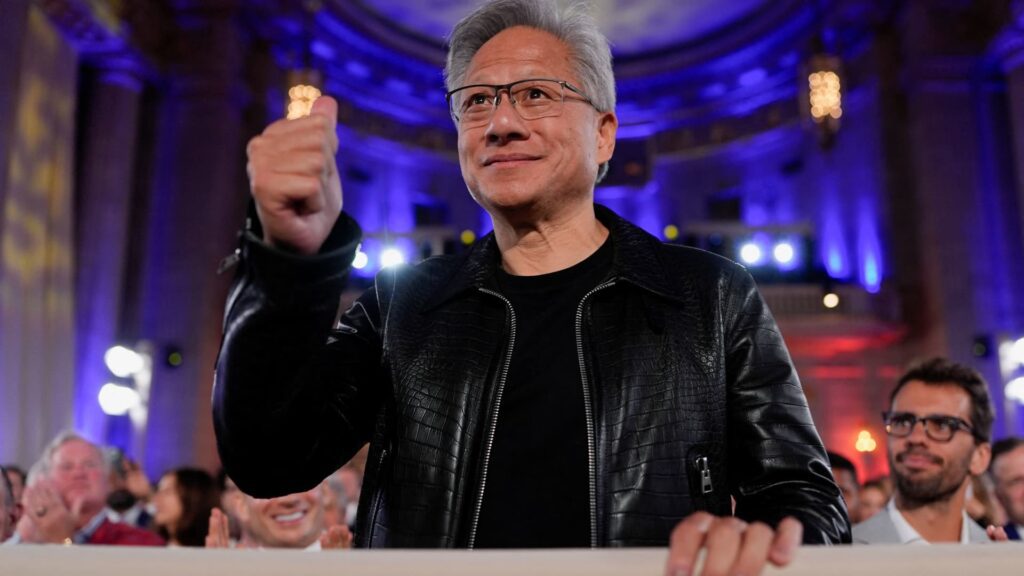

Nvidia CEO Jensen Huang will be attending the “AI Race Winning” Summit held in Washington, DC, USA on July 23, 2025.

Kent Nishimura | Reuters

It’s been two years since the explosion of generative artificial intelligence began to transform nvidia’s work. Since then, chipmakers have more than tripled in revenues and quadruple in profits.

nvidiaThe fiscal second quarter revenue report, scheduled for Wednesday, marks the second anniversary of growth. The company has moved from being known as a manufacturer of gaming chips to its current position at the heart of the technology industry.

Last month, Nvidia became the first company to achieve a market capitalization of $4 trillion and continues to be highly valued. Since the end of 2022, Nvidia’s stock price rose 12 times as Openai launched ChatGPT and sparked a generation AI boom. This year marks a 33% increase, closing at $177.99 on Friday.

For businesses of the size of Nvidia, growth remains substantial, but has slowed dramatically. After a triple digit expansion in the five quarters of 2023 and 2024, growth fell to 69% in the first quarter of this year. NVIDIA plans to report a jump of $45.9 billion from 53% year-on-year in its second quarter report, according to LSEG’s consensus on analyst estimates.

Datacenter revenue for the first quarter accounted for 88% of NVIDIA’s total revenue. This is the most clear indication of how important AI has become to its business. The company said 34% of its total sales last year came from three unnamed customers. Analysts say that Nvidia’s top end users are the leading internet companies. Microsoft, Google, Amazon and Meta.

“Nvidia’s assumptions and performance really determines what the market is beginning to price AI trade, and the entire AI trade has essentially driven the market over the past year,” said Melissa Otto, head of Alpha Research at S&P Global, which brings together Wall Street Research.

Nvidia accounts for around 7.5% of the S&P 500.

Non-NVIDIA Tech Megacap companies reported quarterly results in late July and updated Wall Street in their investment plans. Overall, they are looking to spend around $320 billion this year on AI technology and data center build-outs.

Although still private, Openai, which is valued in hundreds of millions of dollars, says it is affiliated with SoftBank Oracle The next four years will be spent $500 billion on the Stargate project announced by President Donald Trump in January.

Jensen Huang, co-founder and CEO of Nvidia, will be exhibiting his new Blackwell GPU chips at the NVIDIA GPU Technology Conference held in San Jose, California on March 18, 2024.

David Paul Morris/Bloomberg via Getty Images

Analysts say about half of AI capital expenditures end in NVIDIA. The company’s reliance on so-called hyperschools leaves it vulnerable to changes in the macroeconomic environment and the artificial intelligence industry.

Openai CEO Sam Altman last week said last week that he thought “all investors are overly excited about AI” and could even be a “bubble.”

But don’t expect a pullback yet. Openai CFO Sarah Friar told CNBC on Wednesday “constantly” that the company lacks sufficient math.

As always, Wall Street is paying close attention to Nvidia’s guidance and other commentary on future prospects from CEO Jensen Huang. According to LSEG, analysts expect revenue growth of between 50% and $52.7 billion in the third quarter. If Nvidia surpasses second-quarter estimates and above the TOPS estimates, analysts say the “beat and Rays” type could further boost AI optimism.

Blackwell lamp

Nvidia’s most important offering is the Blackwell line. This includes the entire system that connects individual graphics processing units with 72 GPUs.

Ryuta Makino, analyst at Gamco Investors, said the strong Blackwell figures would affirm Nvidia’s ongoing technical lead and foothold among key customers.

“It reinforces that hyperschool spending is still very strong on the Blackwell ramp,” Makino said.

Nvidia said in May that its new product line had revenues of $27 billion, accounting for around 70% of the data center revenue. This is a sharp rise from $11 billion in the last quarter.

With more Blackwell chips installed, experts expect that superior computing power will enable companies such as Openai and humanity to create even more capable AI models. Announced earlier this month, Openai’s GPT-5 was trained with Nvidia’s final generation hopper chips rather than a new Blackwell processor.

Nvidia said last year that Blackwell will be limited by supply. This is not the demand, but the number of chips that a partner can build and ship.

The Blackwell Ultra is expected to begin shipping in the second half of 2025. Nvidia recently pushed back analyst reports from Asia, Rubin, a chip technology expected to make up a large portion of GPU sales in 2027, according to Rubin, who saw early production issues.

One visible sign of Nvidia’s rise is Huang’s global fame. He is regularly named by Trump and traveled this quarter to meet business leaders and officials from Taiwan, China, Germany, the UK and Saudi Arabia.

Huang recently signed a contract with Trump to regain access to the Chinese market. According to Trump, Nvidia will pay 15% of Chinese chip revenue to the US government in exchange for a license to export China-centric AI chips. The president added that he had requested 20%, but Huang negotiated him.

The H20 is worth a lot for Nvidia. Nvidia said the chip would have donated about $8 billion in sales in the second quarter, and that the US government would need a license to ship to China, effectively blocking sales.

Nvidia did not include H20 sales in its second quarter guidance. Analysts doubt that this will be included in current period forecasts as the Chinese government is putting pressure on cloud providers to use home drawback chips from companies such as Huawei.

If H20 is included in the guidance, it could potentially increase H20 by about $2 billion to $3 billion, according to analysts at Keybanc, which recommends purchasing stocks. But they said they hope Nvidia will rule it out completely Advanced micro devices He’s been leading from early August.

“In addition, given the potential 15% tax on AI exports and pressures from the AI government for AI providers to use domestic AI chips, we hope that management will lead to a modest approach,” writes KeyBanc analysts.

Nvidia is working on a new China AI chip based on Blackwell, which could require presidential approval.

“I’m sure he’s always pitching the president,” Commerce Secretary Howard Lutnick said last week about fans of CNBC’s “street squad.”

Watch: Interview with CNBC Commerce Secretary Howard Rutnick