Cryptocurrency has seen a sudden drop as Trump proposes 50% tariffs on EU goods. Bitcoin (BTC) fell by 4%, while Ethereum (ETH) fell by more than 3%. As a market orthodontium for the impact of tariffs, the recent Trump Memo Coingala Dinner sparked controversy and market volatility.

The cryptocurrency market, known for its volatility, faces new uncertainty as US President Donald Trump intensifies global tariff negotiations and sends shockwaves through both traditional and digital financial systems.

Bitcoin (BTC), which recently reached an all-time high of $111,814, has become increasingly sensitive to geopolitical developments as it closely tracks Trump’s latest trade threats.

In particular, the BTC today experiences a sharp decline of 4%, following a 3.2% drop following Trump’s true social post, which declares negotiations with the European Union “doesn’t go anywhere.”

As panic spreads, leveraged positions of over $300 million have been settled, indicating that digital assets, often considered uncorrelated, are becoming more responsive to global policymaking.

The 90-day tariff suspension is almost at the end

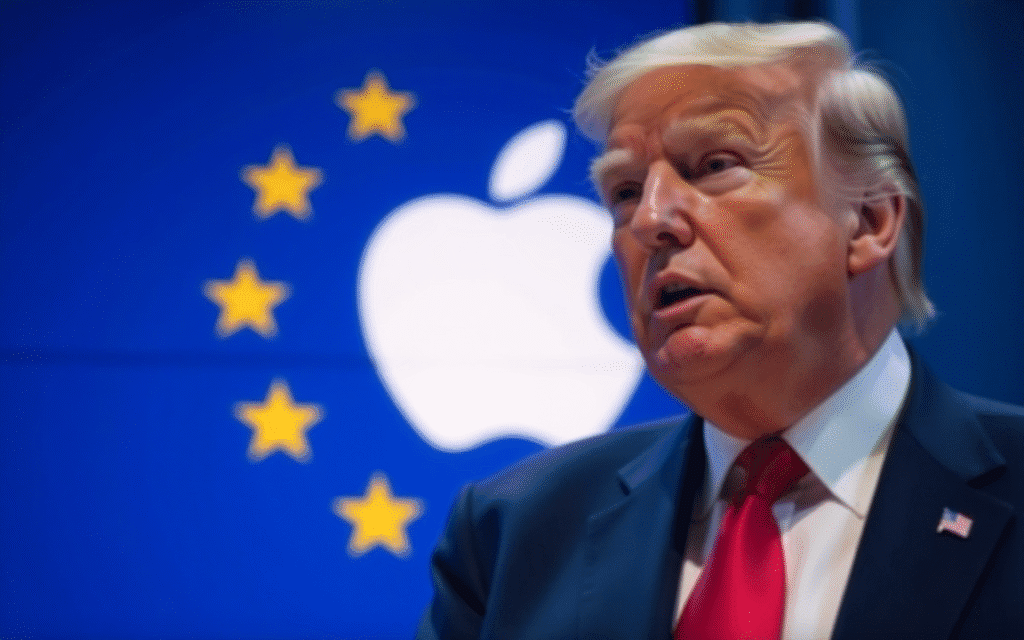

As the 90-day tariff suspension approached its expiration date, Trump proposed a 50% tariff on EU imports and raised vigilance about the broader economic impact, along with a 25% tariff targeting iPhones manufactured overseas.

Investors are now afraid that these tariffs will not only escalate trade tensions, but will also lead to retaliatory actions from the EU, further complicating the situation in the global market.

The EU has so far refrained from escalating the situation, but the clock is ticking as a 90-day tariff suspension was set to expire in July, putting a lot of pressure on continued negotiations.

The UK has only finalised a trade deal so far, and India is expected to sign it within a few days, but other major players remain in a tense waiting game.

Markets are waning amid fears of reopening tariffs

With July just a month away, market watchers like Crypto Caesar view Bitcoin’s $110,000 level as a key point of resistance, with traders highlighting the need for BTC to exceed $109,000 to maintain its current bullish structure.

$BTC – #Bitcoin retested after President Trump proposed a 50% tariff to the European Union from June 1, 2025. I’ll go here again. You must keep the green zone. pic.twitter.com/n9bihua18q

– Crypto Caesar (@cryptocaesarta) May 23, 2025

Ethereum (ETH) has not escaped volatility and holds support levels at $2,500, but struggles to infringe sustained resistance to $2,700, even with daily losses reaching 4%.

In particular, the ETHBTC pair continues to drift downward, suggesting that the wider market will stabilize and that the altcoin will weaken unless Ethereum regains relative strength.

Another asset under scrutiny, Pi Coin showed signs of an upward move earlier this month, but it failed to maintain profits above $1.23 due to aggressive short-term sales and long-term investor skepticism.

U.S. tech stocks reflect a slump in crypto, with Apple’s stocks declining amid concerns that high costs will be taken over to consumers, potentially damaging demand and damaging corporate profits.

Trump’s involvement in the code is controversial

Of all this, Trump’s personal involvement in Crypto added a layer of unexpected controversy.

The event, attended by key figures like Tron founder Justin Sun, elicited widespread criticism and accusations of corruption, particularly as federal lawmakers seek to investigate conflicts of interest in the cryptocurrency venture president.

As a top holder for $Trump and a proud supporter of President Trump, I was honored to attend the Trump Gala dinner by @gettrumpmemes.

Thank you for your unwavering support in our industry @Potus!

– He is Justin Sun (@justinsuntron) May 23, 2025

Following the gala, the Trump token spiked to $16 and then fell to $13.81, reflecting how quickly sentiment changes amidst the political spectacle and regulatory uncertainty.

Trump supporters argue that his aggressive trade stance is a strategic play to bring manufacturing back to the US, but economists have warned of rising consumer prices and slowing economic growth.

Already volatility-heavy crypto traders have found themselves navigating the complex intersection of policy, politics and profits.

As July approaches and tariff deadlines approach, the crypto market continues to have an advantage, predicting either a breakthrough in trade talks or another wave of volatility that could change investor confidence again.