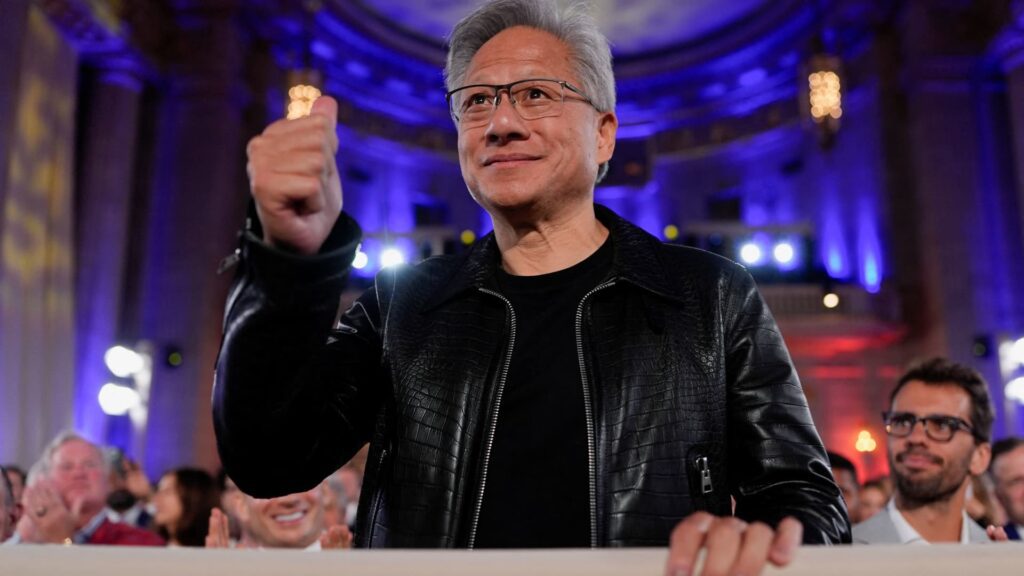

Nvidia CEO Jensen Huang will be attending the “AI Race Winning” Summit held in Washington, DC, USA on July 23, 2025.

Kent Nishimura | Reuters

nvidia It reported better revenue and revenue than forecasts on Wednesday, saying it remains above 50% this quarter, signaling Wall Street that demand for artificial intelligence infrastructure shows no signs of fading.

The stock, which has risen 35% this year since nearly tripling in 2024, slipped in an extended transaction as data center revenues have not reached estimates of two consecutive wins.

Here’s how the company does it compared to the analyst estimates voted by LSEG:

Earnings per share: $1.05 adjusted vs. $1.01 estimated Levenue: $46.74 billion vs. $46.06 billion

Nvidia said it expects the quarter to be 2% negative on top of $54 billion, but that number does not expect H20 shipments to China. According to LSEG, analysts were expecting revenue of $53.1 billion.

The company’s second quarter results for 2026 confirmed that NVIDIA’s data center business remains entrenched in the global AI buildout. Nvidia Finance chief Colette Kress told analysts he hopes to spend between $3-4 trillion on AI infrastructure by the end of the decade.

According to Nvidia, the company’s overall revenues rose 56% from $30.4 billion a year ago. Year-on-year revenues exceeded 50% with nine consecutive wins, dating back to mid-201023, when the generation AI boom began to appear in Nvidia’s results. However, the second quarter marked Nvidia’s slowest growing season during that stretch.

Over the quarter, CEO Jensen Fan has shown that after meeting with President Donald Trump, Nvidia expects to obtain a license to ship H20 chips to China. The processors custom built for sale to China cost NVIDIA’s writedowns $4.5 billion and could add $8 billion to second quarter sales if they were on the market during the period, the company said.

Nvidia said it did not sell H20 chips to China during the quarter, and BU benefited from the release of H20 stock worth $180 million, which is beneficial to its non-Chinese customers. Kress said Nvidia could ship H20 revenues in quarter, between $2 billion and $5 billion, if a geopolitical environment is permitted.

Net income increased by $26.42 billion, or $1.05 per share, up 59% from $16.6 billion in the same period last year, or 67 cents per share.

Nvidia’s growth is driven by a data center business centered around graphics processors or GPUs, and complementary products for large volume connectivity and use. The division’s revenues rose 56% from the same period last year to $41.1 billion, a lack of estimates for the $41.34 billion tram for the quarter.

Kress said in a statement that sales of Nvidia’s $33.8 billion data centers were due to “Compute” or Nvidia’s GPU chips, down 1% from the first quarter due to H20’s sales of $1 billion less. Kress said the $7.3 billion data center sales from networking components needed to build Nvidia’s more complex systems came from networking components, which almost doubled from the same period last year.

Large cloud providers account for about half of Nvidia’s data center business, the company said last quarter. These customers are currently purchasing the company’s latest generation, Blackwell chips.

Nvidia said Blackwell’s sales rose 17% from the first quarter. In May, Nvidia said sales for the new product line reached $27 billion, accounting for around 70% of the data center revenue.

Nvidia’s revenue report comes just a few weeks after the company’s biggest clients. Meta, alphabet, Microsoft and Amazonthe results announced. All four of these companies spend $400 million on infrastructure buildouts to compete to develop the AI models and services used by consumers and businesses.

Nvidia’s gaming division reported $4.3 billion in sales compared to the previous year, with $4.3 billion. This division was Nvidia’s biggest sales before the sale of the AI Boom Supercharged Data Center. Nvidia said in the quarter that GPUs intended for gaming will be tuned to run certain OpenAI models on personal computers.

The company’s robotics division, which management highlights as an opportunity for growth, is just a small portion of Nvidia’s business, with sales of $586 million over the quarter, representing a 69% growth per year.

Nvidia said its board has further approved a share buyback that has not expired. Nvidia bought back $9.7 billion in shares during the quarter.

Watch: What’s next for Nvidia in China?