Unlock Editor’s Digest Lock for Free

FT editor Roula Khalaf will select your favorite stories in this weekly newsletter.

Both HSBC and JPMorgan have problems with their “return to office” strategies. As we reduced our real estate footprint during the pandemic, we actually don’t have enough office space to allow employees to return.

JPM’s large campus in Columbus, Ohio operates a “parks and rides” scheme because there is not enough parking if all desks are occupied. There was talk of the battle over an ergonomic chair. Additionally, HSBC’s new London office now estimates that 7,700 seats are less than the Bums. Even if you could convince traders to crush them like battery chickens and tube commuters, there could be difficult-to-solve bathroom provisions and elevator capacity issues.

Of course, this is very interesting. But raises another question: “How do you not know if there is enough desk space before placing an order of this kind?” At this point, it is actually very important for financial regulators. When a big bank gets confused about office space, it’s just annoying. It is potentially dangerous if it cannot break exposure to private credit, or flood risk, or exposure to Russian sanctions.

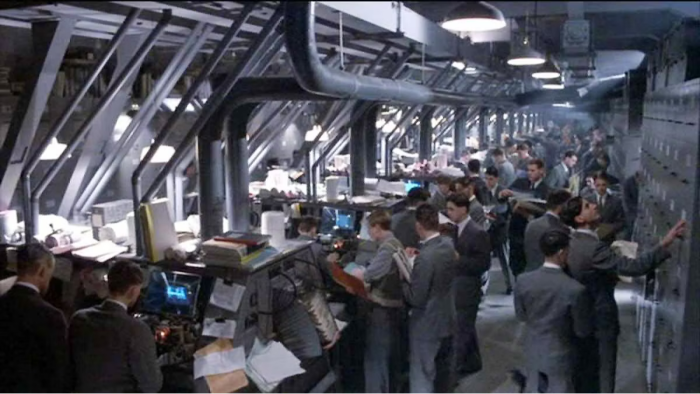

The problem is that while the mental image of people in the banking information system is as follows:

The reality is all this:

Essentially, banks are big, complicated and constantly changing, creating an unclean “fog of war” at the top. It’s extremely tense to bring together all departments and geographical systems and create quarterly accounts. No one would create a large financial institution in Nihiro. They are constantly growing organically.

Business units, just beginning, tend to unofficially retain their own records, even in a single spreadsheet. As you grow, you may be outsourced to some bespoke software and define your own data types. Once it’s big enough to actually move the dial at the group level, people will always look back and hope that everything is integrated into the main accounting and risk management systems from day one. But of course, it would have been the disproportionate amount of time and effort to spend on small startup projects.

Obviously, banks would be better off having a scalable modular IT system that can handle all kinds of record requirements flexibly, automate data collection, and provide a single view of all risks of all risks that depend on the event of the day. The industry loves this idea. I love this concept so much that many major banks have three or four systems that are more or less unused after failing integration projects.

Called “Risk Data Aggregation and Risk Reporting” (RDARR), it is now one of the biggest issues for bank supervisors. Regarding the agenda for this week’s ECB’s “Outstanding Reporting Meeting,” we see things being driven by a desire to reduce the burden of regular reporting and data submission. But if you are doing it, you need to be able to make ad hoc requests to understand the problem when it arises.

Paradoxically, if the RDARR system is “steampunk dystopia” than the “cybernetic panopticon”, measures that reduce daily burdens without compromising surveillance would be more inconvenient and costly for the bank than filing the same old report.

Of course, the solution is for the bank to really invest a lot of money to lead the RDARR system into scratching. To do that, they may need to become bigger and take advantage of economies of scale. That’s one of the reasons why many people want to see bank mergers in Europe. But of course, it’s much easier to support an “integration” of abstraction than to support a real merger in your own backyard.