Unlock Editor’s Digest Lock for Free

FT editor Roula Khalaf will select your favorite stories in this weekly newsletter.

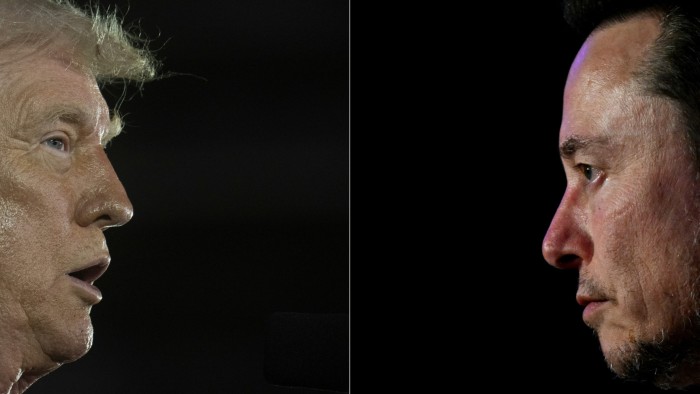

Elon Musk’s artificial intelligence company Xai was locked in a $5 billion debt finance package to fund new data centers and chips. Then on Thursday, the world’s wealthiest man torpedoed his relationship with US President Donald Trump.

Morgan Stanley’s Musk bankers must challenge this new complication. Investors are trying to evaluate the fallout from the dramatic dismantling of mask relations as president, according to those who have been described on the issue. Debt could also be more expensive, they added.

Before the two men launched a war of words that included Trump’s threat to tear off Musk’s government contract, investors had issued more than $4 billion orders for the contract.

As Musk mentioned himself, lending money to an AI venture belonging to the president’s “first buddy” seemed like a solid bet.

The enthusiasm attracted Morgan Stanley near the debt-raising finish line, driven by well-known investors such as TPG.

The interest was so high that Morgan Stanley raised prospects as it could close out a cheaper funding than Xai first pitched.

But that pricing is currently in the air, and some investors who bet on Xai may have to lock themselves up in fundraising and pay.

The multi-billion dollar borrowing package is still expected to be split between fixed and floating interest rate loans and corporate bonds, and those who were explained about the issue said that the $5 billion capital raise is still on track.

The bankers discussed earlier this week the decline from 12% on bond coupons and fixed-rate loans to 11.5%, but floating-rate loans were expected to price at an interest rate that was 7 percentage points above the benchmark floating-rate rate.

“This will be even more difficult,” one due diligence person on the deal said of Musk’s fallout with Trump. “We need government support not only for this, but for that ecosystem as a whole.

Xai Management met investors on Thursday. Two men locked their heads on social media, sharing forecasts for the company’s business and growth outlook.

Several people said Morgan Stanley pitched his debts to large credit shops that can place orders of at least $100 million, and targeted many of the same investors earlier this year who agreed to buy loans from Xai’s sister company, social media site X.

In signs of the effect Kelfaful had on the business of masks, the price of X’s debt slipped to about 96 cents for a dollar, from over 99 cents a day ago.

Even in front of the spat, Morgan Stanley was facing a pushback from investors. Lenders raised concerns about the documents supporting the transaction, demanding that Xai strengthen the many traditional safeguards offered to investors. These include the amount of incremental obligations that Xai can undertake how much cash it is able to pay investors.

Others were questioning the intellectual property that secured the value of the loan package and collateral. The debt is protected by the data centers Xai is building.

Some investors have indicated that they will leave the transaction if their concerns are not met. Morgan Stanley is working to settle these terms ahead of the June 17th deadline.

Xai did not respond immediately to requests for comment. Morgan Stanley and TPG declined to comment.

Investors who are conducting due diligence on debt said Xai is losing money and earnings are low. However, their investment papers are partly supported by the company’s stock valuation, and their belief Xai begins to sell lucrative corporate contracts to use its technology.

“This is a product that will likely be one of the winners of commercial AI,” said one lender. “On the consumer side, Openai has a big lead, but on the commercial side, it can be a material player, worth more than $15 billion to $20 billion.”

The Financial Times reported Monday that Xai has begun selling $300 million in shares, valued at $113 billion.

Nevertheless, some creditors have complained about the limited data they have been shared so far.

Recommended

Those familiar with the deal said Morgan Stanley maintains close York with access to the data room and calling management. One added that the slide deck Xai, which was offered prior to the management presentation to investors on Thursday, had around 10 or less slides.

“It was really quite Fugaji. I’m saying it as a Xai Data Room lover,” the person said.

“It’s all fantasy, it’s an idea,” the second said of the presentation. “They haven’t spent any money yet.”

Additional Reports by Robert Smith of London