Unlock Editor’s Digest Lock for Free

FT editor Roula Khalaf will select your favorite stories in this weekly newsletter.

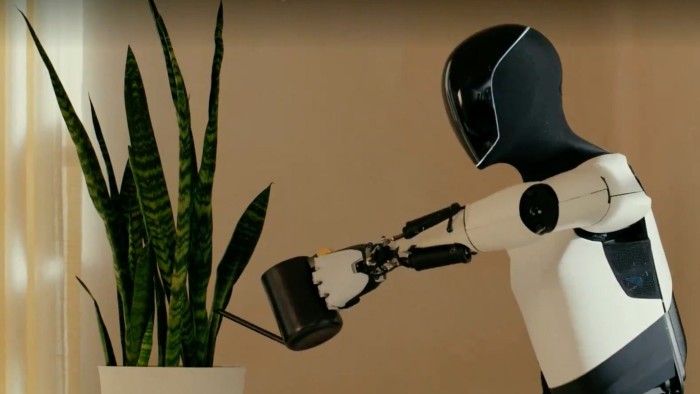

Confused by his corporate and government ambitions, Elon Musk remains a gangho with the rise of robots. This week, Tekra billionaire, Tesla boss, government efficiency TSAR reiterated his purpose of having 1MN Optimus Humanoid by 2030 and even 2029.

Swiss Industrial Giant ABB, which is set to spin-off the Robotics division next year, hopes others will share his views. In 2022, the group became the first manufacturer to sell 100,000 robots, but the pre-depreciation division’s operating profit of $278 million is just a cut of the company’s total of $6 billion.

Despite their long-term outlook, robotics has shown different tariffs’ own goals. Two issues: depressed buyers and useless global supply chains. ABB focuses on industrial applications, like Japanese manufacturers Fanuc and Kuka, which were acquired by China’s MIDEA in 2016, and is building cooperative robots that work safely with humans.

The uncertainty unleashed by Washington’s tariff policies leads to paralysis on the ground. Once a key source of new demand for robotics, automakers were at the heart of a tariff storm. Few people choose to expand or upgrade their factory kits if their expectations for sales are cloudy at best and dented at worst. Other industries may not be that good.

In the US, there are clutches from robot manufacturers such as Apptronik and Diagram AI. However, China is the main supplier of materials and components used in actuators, machines that turn electrical impulses into physical movements – machines such as precision bearings. According to Bank of America’s calculations, actuators account for more than half of the total cost of the material. Even the masks have flagged the issue of securing permanent magnets from China for Tesla’s Optimus robots.

Higher costs or even worse, failing to protect consumables could flick the reverse switch of US robotics ambitions. China leads the duo in manufacturing industrial robotics, but shares top slots with the US when it comes to humanoids that deploy human joints and artificial intelligence to act like humans.

Moreover, even humanoids may have lost some of their glow. Based in Shenzhen, Ubtech is a leader in the field and boasts over 900 corporate clients in 50 countries listed in 2023. This month we have eased forecasts for sending 500 to 1,000 industrial humanoid robots to 500 people. Filling factories, hospitals and, ultimately, houses.

China has long been the largest market for robots. More than half of the world’s robots are installed there. In terms of manufacturing, it is also in second place when it produces four times the production rate of Germany, although it is far behind Japan. The US market is far behind.

Tariffs are threatening to delay adoption of this futuristic technology. On the positive side, this is one example where trade collection could actually bring more American jobs, as robots arrive late.

louise.lucas@ft.com