The same family owned by the Reynolds Ranch for over 116 years, is on the market for $30 million.

Courtesy of an outdoor property in California

For more than 116 years, Deanna Davis’ family has owned Reynolds Ranch, spanning 7,600 acres in California’s Central Coast region. Reynolds Ranch is currently on the market for $30.7 million, as heirs are disagreeing about Homestead’s future.

“It’s very difficult for a family to make decisions about the ranch together,” she told CNBC. “If I had cash, I’d buy everything right now, cash out everyone, start over and win the title with the LLC.”

Davis, who runs the ranch, is a general plight in a family tree with too many branches. Her mother, who passed away last December, was her last family to grow up at Reynolds Ranch. Now, the family is scattered all over the country, with some of her relatives living abroad. Some families who can only visit once or twice a year can rather pay cash.

Families like Davis are increasingly choosing to sell these long-standing properties, a high-end ranch broker told CNBC.

Legacy properties are in great demand, even if not at the pandemic’s highs, as deep pocket buyers slow the pace of wide open sky and life. The so-called “Yellowstone” effect is completely powerful, Paramount It shows you are looking for vast wealth in Montana, Wyoming, Colorado and other western states.

“All I know is people who buy this facility while sitting on the porch in the afternoon sipping margaritas and iced tea. You’d think they’ve landed in paradise,” Davis said.

“There’s nothing similar to that.”

Ranch broker Live Water Properties currently has $700 million listed stocks, starting from under $200 million in May 2024, according to broker Latham Jenkins, Jackson Hole, Wyoming. Many of these properties are the first legacy ranches to market in a generation, he said.

One such listing is Antler Ranch in Metetch, Wyoming, which spans 40,000 acres about three times the size of Manhattan, and costs $85 million. Antlers Ranch is the first in five generations to be on the market.

“The big historical traits are less common because a lot of people are split up and sold,” Jenkins said. “What remains is highly desirable.”

These legacy ranches could request premiums for reasons other than area, he said. Many historic ranches, like Red Hills Ranch, are 190 acres of facilities seeking $65 million, surrounded by undeveloped public land. Buyers are drawn to their privacy and their ability to hike, fish and see wildlife up close.

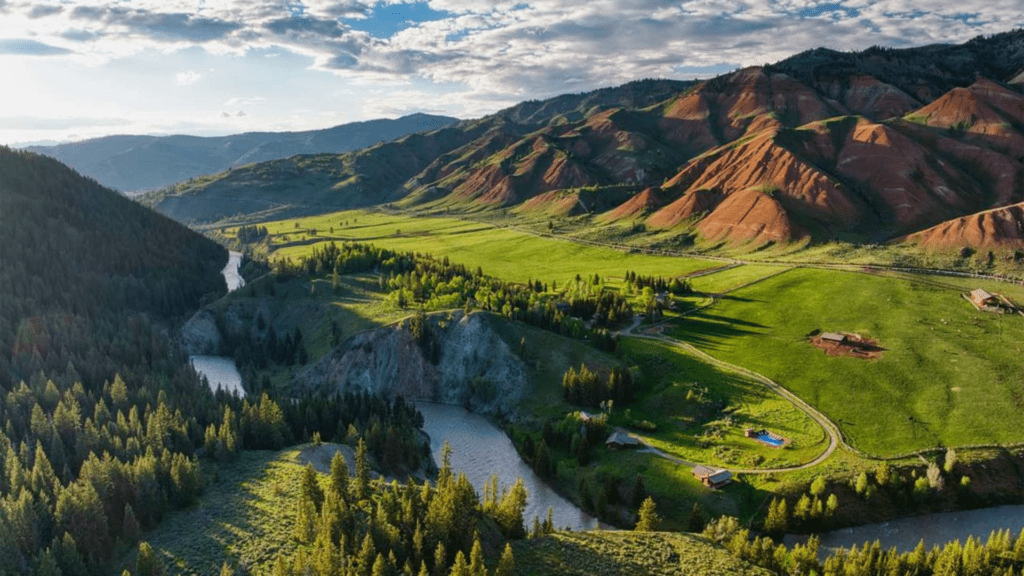

Outside 25 miles of Jackson, Washington, Red Hills Ranch spans 190 acres and is listed for $65 million. Located in the Bridger Teton National Forest, Red Hills Ranch was previously a private guest lunch for the late Senator Herb Call.

Courtesy of a living water facility

“Sitting next to a running river, watching the sunrise and sunset, seeing the elk calves born, nothing like that,” Jenkins said.

The family usually comes to him if the next generation has little interest in taking over the ranch, or when the heirs are unable to reach an agreement. He described these unique properties as “bittersweet” when they first became available for generations.

“It’s from real estate. The land is permanent, but the ownership is not,” he said.

Hall and Hall broker Bill McDavid represents Rocking Chair Ranch, a 7,200-acre Montana Ranch that has been in the same family for over 70 years.

“The adults have come to the point where they realised, ‘No, this family has moved on and do something else,” he said of the seller behind the property.

Generation of Wealth Transfer

According to Missoula, Montana-based McDavid, the ranch has been declining for decades, so many multi-generational ranches have already changed their hands. However, he also sees an increase in families trying to sell ranches they bought 20-30 years ago. The owners usually don’t have family connections with the ranch, so after making their fortunes through high tech and finance, they decided to buy the trophy facility.

“For buyers who made money during their dot-com days, they had some spectacular ideas about family heritage and more,” he said. “And as their kids are getting older, no one has moved to the ranch, so they didn’t move to the ranch. So, the guy at dot com, he came out and visited for the summer.”

He added the heirs, “It was never on the card that they took over the ranch.”

Davis said he hopes that the local ranch family will buy her California property. However, she said it is likely that Silicon Valley buyers will snap up Reynolds Ranch. Reynolds Ranch said it could accommodate a landing zone for a private plane, just an hour and a half from San Jose.

John Onderdonk, advising wealth on agricultural assets of Wealth Manager Northern Trust, said the generational transfer of wealth is shaping the market. He also said he was a fourth-generation cow rancher and was lucky that his brother agreed to keep the Central California ranch in the family. However, he said that many of the families he works in chose to do so for the sake of finances rather than indifferent.

“Real estate is a capital-intensive asset class and if the portfolio is not liquid and the rest of the family can’t support it, a tough decision will be made,” he said.

For $21.7 million, the Rocking Chair Ranch is on the market for the first time in over 70 years. Phillipsburg, the ranch spans 7,200 acres.

Courtesy of the hall

Legacy Ranches may come with livestock and farmland, but according to Ken Mirr of Mirr Ranch Group, there is a lot of due diligence required. For example, these ranches are usually run by long-time managers whose properties are sold and may leave when they are difficult to replace. Or they are staying and spending tough time adjusting to new ownership, Mirr added.

“The managers here start to think they own the place, right?” he said. “Sometimes, that’s not the best person to manage a ranch.”

Buyers who expect complete privacy can get a rude awakening. For example, Mirr said previous families had long oral agreements with their neighbors, allowing them to go beyond their property. In some states, it could be river fish or wads on private property, he said.

McDavid said buyers with deep pockets can have unrealistic expectations that they don’t want country property without sacrificing convenience. For example, many people want to drive within 30 minutes of a major airport. Buyers also prefer ready facilities, and multi-generational ranches may lack modern amenities.

When it comes to sellers, they get the wind blowing away, but they can’t replicate the lifestyle that comes with legacy ranches.

“When you sit on the porch, look around, own everything you see, it’s just unique,” Davis said. “It’s very difficult, the concept of losing that place, but on the other hand, it will make the next family very happy.”