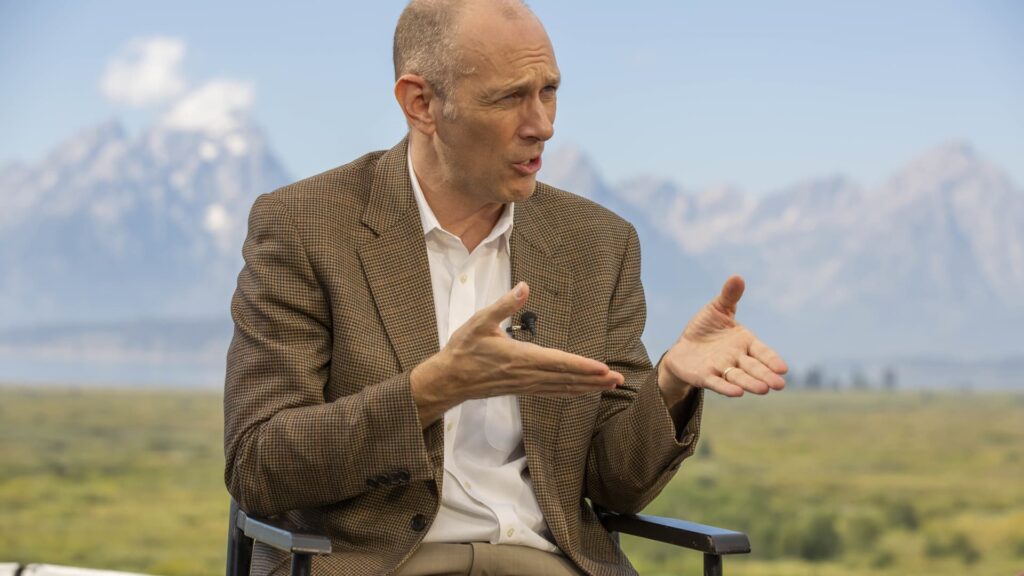

Austan Goolsbee, a lecture at Jackson Hall on August 23, 2024.

David A. Glogan | CNBC

The officials of the Federal Reserve have a great deal of pain not to comment on fiscal policy, but the approach from tariffs forced their hands.

Recently, several central bank policies have not only focuses on the uncertainty of President Donald Trump, except for products from Canada, Mexico, China, and probably from the European Union. It emphasizes the potential impact on inflation.

The signs that tariffs are applying for a long time on the price can increase the Fed holding interest rates longer.

President Austan Goursby cited many supply chains threats, including “the possibility of expanding large tariffs and trade wars” in a remark on the car symposium on Wednesday in Detroit in Chicago.

“If inflation rises or progress in 2025, the Fed will be a difficult position to understand whether inflation is due to overheating or tariffs.” Goursby said. “The distinction is important to determine when or or in case of Fed.”

Last week, the federal public market committee, a voting member, voted for stabilizing benchmark interest rates in a range of 4.25 % to 4.50 % to evaluate economic evolution sets.

The voting occurred in the background of the game manship between Trump and the US largest trading partner. He has postponed the taxation on Canada and Mexico, but has added 10 % to China and retaliation with its own measures.

Economists generally believe that customs duties will have a limited effect on the price, and are subject to duties, but affect specific products that are wider and basic inflation propulsion. Give it. However, in this case, Trump is throwing a wide net enough to create fundamental inflation that the Fed is feared.

Limited road map

In an interview with CNBC earlier this week, President Susan Collins, a Boston Fed FOMC voter, stated that her and her staff were studying the potential impact of tariffs, and Trump’s cleaning fee proposed. I noticed the nature.

“We have such a large and very wide range of tariff experience,” she said. “There are various dimensions and the second effect. This makes it particularly difficult to actually evaluate what the amount is … I do not know what the time frame will be. Price level.”

If the tariff is short -lived, “I will expect the Federal Reserve to investigate, but of course there are many factors from that point of view. The economy is about what we are thinking about future policies. Really important.

Other Fed officials in Philadelphia’s Patrick Harker and the Atlanta Federal Government Rafael Bostic also said they were worried about potential inflation, and said they would monitor long -term effects.

Mr. Jerome Powell said at a post meeting press conference last week, asking multiple questions about tariffs and making a decision on fiscal policy.

“I don’t know what will happen in tariffs, immigrants, financial policies, and regulatory policies,” he said. “I think it is necessary to clarify these policies before starting a plausible evaluation of what their meaning of the economy is.”

-Reuters contributed to this report.