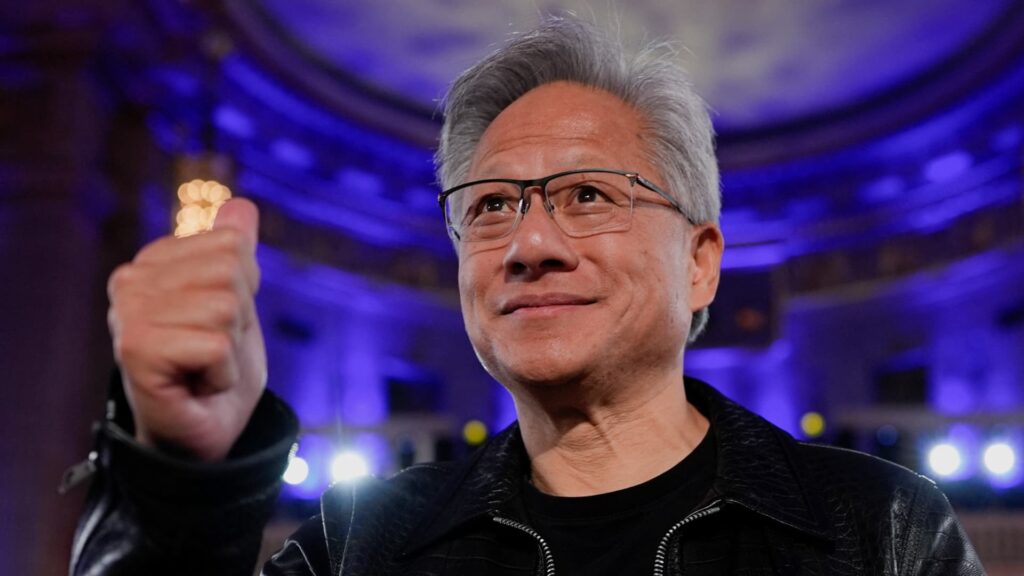

Nvidia CEO Jensen Huang as US President Donald Trump (not pictured) makes a statement during the “Winning the AI Race” summit held in Washington, DC, USA on July 23, 2025.

Kent Nishimura | Reuters

nvidia This week, he said he would invest $100 billion in Openai in a deal that highlights how big the chipmaker’s investment portfolio has been since the arrival of the generator AI in 2022.

The deal comes just a week after Nvidia invested $5 billion in its one-time rival Inteland after the company announced its intention to invest $500 million in self-driving car startup wave and a £500 million ($667.7 million) investment in UK cloud provider NSCALE.

Nvidia’s investment spending highlights the chipmaker’s advantage to the pinnacle of the Silicon Valley hierarchy, providing capital and access to highly desirable artificial intelligence chips in exchange for fairness and insights about where the hottest AI startups are heading.

If the full Openai investment is completed – it is expected to be implemented over an unspecified number of years – it represents Nvidia’s biggest investment in history.

In its financial statements, Nvidia revealed that it would include $4.33 billion of publicly held shares. Applied Digital, arm, coreweave, Nebius Group, Reflexive drugs and width.

At the end of July, Nvidia valued its commercial equity securities at $3.8 billion, up from $1.8 billion a year ago.

The majority of NVIDIA’s portfolio companies have strategic connections to their business. Develop complementary technology to chips, sell rental access to chips, or use AI, enterprise software, or robotics chips.

But just because Nvidia is on the company’s cap table doesn’t mean that it’s one of the chip makers’ customers.

“We don’t need companies to invest in using NVIDIA technology,” a company spokesperson told CNBC.

For example, Nvidia’s deal with Openai is simply a “preferred” computing power supplier for startups, rather than a monopoly provider. Cohere, an enterprise AI startup that Nvidia took part in the funding round, announced this week that it will use AMD chips in addition to Nvidia.

In 2022, Openai launched ChatGpt, bringing the broader world to the importance of Nvidia’s graphics processing units. Since then, Nvidia’s market capitalization has risen beyond $420 billion to around $4.3 trillion, but annual revenues ended in January, up 383% from the company’s $27 billion in fiscal year 2023.

In the year CHATGPT first debuted, NVIDIA made 16 investments in other companies, including seed rounds and stakes acquired through incubators, according to CNBC analysis of Pitchbook data. Nvidia’s investments increased to 41 in 2024, and so far in 2025, Chipmaker has made 51 such deals without counting its commitment to Openai.

Certainly, Nvidia is usually just one of most investors in venture capital transactions. Nvidia refused to provide CNBC dollar figures, but its vast number of ventures and public equity investments indicate that the company has become a focal point of the AI ecosystem.

Nvidia has increased cash flow from rising sales, and the regulatory environment for acquisitions remains challenging, said Jamie Zakalik, an analyst at Neuberger Berman. Openai transactions are “win-win” because Nvidia can spend a portion of its cash and use its chips to influence the implementation of artificial intelligence.

“Nvidia has a lot of capital and doesn’t necessarily have a lot to do,” Zakalik said.

Alden Abbott, a researcher at George Mason University’s Mercatus Center, usually requires regulators to worry about “vertical” investments or acquisitions. But he said regulators will scrutinise investments with exclusive supply contracts in this case, he said, because of how fast AI is moving.

These investments also provide clues for companies that Nvidia is interested in purchasing. Earlier this year, the chipmaker got CENTML after participating in the 2023 seed round. Nvidia also invested in infrastructure networking company Enfabrica, and then spent $900 million to hire a CEO and waive its technology, CNBC reported.

What Nvidia owns

Nvidia’s investments range from chips, biotechnology, robotics, and self-driving vehicles. These include some of the leading AI model companies that use large amounts of NVIDIA chips to process huge amounts of data and create AI models.

The chipmaker has invested unspecified amounts in Openai in multiple rounds, with its latest round valued at $500 billion. It contributed 1.7 billion euros ($2 billion) to French startup Mistral AI in September, and participated in the round that raised $100 million from Cohere in August, part of the round that raised $307 million on the runway in multiple rounds.

Nvidia also reportedly took part in a $2 billion safe, close round in April. The lab was started by former Openai Luminary Ilya Sutskever. Nvidia also took part in the July funding round in July to think about Machine Labs.

Some of Nvidia’s investments have already seen the exit. This was an investor at Scale AI, a company that created data by cleaning AI startups. The startup has signed a $14.3 billion employment and licensing agreement with Meta, whose CEOs and other employees have joined the social media company.

Nvidia also owns a 7% stake coreweavea cloud provider selling access to Nvidia chips. CoreWeave successfully made an initial public offer earlier this year.

coreweave is one of the neo-cloud providers that are competing and working with large cloud companies. Microsoft, Google and Amazon. CoreWeave disclosed a $6.3 billion order from Nvidia earlier this month.

Nvidia also participated in the $480 million Series D round of Neo-Cloud provider Lambda Labs in February.

Some of Nvidia’s most interesting investments come from companies that develop quantum computers. This is still a theoretical technology that we believe will one day enable AI development. Quantum companies can use Nvidia’s chips to simulate computers that do not exist yet.

Nvidia’s shares in these companies came after CEO Jensen Huang apologised to the industry at the Nvidia meeting after he resigned from one of his stumps about a pessimistic timeline that technology had sunk its inventory.

Earlier this month, Nvidia’s Venture Capital Arm was a participant in Psiquantum’s $1 billion round, and Chipmaker was put into early stage funding for Quantinuum in September.

Using Nvidia for your company’s cap table makes it even more attractive to investors. In recent years, after Nvidia revealed the stocks of public companies, investors bought the stocks even with connected connections to AI. Intel’s shares rose 18% the day Nvidia announced its investment.

Modification: Quantinuum raised funds in September. Previous versions were wrong that month.

Watch: Nvidia-Openai trading shows capital strength despite weak commercial monetization: GMO’s Tom Hancock