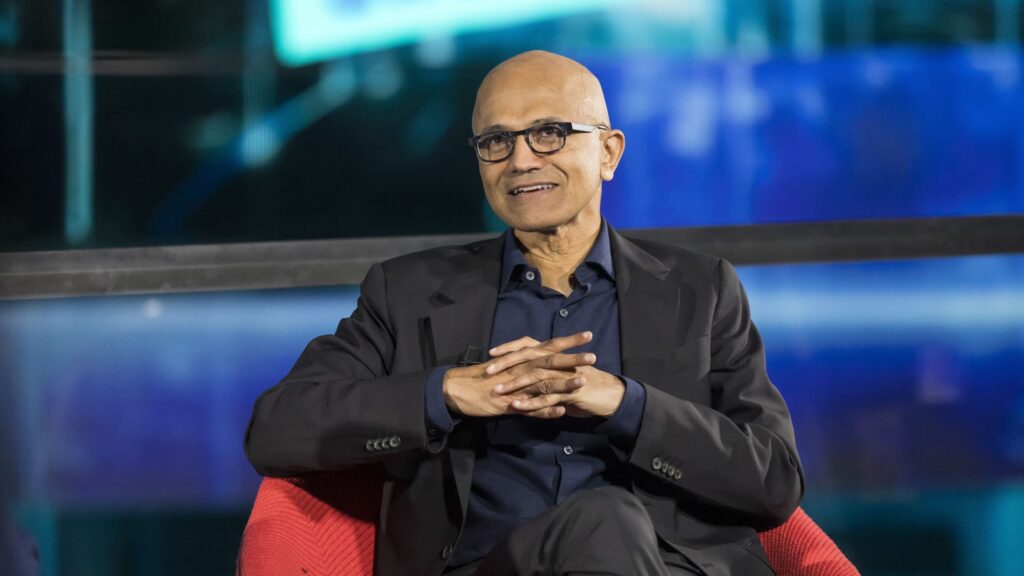

Microsoft CEO Satya Nadella will speak at Axel Springer Neubau in Berlin on October 17th, 2023

Ben Creeman | Getty Images

Microsoft Last week, it said it plans to stop offering discounts on enterprise purchases for Microsoft 365 productivity software subscriptions and other cloud applications.

Since its announcement, analysts have published estimates on whether more customers will ultimately pay. However, as investors are trying to understand what it means for Microsoft’s finances, UBS analysts said the change has already been factored into guidance.

“In our view, it is safe to assume that the impact of pricing changes was included in Microsoft’s forecast,” analysts wrote in a report late Tuesday. They have a buy rating on the stock price.

Microsoft’s disclosure came on August 12, two weeks after the software company’s fourth quarter revenue report, and issued a forecast that includes double-digit year-over-year revenue growth for the new fiscal year. After the report, the stock rose 4%.

In its blog post, Microsoft said, “This update is based on a consistent pricing model already in place for services like Azure, and reflects its ongoing commitment to greater transparency and integrity across all purchasing channels.”

This change applies to businesses with sufficient employees to enter the price level known as A, B, C, and D. This will take place when an organization signs up for a new service or renews an existing contract from November 1st.

“This action will allow us to provide more consistent and transparent pricing, enabling clear and informed decisions for our customers and partners,” a Microsoft spokesperson told CNBC in an email.

Jay Cuthrell, product chief at Microsoft Partner Nexustek, said customers will see price increases of 6% to 12%. The partner estimates a low shock of 3% and a 14%, UBS analysts write.

The growth of Microsoft 365 commercial seating is a measure of the number of licenses clients buy for workers, less than 10% since 2023. Microsoft aims to increase revenue per seat by selling Copilot add-ons and moving some users to more expensive plans.

It’s important to expand that part of your business. Microsoft’s operating profit for fiscal year 2025 came most of its $128.5 billion from productivity and business process units, with approximately 73% of the revenue in that segment coming from Microsoft 365 commercial products and cloud services.

Some customers may agree to pay Microsoft more to continue using the application rather than migrating to alternative services, said Adam Mansfield, who practices leads at the advisory firm Upper Edge. It could also reduce commitment to Microsoft in other areas, such as Azure Cloud Infrastructure, Mansfield said.

Nathan Taylor, senior vice president of SourcePass, an IT service provider for small and medium-sized businesses, says that if companies could potentially be able to pay a lower price with the loss of discounts, they would instead buy Cloud Reseller directly.

SourcePass hasn’t gained much lead as a result of Microsoft’s changes, Taylor says.

“It takes time for that information to spread throughout the industry,” he said.

Microsoft stocks have grown 20% this year, while NASDAQ has grown about 10%.

Watch: Microsoft’s software business has a tailwind for AI, says Ben Reitzes of Melius