When Texas Instruments announced its $60 billion manufacturing megaproject in July, it was a bold bet that companies wanted to mass-produce basic microchips in US soil. In August, Apple vowed to do just that.

At the same oval office press conference where President Donald Trump announced 100% tariffs on chips from companies not manufactured in the US, Apple CEO Tim Cook has increased its US US spending commitments to the next $600 billion over the next four years, starting from the original $500 billion announcement in February.

Part of that spending will be directed at new chip manufacturing plants in Utah and Texas to manufacture “critical foundation semiconductors” for iPhones and other devices, Cook said.

In July, CNBC became the first news organization to see inside Ti’s latest fab in Sherman, Texas. There, full production is scheduled for by the end of 2025. It is one of seven new factories chipmakers are building in the US to provide chips to major customers such as Nvidia, Ford Motor, Medtronic and SpaceX.

Texas Instruments doesn’t create the most advanced chips in the world, but its critical components can be found almost anywhere, from smartphones to Graphics Processing Units, which are generated and powered by AI.

“If there’s something that connects to the wall, or something that has a battery or cord, we’re probably bringing in multiple TI chips,” said Mohammad Yunus, senior vice president of TI technology and manufacturing.

However, just a month after TI announced its $60 billion project, the stock plummeted 13% due to weak guidance and tariff concerns raised in the July 23 revenue call.

“Are the worries are their end customers. In the wake of tariff uncertainty, they don’t know what to expect. Are they stockpiling?” said Stacy Rasgon, senior analyst at Bernstein Research.

It is still unclear whether demand will increase once tariff uncertainty has subsided. Still, the stock regained some position in August.

“I position them as tariff winners rather than tariff losers,” said Timothy Alkuri, managing director at UBS. Arcuri said the U.S. foundry at Ti will allow it to weaken the pricing of its rival Taiwanese chips.

However, the market for Ti chips is not a guarantee. After TI struggled to keep up with demand during the chip shortage in 2020, Arcuri said Ti’s share of the analog market “falls off the cliff.” According to UBS, it has reached 14.7% in 2024 from a high of 19.8% in 2020.

TI’s $60 billion Megaproject includes four Sherman, Texas fabs, one in Richardson, Texas and two in Lehigh, Utah. The new fab will give TI five times the capacity it is today, Yunus told CNBC.

“They are putting a big bet on the fact that they will regain their share and that demand will set back,” Alkri said. “If we don’t regain that share, it’s difficult to justify building so much capacity.”

SM1 and SM2 are the first two of four new chip manufacturing plants being constructed by Texas Instruments in Sherman, Texas, as shown on July 24, 2025.

Graham Marwin

Lamp to 300mm

Although TI is well known for its graph calculators, the company is also responsible for supporting the revolution in the electronics industry. In 1958, TI engineer Jack Kilby filed the first patent for the integrated circuit. It paved the way to miniaturize the chip by building all the components of the circuit directly onto a single piece of silicon as well as transistors.

The majority of TI’s business today comes from automotive and industrial customers who purchase the company’s analog and embedded chips. An analog chip processes signals such as sound, light, and pressure. The temperature of the thermostat and the voltage on the power management chip to keep your electronic devices safe when plugged in. Embedded chips are usually signal processors and microcontrollers for operating everyday devices, as well as microcontrollers for challenging a lottery, such as guiding the ding, ding and dishwasher to finish the cycle.

Unlike the expensive bleeding edge 2 and 3 nanometer chips made by giants like TSMC, Ti chips are cheap and made with legacy nodes: 45-130 nanometers.

Its size is “an analog sweet spot and is embedded to provide the voltage needed for the right performance, power and portfolio,” Yunus said.

According to Arcuri, each Ti chip costs around $0.40, but it plays a key support for the world’s most advanced technology. With a new partnership with nvidiafor example, TI is developing chips to promote efficiency in power-hungry data centers.

In 2009, TI made another bold move to further reduce chip costs. It opened the world’s first 300mm fab for an analog chip, and reused memory fabs from Qimonda after the chipmaker went bankrupt due to the financial crisis.

“That was the catalyst for TI to have this cost advantage,” Arcuri said.

The new wafer size gives Ti “incredibly cost-effective” because 300mm can make 2.3 times the chips 2.3 times the 300mm wafers,” Yunus said. Ti is selling some of its 200mm fabs closed and all seven new fabs are produced on 300mm wafers.

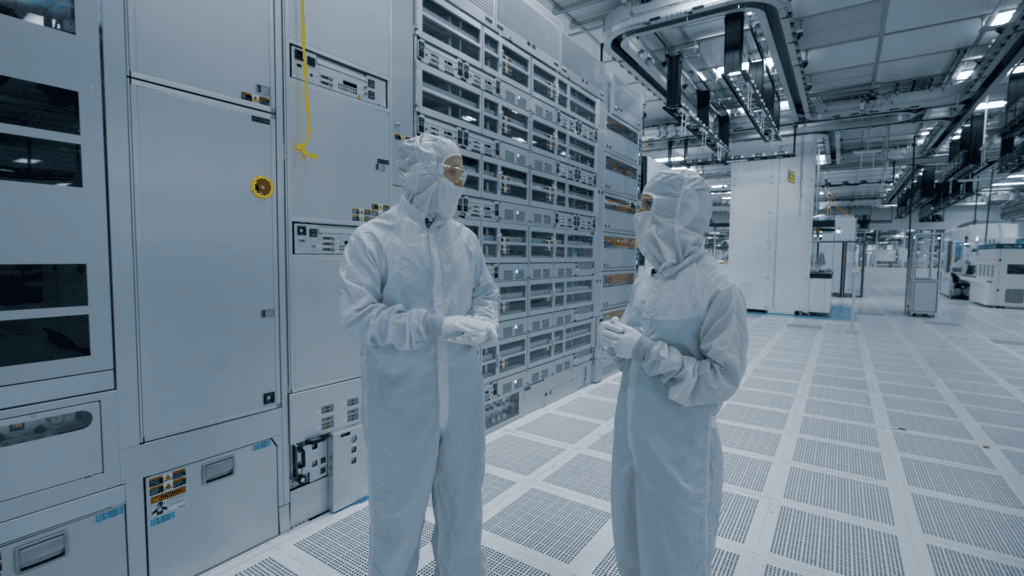

Mohammadyunus, senior technology and manufacturing at Texas Instruments, speaks with Katitalasov of CNBC, the first of TI’s four new chip manufacturing plants in Sherman, Texas, on July 24, 2025.

Graham Marwin

Texas Growth, Global Supply

Ti told CNBC it is the country’s largest analog and embedded semiconductor manufacturer, selling hundreds of billions of chips each year. Approximately 60% of revenue comes from clients based outside the US, with China accounting for around 20%.

Around 75% of TI’s capital expenditures occur in the US, but FABS in Germany, Japan and China also travels chips overseas, the company told CNBC. It has tested and rallied in Mexico, Taiwan, the Philippines and Malaysia, spending $3 billion on two new sites, one of which is currently in production.

Ti’s global footprint is an advantage of the “dynamic situation” of current tariffs, Yunus said.

“Our manufacturing business spanning 15 different sites provides a position to support our customers, in a political or economic environment, wherever they are,” he said.

TI considered building a new site internationally in places like Singapore, but eventually settled in Sherman, Texas. The small city 65 miles north of Dallas has a population of just 50,000 people. It is also home to the GlobalWafers Factory. The Taiwan-based company manufactures bare silicon wafers with chips containing Ti.

Sherman Mayor Sean Team Anne said the city is a “silicon prairie hub.”

Teamann’s grandfather worked with Kilby at TI in the 1950s. Ti first came to Sherman in 1966, but when it announced plans to close the outdated 150mm fab, the city seduced TI and stayed with incentives such as tax credits and water discounts.

The plan works and in 2021 TI announced that it will remain in Sherman along with a new 300mm fab campus. Currently, the first of the four 300mm fabs is completed with a shaman. Teamann said the 300mm project has more than doubled the city’s population growth rate since it was announced in 2021.

When it comes to federal support, TI received a $1.6 billion Chips Act funding and a whopping 35% investment tax credit from Trump’s large bill in July.

At the state level, Gov. Greg Abbott has long provided incentives for chip companies willing to build in the state, ranging from low taxes to the $1.4 billion Texas Chips Act passed in 2023.

Samsung has been another Texas chip giant since 1996. The Korean company is building an advanced chip fab of $17 billion near Austin. That’s also everywhere apple, Amazon and AMD Design many of the chips. Other chip companies in Texas include Infineon, NXP x-fab, micron, GlobalFoundriesand tool suppliers Applied materials.

Water, electricity, workers

Making chips requires a huge amount of water, and about a quarter of Texas is drought.

Luckily, the Sherman has water rights to nearby Lake Texoma.

“It was being able to gain more rights, increase our production and provide the bulk of water that would cost to operate our semiconductor facilities,” said Teamann, adding that Fab has almost doubled the Sherman usage.

TI plans to use about 1,700 gallons of water per minute when the new Sherman Fab is completed, and at least 50% recycle, Yunus said.

Chip manufacturing is also a power-hunger process, so it’s helpful to have a power plant in Sherman that has recently increased capacity. Ti’s new Sherman Fab runs perfectly with renewable energy, Yunus said, adding that making chips with 300mm wafers also helps with energy efficiency.

“You use roughly the same amount of energy, but you produce 2.2-2.3 times the chips,” he said.

Texas’ unique, independent grids significantly block the nation from borrowing power across state boundaries. In 2021, that grid failed during an extreme winter storm, causing at least 57 deaths, and halted production at chip makers like Samsung and NXP. Ti told CNBC it maintained “critical operations.”

“We’ve built redundancy in this facility,” Yunus said. “We have multiple transmission lines that power the site. We also have large diesel storage tanks that can be used, and some generators that can continue to power the site for several days.”

Highly skilled chip engineers are another rare resource. This is a talented pipeline hampered by the dramatic decline in global semiconductor manufacturing in the United States. According to the Semiconductor Industry Association, the United States has only 10% in 2022 since it held a 37% share of the market in 1990.

However, TI has developed partnerships with various universities, community colleges and the military to bridge the talent gap needed to fill the role of Sherman Fab.

“A lot of young people are moving to the area. In fact, I think it’s easier for them to gain talent than they were five or ten years ago,” Alkri said.

TI said it expects to create 60,000 US jobs with a complete $60 billion project, but the company was unable to give it the expected completion date when asked for one.

“It’s hard to predict when that will take off,” Yunus said. “We hope we’re continuing to build at a fairly active pace, but that’s really market dependent.”

Watch the video to see Sherman’s Ti’s first completed Fab in detail: https://www.cnbc.com/video/2025/08/22/apple-will-make-chips-at-texas-intruments-60-10-00-US-Project.html