Unlock Editor’s Digest Lock for Free

FT editor Roula Khalaf will select your favorite stories in this weekly newsletter.

This article is the on-site version of our unedited newsletter. Premium subscribers can sign up here to deliver their weekly newsletter. Standard subscribers can upgrade to premium here or explore all FT newsletters

good morning. Yesterday, Treasury Secretary Scott Becent and other US officials began another trade talk with their Chinese counterparts. The tables contain semiconductors, rare earths, and magnets. HESHED originally doubted that the Trump administration would negotiate with China – we were wrong. However, whether negotiations will be fruitful is another question. Email: Unedged@ft.com.

Metaplanet and Bitcoin

Why buy a company that buys Bitcoin, not just Bitcoin itself? Some people, including those who write this newsletter, don’t buy either. But let’s assume that buying Bitcoin is a good idea. Why do that through a corporate rapper?

One obvious (in the case of a dissatisfied, mild circular) answer is that some of the companies buying Bitcoin outweigh the Bitcoin itself. This is a chart that compares Bitcoin performance, leveraged Bitcoin ETFs, GameStop (announced to start buying Bitcoin this spring) with the strategy that is the largest corporate Bitcoin buyer.

Here, strategy (previously in the micro-strategy, software business) is absolutely dominant. But that is not the most surprising example of this phenomenon. The honor was sent to Japanese hotel developer Metaplanet, and announced on Monday it would raise about $5.4 billion to buy Bitcoin.

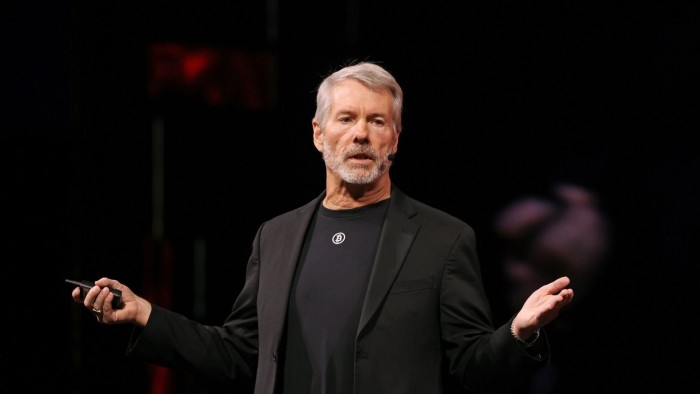

So where is the magic? Gold owning ETFs track gold prices. The ETF owns Bitcoin and tracks the price of Bitcoin. Why do companies that own Bitcoin do better than Bitcoin? Strategies provide some kind of explanation. Currently, it is trading at a premium of 70% against the net asset value, which is overwhelmingly made up of Bitcoin Holding. So, if you sell equity and use your revenue to buy Bitcoin, the transaction is instantly added. The company can purchase more than one dollar of Bitcoin by selling a dollar of stock. Here’s Michael Saylor, executive chair of strategy speaking in April:

How do you generate gain? How do you generate shareholder value? So, when we sell (our) stocks of $100 million at two net asset values from two net asset values, we generally capture a. . . Half that profit. The spread is 50%. We capture $50 million using it as gain. This is a subsidized component of existing common stock shareholders.

A keen reader will notice that this is not an explanation for why strategies are traded at premium with NAV. This explains how you can have a strategy because it trades at a premium to NAV. So, Premium still needs explanation. Saylor claims that premiums exist because the inventory is both very unstable and very liquid, and therefore premiums are present, making it attractive to shareholders who can sell call options in the market and generate high yields. While most companies don’t consider extraordinary volatility to assets today, Saylor believes strategy volatility is special.

You may get massive volatility for either a good or bad reason. However, management teams (high volatile companies) are usually not reliable and durable. How are you going to hold it for 10 years? And you are going to see what we have done. That we created a volatility engine. When you take volatility. . . If you’re smart, you’ll make it a nuclear reactor and it will become a power plant.

Readers can make their own assessment of this approach to corporate finance. However, it should be noted that fiscal strategies that include the sale of volatility tend to work until they do not.

Another sustainable source of premium ratings for Bitcoin Holding companies is that it is a particularly easy way to get Bitcoin exposure. In the UK, for example, getting bitcoin exposure can be daunting. When you buy Bitcoin itself, you will still have problems saving. The ban on purchasing Bitcoin-linked exchange trade notes was simply lifted. Buying Bitcoin ETF shares for both retail and institutional investors includes annoying documents. Buying stocks in strategy is easy. Also, similar patterns may be maintained to a high or lesser extent in various other jurisdictions.

Certainly, Metaplanet board member David Bailey recently told her colleague Philip Stafford, “Michael Saylor has pioneered something with one insight. If you want to sell someone, you have to meet the buyers where they are.” He continued: “Liquidity is everywhere in the world, but it’s trapped. We package Bitcoin into different forms and meet where they are.”

If that’s correct, there’s irony here. If Bitcoin-owned companies are ultimately selling Bitcoin liquidity, their companies will simply add value as long as the Bitcoin market remains inefficient and troublesome. As we are promised, if Bitcoin becomes a universal and practical alternative to Fiat currency, or even a valued, freely traded storage such as gold, the premiums of NAV companies should not disappear.

China and US solar

We recently wrote about the outlook for a US solar company under the Trump administration. However, China is the world center of the solar industry, particularly the production of solar panels. And China’s domestic solar market is huge. Two months ago, China’s solar and wind energy capacity overcame fossil fuels for the first time, according to the country’s energy regulator.

But that doesn’t mean that Chinese solar panel producers are good investments. For the past six months, First Solar, the largest Western solar panel manufacturer, has surpassed many of its Chinese competitors.

China’s solar market is cruelly competitive. Solar panels are now essentially a product. The margin is slim and volatile. Recently, major Chinese manufacturers have been struggling. Jinkosolar lost in the first quarter. Trina Solar reported significant losses in all 2024. The first solar quarter wasn’t particularly strong, but I made some money.

Morningstar Chen Wang explains:

Global Supply makes many solar markets unprofitable, but the US market remains extremely profitable due to trade barriers that limit supply. Most US solar companies focus on the country, which continues to generate healthy profits. This may explain the difference in ratings.

Guggenheim’s Joe Osha points out that the US has had solar import control for some time. “The price difference (between the US and elsewhere) is dramatic. In the US (panel cost), it is more than twice the cost in other markets.” According to OSHA, the even higher tariff potential on China actually presents opportunities for the first solar and other US producers.

Solar tariffs are controversial. They may make sense if having a domestic solar panel industry is a legitimate national security priority, or if the Chinese government is engaged in predatory dumping. But the price Americans pay is more expensive solar. Owning customs duties may be worth it. Domestic solar producers will benefit either way.

(writer)

One good read

Money vs. power.

ft HESHGED PODCAST

Is it not being properly kept? Listen to our new podcasts and dive in to the latest Markets News and Financial Headlines twice a week for 15 minutes. Check out previous editions of our newsletter here.

Recommended newsletter

Due Diligence – A top story from the world of corporate finance. Sign up here

Lex Newsletter – Our investment column, Lex, categorizes key themes of the week, along with analysis by award-winning authors. Sign up here