Unlock Editor’s Digest for free

FT editor Roula Khalaf has chosen her favorite stories in this weekly newsletter.

The British government on Thursday sought to calm the turmoil in Britain’s bond market by saying it would stick to fiscal rules even as borrowing costs hit their highest level since the financial crisis.

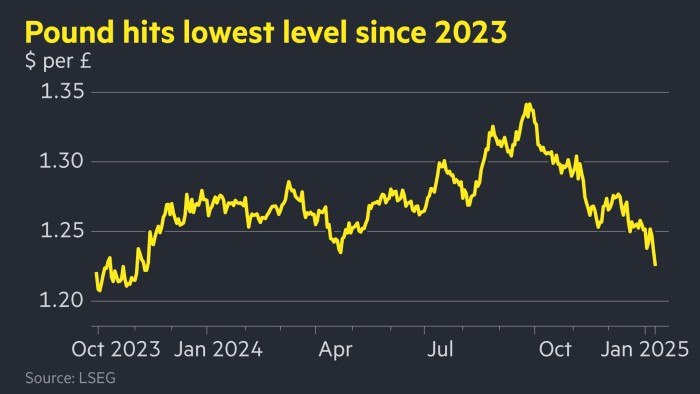

Darren Jones, Britain’s No. 2 at the Treasury, has issued an urgent statement regarding market turmoil after the 10-year gold bond yield rose to 4.93%, the highest since 2008, and the pound fell by 1% against the US dollar. appeared before Congress to answer questions. The dollar is at its lowest level in more than a year.

Mr Jones told MPs: “The UK gold market continues to function in an orderly manner.” “There is no doubt about the government’s commitment to economic stability and fiscal health. This is why meeting fiscal rules is non-negotiable.”

Mr Jones’ appearance came after Speaker Lindsay Hoyle accepted an urgent question from the Conservative opposition on the “increasing pressure of borrowing costs on public finances”.

Treasury Secretary Rachel Reeves is about to depart on a long-planned trip to China and sent Jones, the Treasury principal secretary, to respond.

Britain’s borrowing costs have soared as investors worry about the government’s large borrowing needs and the growing threat of stagflation, a combination of lackluster growth and persistent price pressures.

“The economy is entering stagflation,” said Mark Dowding, chief investment officer at RBC BlueBay Asset Management.

On Thursday, the 10-year gold yield fell to 4.85% after rising 0.12 percentage points. The pound was caught in a sell-off that fell to $1.224, its lowest since November 2023, before partially recovering.

Analysts at Brown Brothers Harriman said: “The decline[in sterling and gold coins]reflects a deterioration in the UK’s fiscal outlook.”

Mr Jones insisted it was normal for gold prices to fluctuate and that underlying demand for UK government bonds remained strong.

“The most recent auction, which took place yesterday, had bids three times the asking price,” he said.

The minister said the Treasury was still working on a multi-year spending review scheduled for this summer, based on the assumptions set out in October’s Budget.

But he acknowledged that the Office for Budget Responsibility, the independent budget watchdog, published new forecasts on March 26 that could influence discussions with ministers.

Recent bond market tensions have also raised concerns about tax increases and spending cuts. The Ministry of Finance has indicated that it will cut spending rather than increase taxes if necessary.

Shadow chancellor Mel Stride, who raised the urgent question, said Mr Reeves himself should have appeared in parliament.

“Where is the Prime Minister?” he asked. “It is very unfortunate that in these difficult times with such serious issues, she herself is nowhere to be seen.”

Chancellor Reeves left a tiny £9.9bn leeway for revised fiscal rules in last autumn’s budget, even after announcing a £40bn tax increase aimed at “wiping the slate clean” on the public finances. Ta.

The prime minister’s key fiscal rule is a promise to ensure that all day-to-day public spending is covered by tax revenue by 2029-30.

Since then, rising bond yields have threatened budget space. The level of bond yields is a key factor in determining budget space, given its impact on the government’s interest bill of more than £100bn a year.

Recommended

Analysts said they could see another sell-off in the bond market on Friday if U.S. bond yields rise, dragging gold prices as they closely monitor U.S. jobs data.

“If we see a strong employment report, it could be a very challenging situation for UK bonds,” said Pooja Kumra, UK rates strategist at TD Securities.

Analysts said the simultaneous fall in gold and sterling was an echo of the backlash caused by Liz Truss’s 2022 “mini” Budget.

However, many investors believe the situation will fall short of the 2022 sovereign debt crisis.

“I expect things to start bottoming out… We’ve already seen a washout last year in gold stocks,” said Jeffrey Yu, senior strategist at BNY. “I’m not denying there are problems in the UK, but when you suddenly start comparing things to 2022, I think that’s what’s driving things forward.”