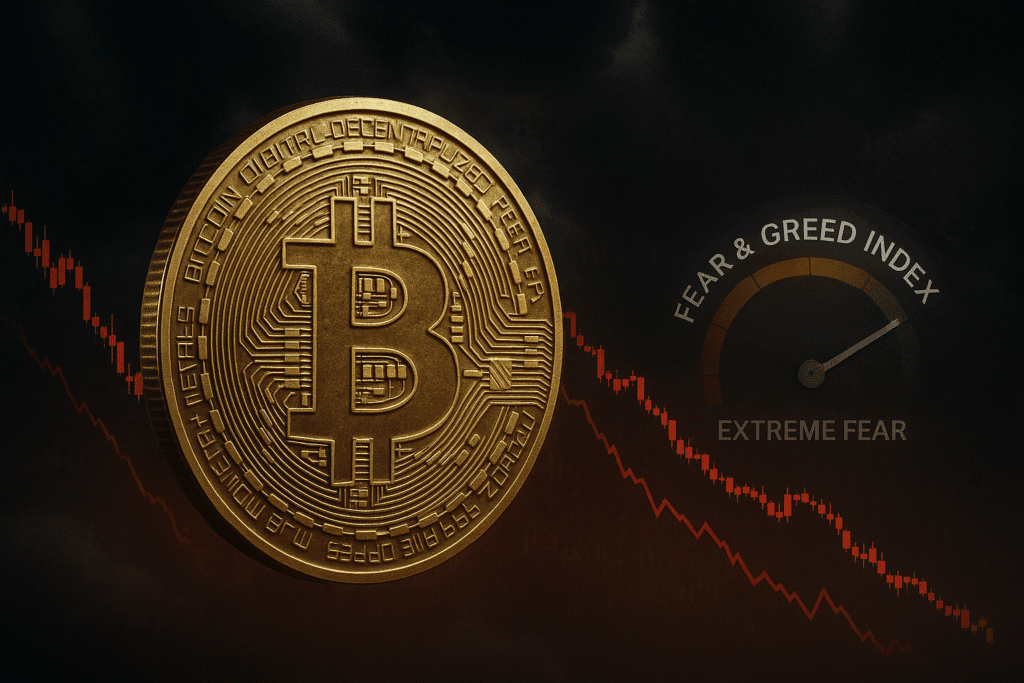

The Bitcoin Fear and Greed Index has dropped to 22, indicating extreme fear in the crypto market. BTC fell 13% in one week to $105,600, causing a sharp decline in investor sentiment. Extreme fear may signal a potential bottom for the market, but uncertainty remains high.

The crypto market has entered a phase of heightened anxiety as the Bitcoin Fear & Greed Index has fallen into the “extreme fear” region.

Investor sentiment has deteriorated significantly following the sharp decline in Bitcoin and other major digital assets, raising questions about whether the market bottom is near or whether further downside is in store.

Fear and Greed Index reduced to extreme levels

The Fear & Greed Index is designed to measure investor sentiment in Bitcoin and the broader cryptocurrency market.

This is done by aggregating data from multiple sources, including volatility, trading volume, market cap dominance, social media activity, and Google Trends.

This index operates on a scale of 0 to 100, with high numbers indicating greed and low numbers indicating fear.

A score above 53 suggests traders are getting greedy, while a score below 47 suggests a frightening environment.

Values below 25 are considered “extreme fear” and values above 75 are considered “extreme greed.”

At the moment, the index is at 22, firmly placed in the extreme fear zone.

This marks a decline from recent statistics that showed only moderate fear, and indicates that market sentiment has weakened significantly in a short period of time.

Bitcoin price drop fuels market anxiety

The recent move towards extreme fear has coincided with a sharp decline in Bitcoin prices.

The world’s largest cryptocurrency has fallen sharply over the past few days, dropping about 13% in the last week and trading at about $105,600 at the time of writing.

This economic downturn follows a widespread decline in the overall cryptocurrency market, with other digital assets also posting significant losses.

Sentiment changes quickly, with the index hitting a similar low of 24 just last week following a sudden market decline.

This early episode saw the index swing dramatically from greed to extreme fear in a short period of time, reflecting how optimism can quickly turn to caution in a volatile crypto environment.

The current situation in the market reflects past instances where sharp price corrections caused widespread anxiety among investors.

Historically, periods of extreme sentiment like this do not always occur in a straightforward manner, but often coincide with important turning points in the market.

Extreme fear can be a turning point

Reading extreme fear may seem alarming, but in Bitcoin’s history it has sometimes preceded market bottoms.

The relationship between sentiment and price is usually inverse, with periods of extreme fear often indicating potential accumulation phases, and extreme greed tending to accompany high market ceilings.

However, connection is not guaranteed.

A final example of extreme fear resulted in a temporary bottom before prices resumed their decline. This suggests that investor sentiment alone may not determine short-term price direction.

With the market once again finding itself in a state of deep fear, traders and analysts alike will be watching closely to see if Bitcoin will stabilize or continue to fall.

The next few days could be crucial in determining whether this scary episode marks the beginning of a long-term bearish trend or the preparation for a new phase of recovery.