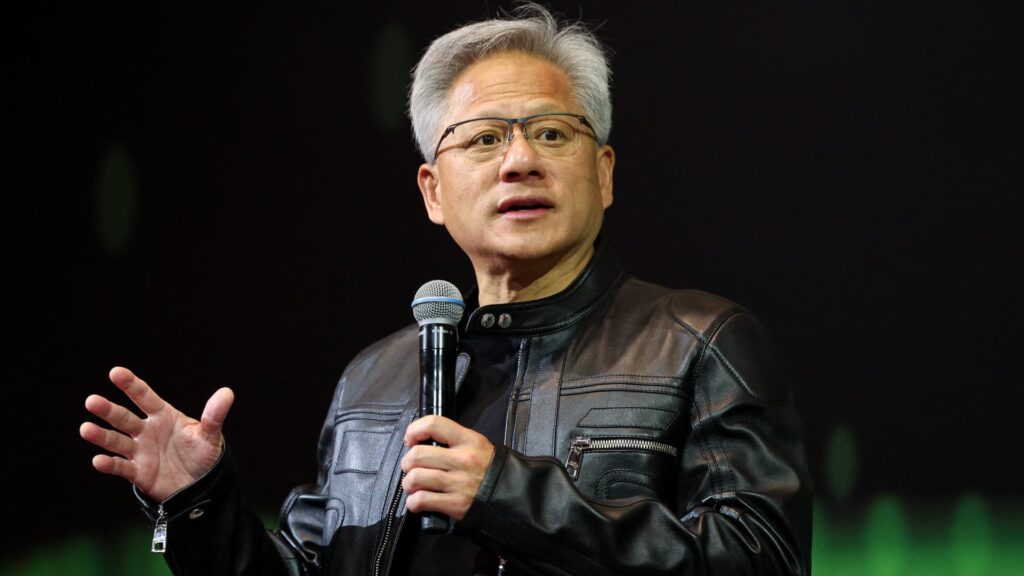

Jensen Huang, co-founder and CEO of Nvidia, will speak at a press conference in Taipei on May 21, 2025.

i-hwa cheng | AFP | Getty Images

nvidia We will report fiscal first quarter revenues on Wednesday after Bell.

What Wall Street is hoping for is: for each LSEG:

Earnings per share: 93 cents Adjusted Recording: $433.1 billion

Wall Street expects the artificial intelligence chip giant to be led by 99 cents in adjusted earnings per share with $45.9 billion in sales in July quarter.

Nvidia continues to grow significantly through the sale of graphics processors, indicating that demand for its AI chips shows no signs of cooling.

However, there is a big idea about the hearts of many investors during this revenue call: China.

On April 9, the Trump administration sent a letter to Nvidia saying it would require an export license for the H20 chip, a version of the hopper AI chip specifically designed for the Chinese market to comply with previous US restrictions.

Nvidia said it would require $5.5 billion in writing to its inventory. Nvidia analysts are keen to see how restrictions affect the company’s revenue.

Nvidia CEO Jensen Huang has competed on the road in recent weeks to sell AI infrastructure to foreign countries, including Saudi Arabia. He will probably be dealing with the topic on Wednesday and wanting to give insight into how the company sees its current export control regime.

Aside from Nvidia’s geopolitical issues, the big story is when the company’s current AI GPU, Blackwell, has adequate supply and continues to see endless demand.

But ultimately, what investors would like to see is that they are confidently saying that demand for Blackwell products such as the GB200 racks currently shipping remains strong.

“What’s important here is optimism about the improvements in the GB200 and strong demand, and if the company can make a point for that, then in our view, the stock price should respond well, even if the numbers don’t change much.”

Wall Street expects growth of 66% in the April quarter. But that’s a sharp slowdown from a year ago, when the company’s revenues were more than tripled.

Driven significant growth for Nvidia is the sales of a small number of huge cloud providers, often referred to as Hyperscalers. These cloud companies are purchasing as many Nvidia Blackwell chips as possible to power and install data centers.

Earlier this month, hyperschools such as Microsoft and Meta said they plan to continue to actively spend on AI.