Courtesy of Built Technologies

A version of this article first appeared in the CNBC Property Play newsletter with Diana Orrick. Property Play covers new and evolving opportunities for real estate investors, from individuals to venture capitalists, private equity funds, family offices, institutional investors and large publicly traded companies. Sign up to receive future editions directly to your inbox.

If you rent an apartment, you’ve probably “talked” to an AI agent to fix a leaky toilet. But what if you’re a builder and you want to request funding from a lender? This is a much more complex process, and we now even have AI agents for that.

Built Technologies, a construction and real estate finance technology provider valued at $1.5 billion in 2021, has taken its proprietary software to the next level and unveiled an AI agent that has been in testing with some lender clients. Bild says it is now ready for a broader market.

“We strive to improve the construction real estate industry’s ecosystem across the entire value chain,” said Chase Gilbert, CEO of Built Technologies.

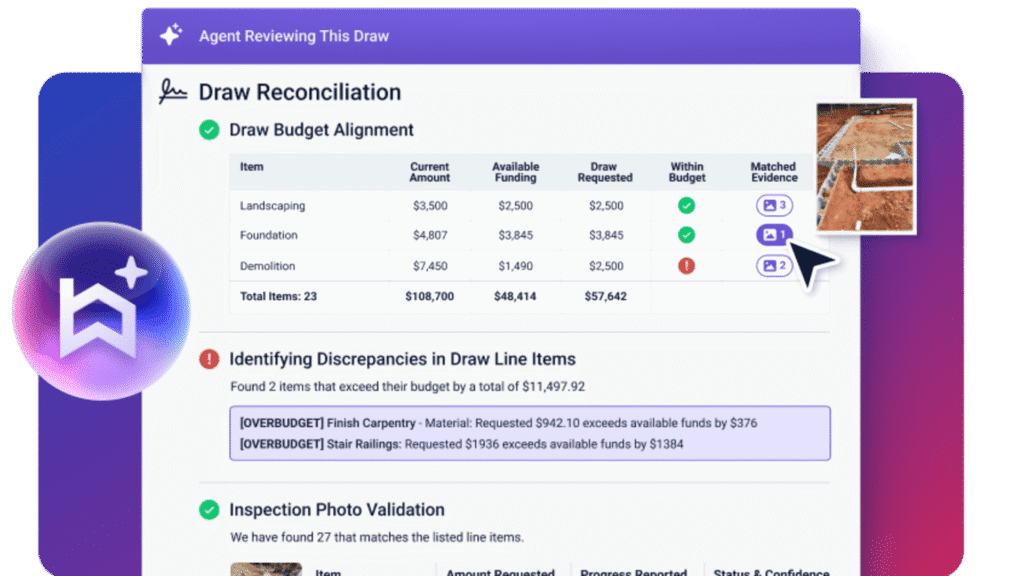

This agent is implemented specifically for what is known in the industry as draw requests. Traditionally, once a developer or construction company completes each step of the process, they turn to a lender for the next step in financing: a drawing. This process typically takes days to weeks, as the loan officer must review documents, check progress, assess risk, and approve payment. From now on, so-called Draw Agents will take over.

“There’s an opportunity to fundamentally contribute to the ecosystem, and in fact we’re delivering purpose-built technology that brings together key stakeholders, where everyone can see the same information at the same time and request funds and make payments with more confidence,” Gilbert said.

Over the past decade, Built has worked with both bank and non-bank lenders, as well as lenders in the private credit sector, to help them manage capital improvement construction projects and help them access funding from capital partners more quickly and easily.

Customers include US Bank, Citi, and Fifth Third. Built also helps you pay your downstream business partners, such as general contractors, subcontractors, architects, attorneys, and designers. That was the original software.

AI has arrived and now Built has created what Gilbert calls built-in teammates. This teammate can do all the work and there is no room for human error, ensuring everything is compliant. Bild has been testing the agent with several lenders, including Anchor Loans, over the past three months.

Now, reviews are reported to take just 3 minutes, pull approvals 95% faster, increase risk detection by 400% compared to human-led reviews, and achieve 100% compliance with each lender’s policies and procedures.

According to Built, companies using the new agent reported a return on investment (ROI) of 300% to 500%, even for small portfolios of about 500 loans. Companies arrived at this discovery by weighing their investment against the time and operational cost savings provided by automation. Financial institutions participating in the pilot said it significantly reduced manual work and increased efficiency by eliminating the need to hire new staff.

Gilbert said the AI agent is acting on trillions of dollars worth of construction drawing data that Bild has collected over the past decade.

“And that’s where AI really shines. AI needs a lot of data and context to be smart and make decisions, and we certainly have a lot of unique data on that,” he said.