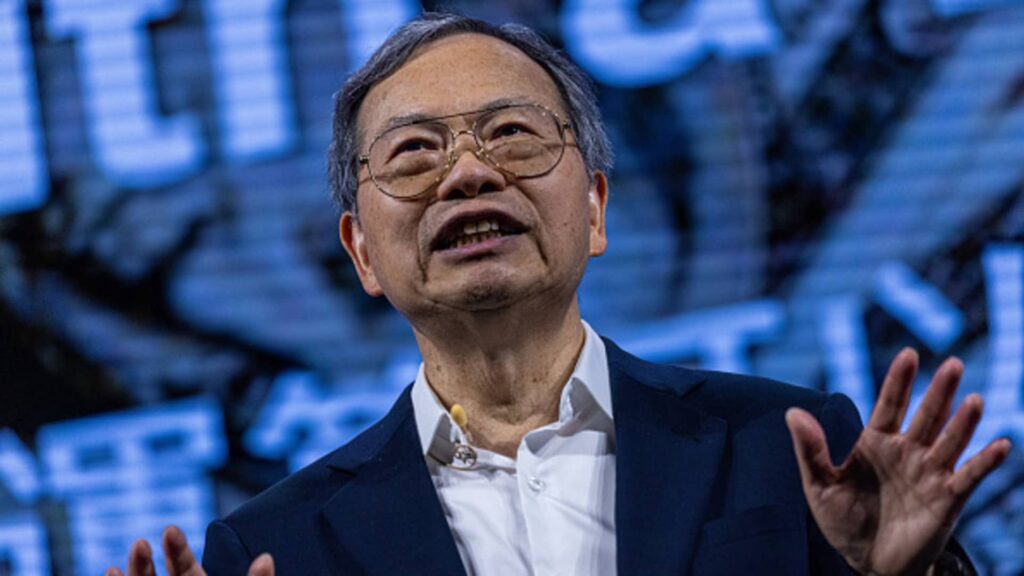

Charles Liang, CEO of Super Micro Computer Inc., during the Computex conference in Taipei, Taiwan, Wednesday, June 5, 2024. The exhibition will run until June 7th.

Annabelle Chee | Bloomberg | Getty Images

Server manufacturers in trouble super microcomputer announced Monday that it has hired BDO as its new auditor and submitted a plan to Nasdaq detailing its efforts to restore compliance to the exchange. Shares rose 37% in extended trading.

“This is an important next step in bringing our financial statements up to date, and we are working diligently and urgently on this initiative,” Supermicro CEO Charles Liang said in a statement. ” he said.

Supermicro has delayed filing its 2024 year-end report with the SEC and announced earlier this month that it was looking for a new accountant after its previous auditor, Ernst & Young, resigned in October. Ernst & Young has just replaced Deloitte & Touche as Supermicro’s accounting firm in March 2023, and is new to the job.

Supermicro said it has told Nasdaq it is confident it will be able to file its annual report for the year ending June 30 and quarterly report for the period ending September 30. The company said it will “continue to be listed on Nasdaq until the exchange’s listing is complete.” Review of compliance plans. ”

Supermicro’s stock price soared more than 20 times in the two years from early 2022 to its peak in March of this year. However, worrying news regarding the company’s compliance with Nasdaq has hurt the stock price. The company’s market capitalization, once valued at about $70 billion, rose 16% during regular trading to $12.6 billion as of Monday’s close.

Super Micro is one of the main beneficiaries of the artificial intelligence boom. Nvidia. Last year’s sales more than doubled to $15 billion.

On Monday, Super Micro announced it would sell products equipped with Nvidia’s next-generation AI chip called Blackwell. The company competes with vendors such as: Dell and hewlett packard enterprise In packaging Nvidia AI chips for other companies to access.

Supermicro was added to the S&P 500 in March, reflecting its rapidly growing business and high stock price at the time. Less than two weeks after the index changes were announced, Supermicro hit a closing high of $118.81.

The problems started within a few months. Supermicro announced in August that it would not file its annual report with the SEC on time. Prominent short seller Hindenburg Research later disclosed its short position in the company, saying in a report that it had identified “new evidence of accounting manipulation.” The Wall Street Journal later reported that the Justice Department was in the early stages of investigating the company.

The month after announcing the report delay, Supermicro said it received a notice from Nasdaq stating that the delay in filing its annual report meant the company was not in compliance with the exchange’s listing rules. Supermicro said Nasdaq regulations give the company 60 days to file a report and submit a plan to regain compliance. Based on that deadline, the deadline was Monday.

WATCH: Supermicro is on sale due to accounting fraud