2024 was a landmark year for the crypto market. It was a year when markets matured, barriers to the institutional investor world fell, and international regulations began to pave the way for digital currencies to enter the mainstream global financial system.

The market grew significantly as the president-elect was keen to make the US a global crypto hub. As cryptocurrencies become more popular, more users are investing in cryptocurrency platforms and ETFs. 2024 was a transformative experience for the cryptocurrency market and the blockchain technology that underpins it.

The general public, buoyed by positive sentiment and rising crypto prices, rushed to DeFi platforms to download the first wallets. Many of these new users ended up on the highly trusted cryptocurrency brand Binance.

As the industry continues to mature, Binance CEO Richard Teng has carried the role through significant growth in 2024. Commenting on his leadership and future, Mr. Teng said, “Since our inception, we have continued to put our users’ best interests first, lead industry standards, and responsibly shape the future of our industry.” I commented.

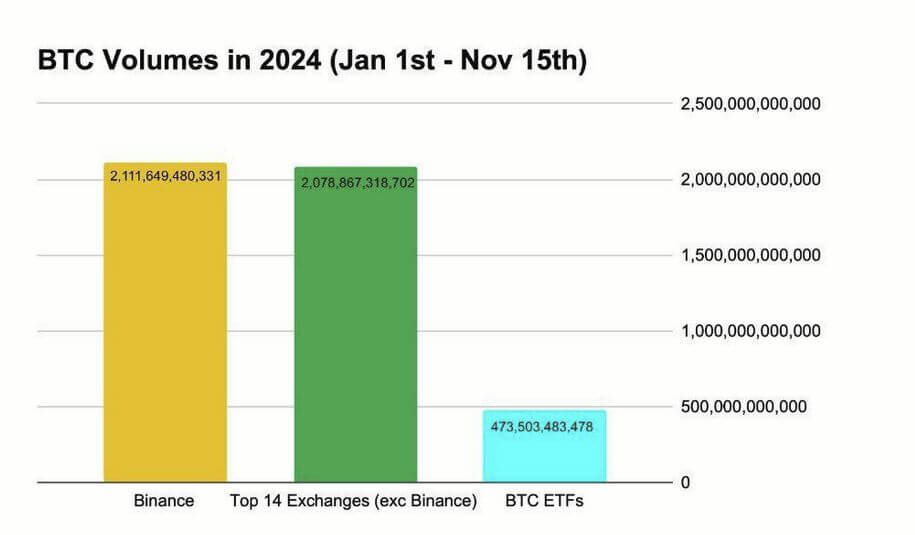

Binance accounts for approximately 50% of the world’s total trading volume. This number just increased from January to November 2024. During the week of the 2024 US presidential election, Binance received $7.7 billion of the $20 billion in total inflows across all exchanges. Combine this with the leading cryptocurrency exchange reaching a new milestone of exceeding 200 million users and securing over $130 billion in user assets.

Therefore, 2024 will be an exciting time for the crypto industry as a result of many efforts. This year’s highlights include:

Institutional involvement and widespread adoption

In 2024, BlackRock launched the Spot Bitcoin ETF IBIT, which subsequently brought options to the table on November 19, 2024. broke all records On the first day, 354,000 contracts were traded with a notional amount of $1.9 billion. This was a landmark moment for the crypto industry, but it came at the end of a year for institutional investors.

Pension funds, hedge funds and sovereign wealth funds have been hard at work developing cryptocurrencies this year, hoping to capitalize on the growth potential and protect themselves from the problems of fiat currencies. They join Goldman Sachs, Morgan Stanley, and Fidelity Investments, all of which offer Bitcoin as part of their wealth management services.

Bitcoin has emerged as a way to hedge against inflation this year, as institutional investors dampen market volatility. New regulatory clarity, improved custody solutions, and advanced risk management frameworks have all given financial institutions the confidence to be among the first to enter crypto in 2024.

The rise and rise of DeFi

Decentralized finance (DeFi) is changing the world we live in and offering a real alternative to traditional banking. The world’s unbanked poor and privacy-conscious wealthy alike have discovered the joy of downloading cryptocurrency wallets and sending money for low fees and no questions asked.

Global DeFi market should be valuable, according to a recent study Approximately $440 billion in 2030up from just over $20 billion in 2023.

It is now possible to tokenize and increase liquidity of any asset, from real estate and art to cars and stocks, without the help of traditional banks. This opens up new ways to borrow, save, lend, and earn interest, putting power in people’s hands.

Unbanked individuals around the world can access basic financial services such as sending and receiving money to friends and family without hefty fees. We are also seeing an ecosystem of liquidity pools and borrowing capabilities opening up that has the potential to change the world of finance.

Retail market consolidation

The reason for this is that the Web3 technology that underpins the cryptocurrency market is well-established not only in retail and e-commerce, but also in DeFi platforms. Blockchain technology is now the foundation of supply chain management, healthcare providers, and numerous corporate processes. If blockchain continues to take over businesses and public life, the tokenized crypto ecosystem will have to go along with it.

Retailers are increasingly relying on blockchain, with Starbucks using it to trace its coffee from farm to cup and Nike using it to track its coffee on the Swoosh platform to ensure authenticity and traceability. Tokenizing sneakers.

In October 2023, Ferrari joined Tesla, PayPal, Shopify, Microsoft and others to begin accepting cryptocurrency payments for its luxury sports cars. It has been a slow process, but cryptocurrencies have slowly gained the social proof needed to break through with mainstream retailers. Blockchain, which forms its foundation and is becoming mainstream, has been an unexpected bonus.

Regulatory framework: From confusion to clarity

Fragmented regulations that change from country to country are terrible for the cryptocurrency industry, and 2024 is the year the cryptocurrency industry finally gets its system together. Financial Stability Board, International Monetary Fund, and world economic forum This helped guide disparate countries toward one standard practice for virtual currency taxation, anti-money laundering compliance, and consumer protection. A simple foundation of regulation that works across borders can do wonders for the industry. We are not there yet, but we are getting closer.

Technological advances drive maturity

It’s not just the political climate that has had to change to give the cryptocurrency market a chance for mass adoption. Due to real technical issues with early blockchain systems, they were treated as a niche interest rather than an everyday occurrence.

Blockchain congestion, slow transactions, high energy consumption, and scalability were all real issues. Ethereum 2.0 and Layer 2 solutions mean Ethereum, the most ubiquitous blockchain to date when it comes to dApps and Web3 technology, will become more scalable, have lower fees, and reduce blockchain congestion . Alternative blockchains like Solana and BNB Smart Chain also offer alternative solutions with blockchain bridges that seamlessly connect networks.

The integration of AI is already changing the world of trading, analytics, risk management, and supply chain management. Artificial intelligence can further improve the performance of Web3 technologies, automate complex processes, and streamline almost any enterprise.

conclusion

All of these factors have combined to create a market that is ready, willing, and waiting for mass adoption. Institutional adoption, regulatory clarity, cultural acceptance, and technological improvements are all helping the cryptocurrency industry move from sideshow to center stage in 2024. We haven’t seen anything yet, but next year could be the biggest yet.