This version of the article first appeared on CNBC’s Inside Wealth Newsletter. This is Robert Frank, our weekly guide to Net-Worth Investor and Consumer. Sign up to receive future editions directly in your inbox. David Adelman, founder of Entrepreneurs and Family Offices, said family offices have a higher competitive advantage over venture capital and private equity companies when it comes to investing in startups. Family offices are rapidly growing in number and size, and with assets currently at over $3 trillion, they are increasingly challenging for startup investments and merger transactions. Adelman, whose family office Darco Capital currently invests more than 90 private companies, said the family office can provide entrepreneurial expertise and more patient capital than private equity or venture funds. “We’ve been there for a long time,” said Adelman, CEO of Campus Apartments and co-founder of FS Investments. “All the funds are when it’s sunny at 80 degrees, when things are great. But when it’s cloudy and rainy, they’re not there for you.” As a serial entrepreneur, Adelman said he knows the experiences of UPS and Downs’ startups. Private equity and venture funds, on the other hand, are often constrained by strict timelines and fund requirements. Over dozens of Darsco’s portfolio companies suddenly needed capital during Covid, Adelman said. While larger funds have harped on providing more funding, Darco has extended its low-cost credit and support. “We were the last ones,” Adelman said. “I was there. You know. There have been really (hard) times in my career. And if someone had put screws on me, it could have made things worse. Billionaire entrepreneurs lead a new generation of more aggressive and handling family offices. Many of today’s family offices aim to launch new growth startups by investing directly and providing management expertise rather than simply maintaining wealth for the next generation. A family office survey from Bastiat Partners and Kharis Capital found that half of family offices plan to invest directly into startups over the next two years rather than traditional funds. Still, direct trading is risky. Adelman said he invested in a deal recommended by a friend before launching Darco. “Friends would say, ‘Here’s there, there’s a deal, and I’ll put X amounts.’ So it’s $250,000 or $500,000, or $1 million,” Adelman said. “I realized very quickly that investing in a friend of a friend’s idea, or someone from your country club is investing in it, so perhaps a potential customer who will lose money.” He launched DARCO, creating a formal process of assessing startups and making direct investments. Darco’s portfolio companies range from vodka and spirits to women’s shoes, energy companies and sports teams. Along with campus apartments, FS and Darko, Adelman is also a limited-edition partner at Harris Blitzer Sports & Entertainment, which owns and operates the Philadelphia 76ers and the New Jersey Devils. Adelman said he receives investments that are invested every day. His first rule of thumb when choosing an investment is to understand business models and business models. “I don’t invest in things I don’t understand,” he said. “I’m not trying to control someone else’s business, but I have to understand that,” Adelman said he’s also looking for a strong founder, rather than investing in a business model alone. His investment in Margaux, a women’s shoe company, was driven largely by his faith in two female founders, Alexa Buckley and Sarah Pearson, whom he met at Harvard University. “I bet on the jockey, not the horse,” Adelman said. “I ask, ‘If things fail, will we support them again?” To clarify, many of our (investments) are they honest or ethical, as we are in the early stages? He said the investment in Credo, a Philadelphia-based fintech, has helped consumers build credit through debit cards and has recently partnered with Starbucks to begin improving the financial lives of their already younger users. “When you think about employees at these big companies, the question is what you can do as a major employer to show your care,” he said. “The easiest way to do that is financial health.” Adelman is also looking for companies that will benefit from synergistic effects with his other possessions. Currently, campus apartments house more than 25,000 students, allowing you to find trends among young consumers with new products and brands. His spirits company Darco Spirits sells American harvest vodka and beach whiskey, but he said it “does work well” with sports venues and sports investments. As for advice on other family offices, Adelman said wealthy entrepreneurs and families should first ask themselves the difficult question of whether they really need them. “There are a lot of multi-family offices and businesses that can provide the majority of the services that we need as a family,” he said. “You can outsource it and still get great results. I’m always the concept of borrowing better than buying.”

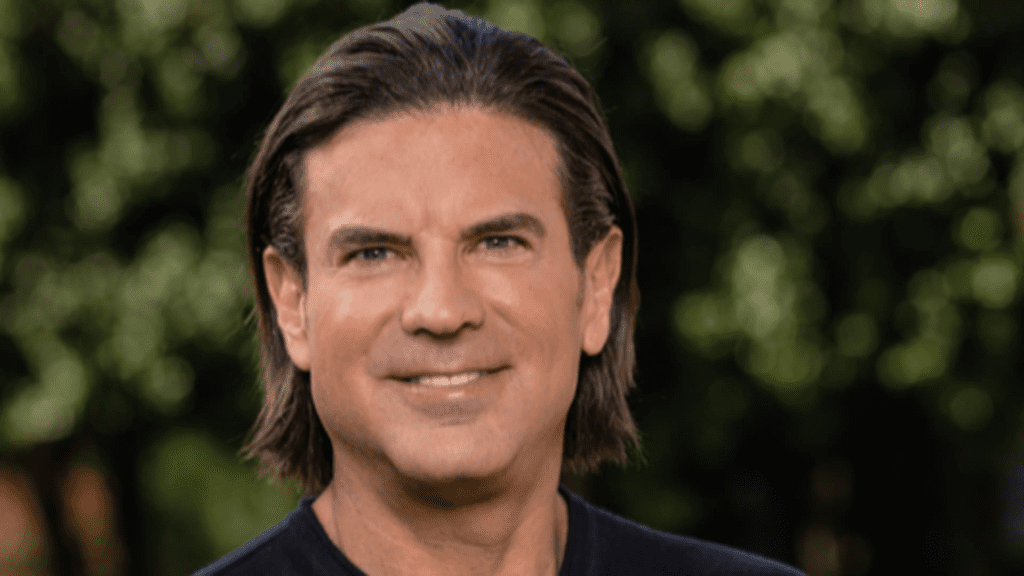

David Adelman is CEO of Campus Apartments, co-founder of FS Investments and has family office Darco Capital.

Credit: Darko Capital

This version of the article first appeared on CNBC’s Inside Wealth Newsletter. This is Robert Frank, Net-Worth Investor and Consumer’s weekly guide. Sign up to receive future editions directly in your inbox.

David Adelman, founder of Entrepreneurs and Family Offices, said family offices have a higher competitive advantage over venture capital and private equity companies when it comes to investing in startups.