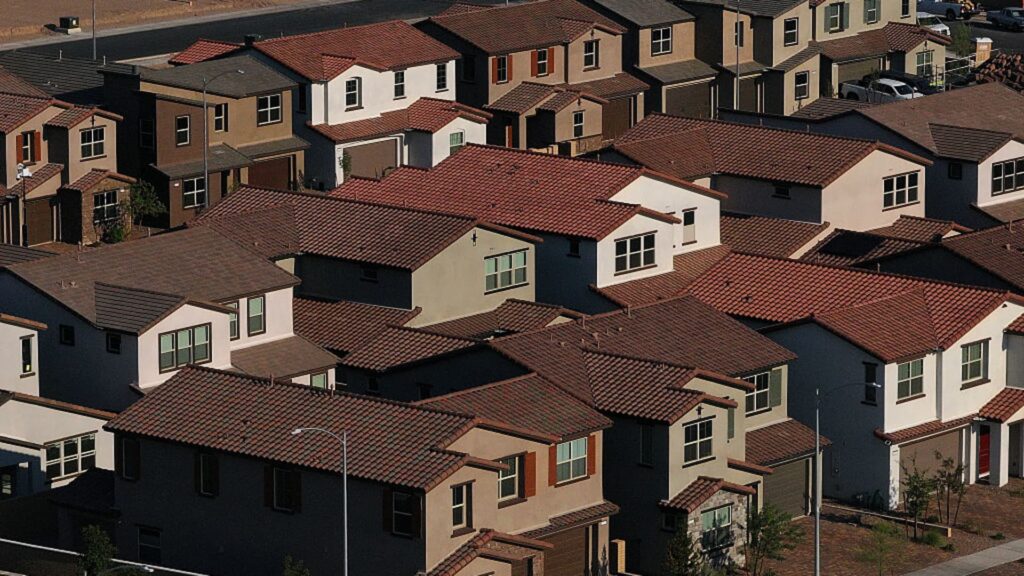

Aerial view of a residential development in Las Vegas, Nevada, August 8, 2025.

Justin Sullivan | Getty Images

After a massive surge in refinancing requests last week, which was brought about by a slower mortgage rate, where both refinance and home buyer mortgage applications stalled.

Mortgage fees were very slightly higher, but according to the Mortgage Bankers Association’s Seasonally Adjusted Index, a 1.4% reduction in total application amount by 1.4% compared to the previous week was enough.

The average contract interest rate for a 30-year fixed-rate mortgage with conforming loan balances rose from 6.67% to 6.68%, below $806,500, and points for a 20% down payment loan fell from 0.64 to 0.60.

Applications for refinancing household loans fell 3% in a week, but 23% higher than the same week a year ago. This is despite the fact that today’s prices are actually higher than this time of year. Last week, demand for refinancing increased by 23% per week. This figure is becoming increasingly unstable as there are so few borrowers who can make a profit from refinancing at the higher rates today.

Mortgage applications to buy homes rose 0.1% a week, 23% higher than the same week a year ago.

“The purchase application had little change over the course of a week, but it was at its strongest in four weeks, and it continued to surpass last year’s pace,” MBA economist Joel Kang released. “Faculty home buyers are more aggressive than last year despite economic headwinds, uncertainty and affordable challenges.”

Mortgage fees have been done nothing this week so far, but they have barely moved.

“Bonds (and therefore fees) remained open to the extent that we could see 24 hours after the employment report on August 1. The mortgage rate was even narrower than the broader bond market.”