Lock the White House Watch Newsletter for free

Your Guide to Washington and the World’s 2024 US Election Means

Since President Donald Trump took office, European stocks have surpassed the US that month. This raises hope that the region may escape the worst-case scenario trade war.

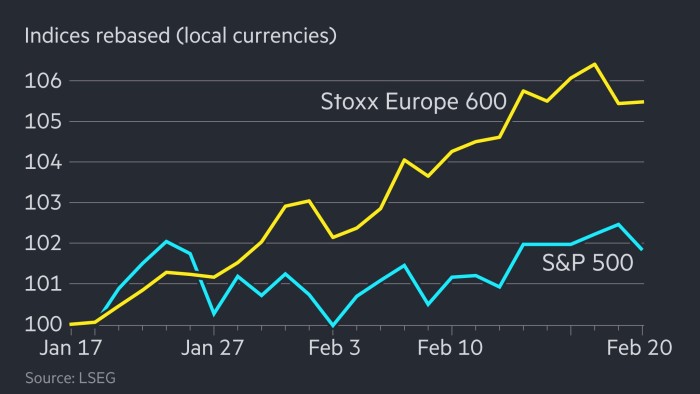

The benchmark Stoxx Europe 600 index has won 5.3% since January 17, the last trading day before Trump re-entered the White House, but the S&P 500 rose 1.6% on Wall Street, and the high-tech NASDAQ composite has increased by 1.4%. percent.

Analysts say the unexpected and strong performance of European indicators is driven by Trump’s decision not to impose immediate tariffs on the EU and the prospect of peace negotiations in Ukraine.

The EU was supported as a major target for Trump’s first US policy after the US president pledged to impose full tariffs on the bloc, but it was not yet in effect.

“For Europe, the bark of the trade war has so far been worse than biting,” said Andrew Peas, chief investment strategist at Russell Investments. “But the other story is the upward trend in bank lending over the past year,” says the European Central Bank’s cut in interest rates.

European stocks enjoy the best start of the late 1980s to the year, enjoying the strongest performance compared to the US in almost a decade, Bank of America analysts note on Wednesday It is stated in.

The benefits came after a slowdown in the US performance in Europe. This is because large gatherings in major tech stocks in recent years have lifted Wall Street. Trump’s election was the latest catalyst, pushing European stocks to slow the US at the widest margin on record amid the hopes of a bruise trade war.

The recent strong performance of Europe comes despite signs of stagnation of concern over the long-term security of the continent’s major economies and regions, as the United States threatens to pull back military support.

Daniel Morris, Chief Market Strategist at BNP Paribas Asset Management, said:

The rally was helped by European fund managers increasing allocations since the beginning of the year. This week’s survey shows that the percentage of local stocks undervalued is the highest in six years.

Sectors including finance, defense – boosted by the prospect of increased spending by the European government, the gorgeous stocks are attributed to a lack of daily tariffs.

Rheinmetall, Europe’s largest ammunition manufacturer, has grown 31% over the past month, with luxury manufacturer Richemont increasing 10%.

Meanwhile, the euro has won 1.8% against the 1.8% dollar for the past month.

UBS analysts upgraded their allocation to continental Europe to overweight last week, citing Russian invasions of Ukraine, slow fiscal policies and lower energy prices if they end more powerful corporate income.

Hong Kong has been the key indicator of top performance since Trump’s inauguration, with the Hangsen index rising 15% since January 20th, leading to a rally of Chinese technology stocks listed on the territory following the deepscake shock It is being done.

However, mainland China’s CSI 300 is only 3% ahead. The rest of Asia is more flat, with Japan’s broad topics increasing by 2%, while India’s Nifty 50 down by 1%.

However, some analysts have expressed doubts about whether European performance could last throughout the year, especially if US tariffs are simply lagging rather than diluted.

Trump could be next in line with imports from Europe after the US moved to impose a 25% tariff on Canadian and Mexican imports and a further 10% collection on Chinese goods. I warn that there is.

Regional stock markets fell on Wednesday after the US president said he was considering imposing a 25% tariff on automobile, drug and chip imports. The Stoxx 500 on Thursday fell 0.1%.

“The muscle memory for most investors is that outperformance in Europe is only small amounts in a very short period,” says an analyst at UBS.

Additional Reports by Ray Douglas