Cameron Pappas, owner of Norton’s Florist

Norton’s

For Cameron Pappas, owner of Norton’s Florist in Birmingham, Alabama, the artificial intelligence boom is a world away.

While companies prefer Nvidia, alphabet and broadcom They’re driving the stock market to new highs and boosting GDP, but Pappas is experiencing what’s happening in the real economy, far from Wall Street and Silicon Valley.

Small businesses like Norton, as well as businesses of all sizes in retail, construction and service industries, are struggling as the Trump administration’s steep tariffs drive up costs and consumers cut back on spending in an economic downturn.

“We’re looking at all the costs,” Pappas, 36, said in an interview with CNBC.

Norton’s made $4 million in revenue last year selling flowers, plants and gifts to local residents. To avoid price hikes that could drive customers away, Pappas was forced to get creative and rework some of the designs.

“If your bouquet contains 25 stems, you can reduce the number of stems by three or four and keep the price the same,” Pappas says. “So we had to focus on that and get the best price possible.”

Pappas’ story, and many like it, are hidden in macro data by the power of AI. According to a September report, AI-related capital investment contributed to 1.1% of GDP growth in the first half of this year. JP Morgan Chase. This spending exceeded that of U.S. consumers “as a driving force for expansion,” the report said.

According to the Department of Commerce, total U.S. GDP grew at an annual rate of 3.8% in the second quarter of 2025, after declining 0.5% in the first quarter.

U.S. manufacturing spending contracted for the seventh straight month, according to the Institute for Supply Management. Additionally, construction spending is flat or declining due to high interest rates and rising costs. Cushman & Wakefield predicted in a report this month that construction costs will rise 4.6% in the fourth quarter from a year ago due to the impact of building material tariffs.

We see a similar disconnect between AI and everyone else in the stock market.

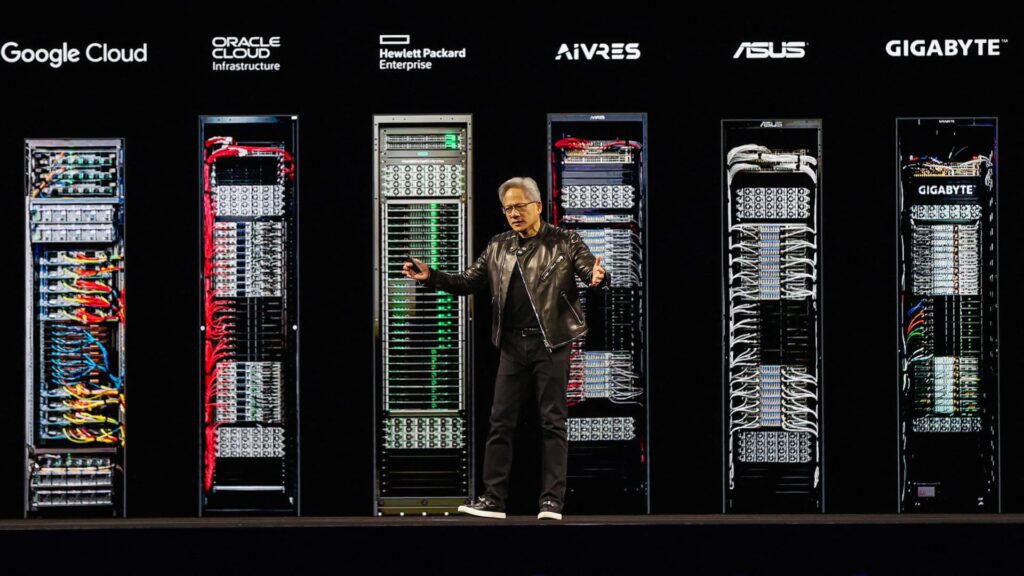

Nvidia CEO Jensen Huang delivered a keynote address at the Nvidia GPU Technology Conference (GTC) held at SAP Center in San Jose, California, USA on March 18, 2025.

Brittany Hosea-Small | Reuters

Eight technology companies are valued at more than $1 trillion, and all are tied to AI to varying degrees. Those companies — Nvidia; microsoft, applealphabet, Amazon, Meta, tesla With a market capitalization of $4.5 trillion, Nvidia alone accounts for more than 7% of the benchmark’s value.

Investors are dazzled by huge investments in AI infrastructure. Broadcom stock is up more than 50% this year after more than doubling in each of the past two years, while Nvidia and Alphabet are up nearly 40% in 2025.

That explains why the S&P 500 and Nasdaq rose 15% and 20%, respectively, to record highs on Friday, even as the government shutdown continues to cause economic uncertainty.

Meanwhile, the S&P 500 subgroup, which includes consumer products and consumer staples companies, is up less than 5% year-to-date.

The latest sign of trouble in the consumer market appeared on Thursday. target The company announced that it will cut 1,800 employees. This will be the retailer’s first major layoffs in a decade. Target stock has fallen 30% this year.

“I think the message that the AI economy is driving up GDP numbers is correct,” Arun Sundararajan, a professor at New York University’s Stern School of Management, said in an interview with CNBC. “There may or may not be weakness in the rest of the economy, but there may be slower growth.”

Investors will be hearing all the talk about AI over the next few days, during the busiest quarter for tech company earnings, and will be listening closely for additional guidance on capital spending. Meta, Microsoft and Alphabet reported on Wednesday, followed by Apple and Amazon on Thursday.

Nvidia stock price last year.

Last month, Nvidia announced a $100 billion investment in OpenAI, a startup with a market cap of $500 billion. The funding will help OpenAI deploy at least 10 gigawatts of Nvidia systems. This is roughly equivalent to the annual electricity consumption of 8 million U.S. households.

shares of advanced micro device has doubled this year and soared more than 20% earlier this month after the chipmaker announced a deal with OpenAI, while Oracle has languished of late due to its relationship with OpenAI and broader infrastructure buildout.

“Are we kind of inflating the economy now and thereby preparing for a future crash?” Sundararajan said. He added that there is no sign that demand for AI infrastructure will slow down anytime soon.

“Tariff price management”

When it comes to local businesses, most people only know about the AI Gold Rush from the headlines. According to a September KeyBank survey, one in four small business owners are stuck in “survival mode” as they battle challenges such as rising costs and tariffs. This is an economic sector that routinely accounts for approximately 40% of a country’s GDP.

Pappas’ flower shop was founded in 1921 and was purchased by her father in 2002. The business has survived the Great Depression, World War II and the coronavirus pandemic. Pappas said her father, who passed away in 2022, reminded Norton that this is “another season” and that challenges like this are common in this area.

But since about 80% of all cut flowers in the United States are imported from countries like Colombia and Ecuador, according to the U.S. Department of Agriculture, President Trump’s tariffs created a whole new set of constraints.

Although there is no way for Nortons to avoid higher import costs, Pappas said he has started buying some flowers directly from growers in South America, which saves him money rather than going through agents who charge extra.

Pappas said this was part of a “tariff price control” effort.

President Trump’s tariffs will cost global businesses more than $1.2 trillion this year, with most of the costs being passed on to consumers, according to S&P Global.

Consumer sentiment is especially important as the holiday season rapidly approaches. The picture is dark.

A majority (57%) of U.S. consumers responding to a Deloitte survey released this month said they expect the economy to be weak over the next year, up from 30% a year ago. This is the most negative outlook since the consulting firm began tracking sentiment in 1997.

Gen Z consumers, defined in the survey as those between the ages of 18 and 28, said they plan to spend an average of 34% less this holiday season compared to last year. Millennials ages 29 to 44 said they expect to spend an average of 13% less this holiday season.

Additionally, seasonal retail employment is expected to fall to its lowest level since the 2009 recession, according to a September report from employment agency Challenger, Gray & Christmas.

The company released a separate report earlier this month showing new U.S. hires totaled just under 205,000 so far this year, a 58% drop from a year earlier.

The Starbucks logo is displayed in the window of a Starbucks coffee shop on September 25, 2025 in San Francisco, California.

Justin Sullivan | Getty Images

starbucks announced a $1 billion restructuring plan in September that included closing multiple stores in North America. About 900 non-retail employees were laid off as part of the plan, and the company laid off another 1,100 office workers earlier this year.

Starbucks stock has fallen about 6% this year.

shares of Wyndham Hotels & Resorts Shares fell on Thursday after the hotel chain reported disappointing third-quarter results. Chief Executive Officer Jeff Barotti cited a “challenging macro backdrop” in the earnings announcement. The stock price has fallen about 25% since the beginning of the year.

Even in some of the technology industries that have benefited most from the AI boom, companies are cutting jobs. Microsoft announced plans to cut about 9,000 jobs in July, which the company believes is a contributing factor to the reduction in management. sales force is one of many technology companies that has announced job cuts as AI can now do the job.

But Hatim Rahman, an associate professor of AI at Northwestern University’s Kellogg School of Management, said most companies using AI for efficiency don’t see it right away. As a result, companies cannot rely on technology to combat declining revenues, and “the road ahead is going to be rocky,” Rahman said.

“AI is not a plug-and-play solution,” Rahman said. “For many organizations, reaping the benefits will require engagement with people, processes, culture, and tools. And overall, it will take time.”

Note: AI boom is boosting stock markets, but may mask economic weakness