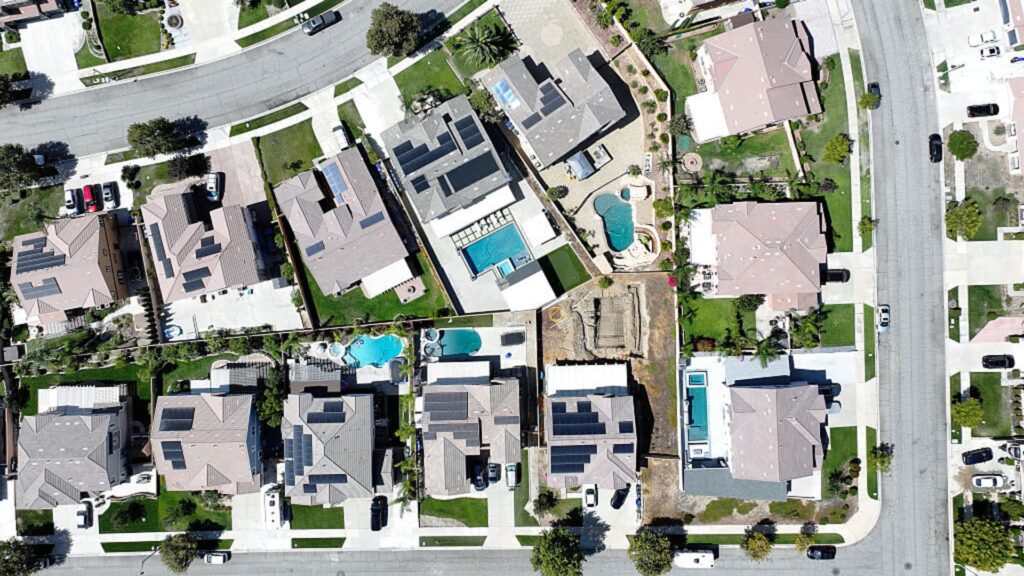

Aerial view of homes in Fontana, California, September 17, 2025. Many homes have solar panels installed.

Tama Mario | Getty Images

Mortgage rates fell to their lowest levels in a month last week, prompting more borrowers to refinance. However, prospective home buyers were not so enthusiastic.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances of $806,500 or less, including origination fees for loans with 20% down payments, decreased from 6.42% to 6.37% last week, from 0.61 to 0.59 points.

As a result, refinance applications for mortgages, which are most sensitive to weekly interest rate changes, rose 4% for the week and 81% from the same week last year, according to the Mortgage Bankers Association’s seasonally adjusted index. The 30-year fixed rate rose 15 basis points a year ago. A basis point is 0.01 percentage point.

“The refinance index rose 4%, driven by a 6% increase in conventional refinances and a 12% increase in FHA refinance applications, as borrowers continue to focus on these opportunities to lower their monthly mortgage payments. VA refinances bucked that trend, falling 12%,” MBA Economist Joel Kang said in a release.

Prime Minister Suga pointed out that demand for variable rate home loans has increased again.

“ARM applications rose 16% over the week, and ARM share rose to 11%. ARM rates are more than 80 basis points lower than 30-year fixed rates,” he added.

ARM applications typically increase when overall interest rates rise, not when they fall. This increase says more about current home prices than interest rates. Buyers are doing everything they can to buy what is available.

The number of applications for mortgages to buy homes fell by 5% during the week, and increased by 20% compared to the same week last year. Buyers are finding more supply in the market and prices are starting to soften a bit in some areas, while others are holding out hope that interest rates will fall further.

And mortgage rates have fallen further this week, according to a separate Mortgage News Daily survey.

Matthew Graham, chief operating officer at MND, said while there was no particular reason for the decline, “some financial institutions are offering the lowest interest rates in over a year and some in more than three years.”