This article is the on-site version of Firstft Newsletter. Subscribers can sign up for the Asian, European/Africa and American versions to deliver their newsletter every morning. Explore all our newsletters here

good morning. Here is what we have for you today:

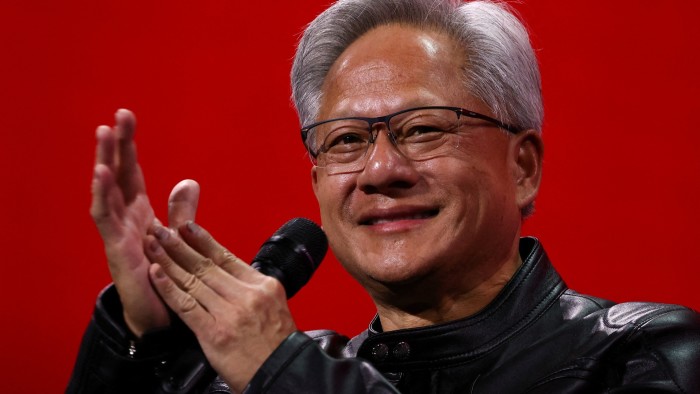

Nvidia’s rating is over 40tn

Moet Hennessy’s Sexual Harassment Case

Independence of the US Federal Reserve System

And what makes a great party?

Nvidia yesterday became the first company to achieve a $40 market valuation over the rapid rebound of Wall Street Technology stocks in recent months.

How was the stock made? The stock peaked at $164.42, surpassing the milestone and reverted to closing at $162.88, giving it a market capitalization of 3.97tn. They have been rising 40% since early May after sputtering at the beginning of the year on concerns about increased demand for AI chips and the emergence of Chinese rival Deepseek. However, these concerns are backwards, with Nvidia projected to reach $200 million revenue this year, up 55% per year.

Why does it matter: Nvidia has become the biggest beneficiary of the high-tech boom beyond the smartest days of the dot-com era. The chip is used to fuel AI chatbots and “sovereign AI” models such as ChatGPT and humanity. And despite US export control, China also operates important businesses, which accounts for 13% of total sales. Details about the company’s growth are available.

Here is the other thing we keep tabs today:

JAMIE DIMON: The CEO of JPMorgan Chase will give a speech and participate in a Q&A at the Irish Ministry of Foreign Affairs in Dublin.

Central Banks: Albert Musalem of the Federal Reserve Bank of St. Louis, President Mary Daly of the Federal Reserve Bank of San Francisco, and Federal Reserve Board Christopher Waller are taking part in the public event. The Bank of Mexico will issue monetary policy minutes and ensure that Peru’s central bank does not change to 4.5%.

Economic Data: Brazilian statistical agency IBGE has published its consumer pricing data for June.

Results: Conagra Brands and Delta Air Lines report revenue.

Five more top stories

1. Exclusive: Moet Hennessy faces charges of sexual harassment, gender discrimination and unfair dismissal in a lawsuit that people who worked in the business are symptom of broader cultural issues in LVMH’s 6 billion euro drinks sector. Adrienne Klasa has details of this case.

2. Coffee futures prices jumped today after President Donald Trump threatened a 50% tariff on Brazil, the world’s largest Arabica producer, shaking the industry and risking a surge in prices for US consumers. Arabica coffee prices in New York rose more than 3.5% in response to Trump’s threat.

Brazilian US tensions: The US president also criticized the government of Luis Inacio Lula da Silva for his treatment of former Brazilian right-wing president, Jea Bolsonaro.

More Trade News: Automakers and shipowners have called on the Trump administration to reconsider the sudden new port rates for car carriers, claiming that taxation will hurt American consumers and exporters.

3. US electricity providers are trying to impose a significant price increase on consumers amid the energy intensive requirements for artificial intelligence data centers. The energy advocacy group said utilities have sought regulatory approval for a 142% higher rate in the first half of 2025, highlighting the question of whether a surge in electricity costs will be shared among all users or directly charged to large industrial customers that will drive new demand.

4. Ferrero, a family-owned Italian cuisine group behind Ferrero, Ferrero Rochar, Chick Tuck and Kinder Sweets, has a high-level discussion to buy American Breakfast Cereal Company WK Kellogg for deals worth up to $3 billion. The food industry is tackling changes in consumer habits that have been forced to change strategies for manufacturers, particularly sweet companies.

More Trading News: Amazon is considering billions of dollars in investments to deepen its strategic alliance with multi-billion dollar investments in AI model builders, according to multiple people with knowledge of the debate.

5. The devastating floods that killed more than 100 people in Texas have escalated concerns that climate change is making extreme weather events more frequent and more intense, but are not prepared to warn citizens of the immediate danger. “It’s particularly shocking and I’m concerned that the floods were extremely deadly in places where we know that floods are at risk of flash floods,” said a senior adviser at the Red Crescent Climate Centre for the Red Cross.

Big reading

Donald Trump’s growing frustration with the US Federal Reserve has led Jerome Powell to view various “silly”, “bad”, “nuxcle”, “stubborn mules”, and “complete and complete idiot”. Inhumousness overwhelmed the dollar, worrying about the central bank’s independence, but replacing him with a more flexible person is not easy. Can the Fed remain independent under Trump?

I also read and listen to it. . .

ICE: When Trump outlined his vision for deportation in 2024, he said he would focus on banishing people with criminal history. But it expands to include everyone who has no legal status.

Defense: Europe is only a few years away from being able to deploy fighter jets without human pilots, said the continent’s most valuable defense startup.

Trade: Trump’s shambolic tariff policy may have some useful effects, senior trade writer Alan Beatty argues.

Secretly Investigated Economist: The Law of Unintended Consequences strikes once more.

The chart of the day

According to data from the Centers for Disease Control and Prevention, the number of measles infections in the United States reached its highest level since 1992, causing 162 hospitalizations and three deaths this year. About a third of the incidents take place in one West Texas County.

Take a break from the news

In addition to a $100 million budget, all boards, hosts of A-listers with Venetian backgrounds, do well for a good gathering, but James Max writes. If you’re planning a party this weekend, here’s James’s DOS and DOTS list.