Unlock Editor’s Digest Lock for Free

FT editor Roula Khalaf will select your favorite stories in this weekly newsletter.

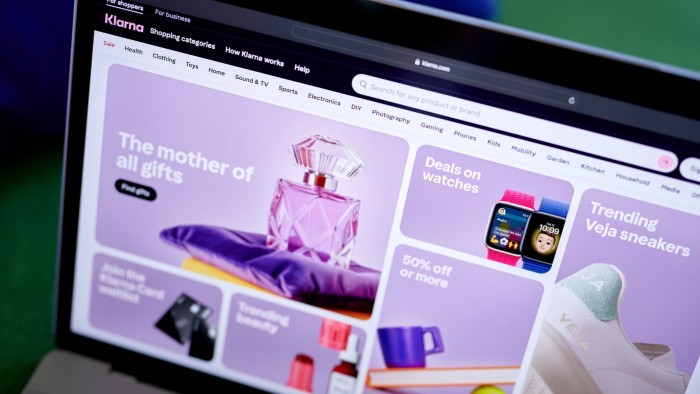

Swedish Fintech Kraruna targeted IPOs in the US in April, with a valuation of up to $15 billion when it comes to one of the biggest lists of the year.

According to people familiar with the company’s ideas, the purchase obligation is preparing later credit companies to announce their listing plans soon next month. According to anyone familiar with the issue, he applied for an IPO with the U.S. Securities and Exchange Commission in November, but has yet to select a US listing venue. Klarna declined to comment.

The company was founded in 2005 by CEO Sebastian Siemiatkowski and offers short-term free loans to consumers, usually at retailer check-outs.

It became a symbol of the fintech boom and bust when its valuation hit $6.7 billion in 2021, becoming Europe’s most valuable startup.

Fintech recently emerged from a governance crisis caused by a conflict between Siemiatkowski and his co-founder, Victor Jacobsson.

Klarna has narrowed its losses over the past year and is on track to return to annual profitability. It was profitable regularly until 2019 when it began accepting some credit losses to pursue US expansion.

They are trying to cut costs and reduce their balance sheet before IPOs, and believe that AI can almost halve its personnel. It also offloads loans on drives to free capital for loan growth, and has recently sold most of its UK portfolio to hedge fund Elliott. It is also under discussion to sell the US loan books previously reported by FT.