Unlock Editor’s Digest Lock for Free

FT editor Roula Khalaf will select your favorite stories in this weekly newsletter.

Defense is a new technology when it comes to the hot sector. Or is it the opposite? This is a question worth asking as defense stocks have recovered over the last few weeks, from the news of Donald Trump’s “Golden Dome” missile defense shield, the new UK-EU security agreement that will allow UK defense companies to access Europe’s 15 billion euro defense funds, and the US-China strategic competition to stay here and Europe’s own defense.

The question is whether all this new spending will be rewarded, or whether the technological disruption is changing not only the nature of war, but the business of defense itself.

The US military budget has long been huge (defense is the biggest item in the federal budget), and is even bigger under Trump. The president has called for a record $1tn for the defense of the “Big Beautiful” budget bill.

China’s military spending is also on the rise. The country is the second largest Spender after the US and has the largest navy in the world. European defence investments are also set to increase significantly as the Russian war in Ukraine has revived its own security and a growing sense that the US has become an unreliable ally.

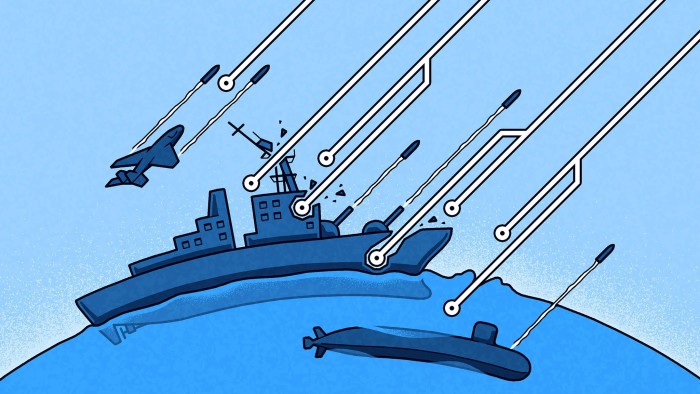

However, much of this new investment will become legacy items such as F-35 fighter jets, ships, and submarines. Trump’s missile defense programme is straight from the Reagan era Star Wars playbook. Some analysts are beginning to ask whether technology is money spent when it is changing the nature of war, even considering the rise in global conflict.

After all, cheap drones and missiles can take out a line of Russian tanks moving to Ukraine. It is also used by the Houthi rebels of the Red Sea to destroy multiple ships and spend almost $1 billion on military operations on the US.

In some respects, Ukraine has become a testimony for this change in the war. Eric Prince, the founder of Blackwater, a private military company that currently leads the private equity company Frontier Resource Group, said in a speech on the war in February that the Russian-Ukurein conflict “substantially promoted the war.”

Today, innovations such as 3D printed canister explosives on software-led drones can take Russian tanks for thousands of dollars, but within weeks, hackers have found a way to thwart the navigation system of the US-made $150,000 Javelin missile. Adding the growth power of artificial intelligence, says Prince, a former Navy seal. The next big military innovation probably won’t come from the Department of Defense, or the DARPA, of the Defense Research and Development Agency, and from the “smart people” in “their garage.” As he said, “trillions of dollars’ installation ability” has become obsolete.

Market analyst Luke Gromen said that “tech-driven deflation and decentralization came in a major way to fight for the first time.” He resembles the issue of the defense industry as a “curse of the incumbent,” which resembles the decimation of Netflix’s blockbuster video. Louis calls it “Microsoftization of War” by conducting his research on Dividkal.

Like companies such as IBM and Microsoft’s democratized PC ownership (previously had to work for large companies to access mainframes), Ground-Up Innovation is shifting the nature of today’s war. This has a potentially profound impact on Raytheon to BAE Systems, Ge Aerospace and other people whose stock prices have risen at recent market gatherings and incumbent defense contractors to GE Aerospace. Their products could become military equivalents to mainframe computers compared to laptops increasingly used on the battlefield.

Of course, these companies are moving forward with their own innovation efforts. There are also many cutting-edge startups, from Silicon Valley to Israel, that aim to harness high-tech and decentralized warfare. However, the changing nature of war is not merely a market issue, but also has macroeconomic and geopolitical implications. As Gromen puts it, “Western investors operate on the first principles of US military control, as absolute fallback support for US foreign policy, economic policy and the USD system itself.” “What happens if that assumption is not correct?

First of all, it is likely that there will be a lower dependence on US manufacturers, as evidenced by European Remilitary Plans, which rely on EU companies. I also ask whether the US can afford to boost military spending at a time when debt and deficit levels are raising alarms. Finally, the democratization of war gives more defence autonomy to both individual and individual states. Success in this new world could be measured at the scale of your budget and be tech-savvy.

rana.foroohar@ft.com