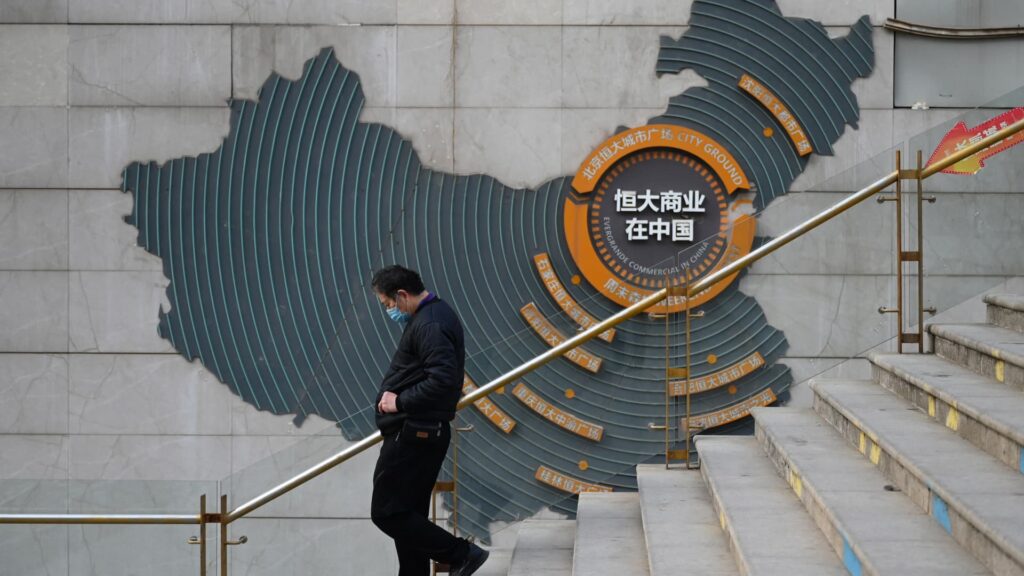

Commercial facility in Evergrande, Beijing on January 29th, 2024.

Greg Baker | AFP | Getty Images

China’s Evergrande Group was delisted on Monday by the Hong Kong Stock Exchange. This is an ignorant exit for former high-flying developers who once symbolized Beijing’s economic rise and later became a bust of the country’s wealth.

Following the 2009 list, Evergrande became one of China’s hottest stocks, peaking in 2017 at a market capitalization of $51 billion. LSEG data shows that trading in the company’s stocks has been suspended since it received a liquidation order in January 2024, exceeding $280 million.

Evergrande, once China’s biggest seller, is remembered as the world’s most beneficial developer with more than $300 billion in debt, and its default has sparked a long-standing crisis that focused on the country’s economic growth.

This was one of the earliest developers who were upset after Beijing rolled out its 3-Redline policy in 2021. Policy aimed at restraining active borrowing has caused a sector-wide liquidity crisis.

Shrink property bubbles

Evergrande was rewind in the aftermath of the collapse during a long-term real estate slump, but analysts expect the drag to be easier in the coming years.

The Chinese housing slump was extended to its fourth year, with price, sales, investment and construction activities shaking completely.

China’s new home prices fell at its fastest pace in the eight months of June, falling 3.2% year-on-year before recovering slightly in July, but the decline in real estate-related investments deepened.

“The Chinese property bubble peaked in 2021 and has been contracting ever since,” said Andy Shee, an independent economist based in Shanghai. He noted that sales of new home properties have been halved in four years. Prices have also been halved in the suburbs of small and major cities, with a decline of up to 30% in the central regions of Tier-1 cities, economists noted.

“The adjustments are not finished, but the economy is already absorbing most of the impact,” Xie added.

“The revision of China’s housing market remains a continuous headwind, but it has reduced resistance over the next few years,” said Chang Chang Hua, chief economist at Da Hua Sekai at KKR, estimated a small dentist with 1.5% points of China’s gross domestic product in 2025, compared to 2.5% points in 2022.

Hua estimates show that its impact will continue to be easy to just 0.3 percentage points by 2027.

At a high-level policy meeting last week, Chinese Prime Minister Li Qiang highlighted the need for more effective measures to address the real estate market and stabilize market expectations. China’s property and construction sector accounted for more than a quarter of China’s GDP before Beijing cracked down on developers’ excessive debt in 2020.

On Monday, the Shanghai government announced numerous measures to increase housing demand, including allowing eligible families to purchase an unlimited number of homes in the outskirts of outside countries and calling for a lower mortgage rate. It removed the purchase restrictions on suburban homes following similar easing measures from the Beijing Municipal Government earlier this month.

China’s developer stocks rallied on Monday morning with optimism that Beijing is pushing for more stimulation to support the housing market, according to William Wu, China Property Analyst at Daiwa Capital Markets.

“Safe flight”

Leonard Law, senior credit analyst at Lucror Analytics, said that “we’re past the peak default wave” as most private developers have already defaulted and are restructuring debt.

That said, some of Evergrande’s peers could face similar abolition risks, according to Christine Li, Head of Asia-Pacific Research at Knight Frank at Global Property Consultancy. Li estimates that since its launch this year, dozens of Chinese developers have been approved in debt restructuring plans, clearing more than 1.2 trillion yuan ($167 billion) of debt.

Beijing has urged local governments to secure rapid loans to cash-bound developers, reportedly considering plans to mobilize state-owned businesses to take over homes sold by deceased developers as part of an effort to stabilize the sector.

The risk of defaulting for more developers is subsidering, but as the multi-year crisis has become more cautious than before, consolidation around state-backed developers seems inevitable.

“We are pleased to announce that Cathy Lu, a credit analyst at Octus, known as Reorg, a financial data company specializing in debt restructuring.

MacroLens Principal Brian McCarthy said many of the large developers who have become “zombie companies” will eventually get caught up in state machinery. He predicts that state entities will come in and fund the completion of the unfinished units.

“State-owned developers will run the entire industry. Chinese policymakers will never approach anything like what this bubble has seen over the past 15 years,” he said.

The Shell of the Estate Empire

Last January, a Hong Kong court ordered the liquidation of Evergrande’s local assets after creditors filed a petition and appointed Alvarez and Marsal, the companies that unleash the Lehman brothers.

So far, progress has been slow. Overseas creditors have taken back most of the Evergrande’s assets sitting on the mainland, only a small portion of what they owed.

Evergrande still has at least hundreds of unfinished projects across the country, with hundreds of thousands of home buyers waiting for their homes, with long creditors from Chinese companies supplying bonds to Evergrande to bondholders to remember their losses.

“For Evergrande, home delivery remains a priority,” Octus’ Lu said. Evergrande said it has delivered 1.2 million homes over the past four years, with over 95% of the sales units being completed citing company representatives.

However, creditors continue to face uncertain outlook for repayment. The offshore entities have been in the liquidation process since last year, but Evergrande’s large onshore units are also insolvent and have little restructuring value, Lu added.

The Hong Kong liquidator said in a filing earlier this month that Evergrande’s debt burden was far greater than estimates, and that “overall” restructuring was out of reach. Evergrande’s debt pile reaches $45 billion, significantly higher than the $27.5 billion liability proven in 2022 Evergrande financial disclosures, the liquidator said.

Despite liquidation efforts, overseas bondholders and shareholders are likely to be wiped out for the majority, MacroLens’ McCarthy said. “For foreign investors investing in China through Hong Kong, if things get worse, you’re limiting your reliance on land assets.”