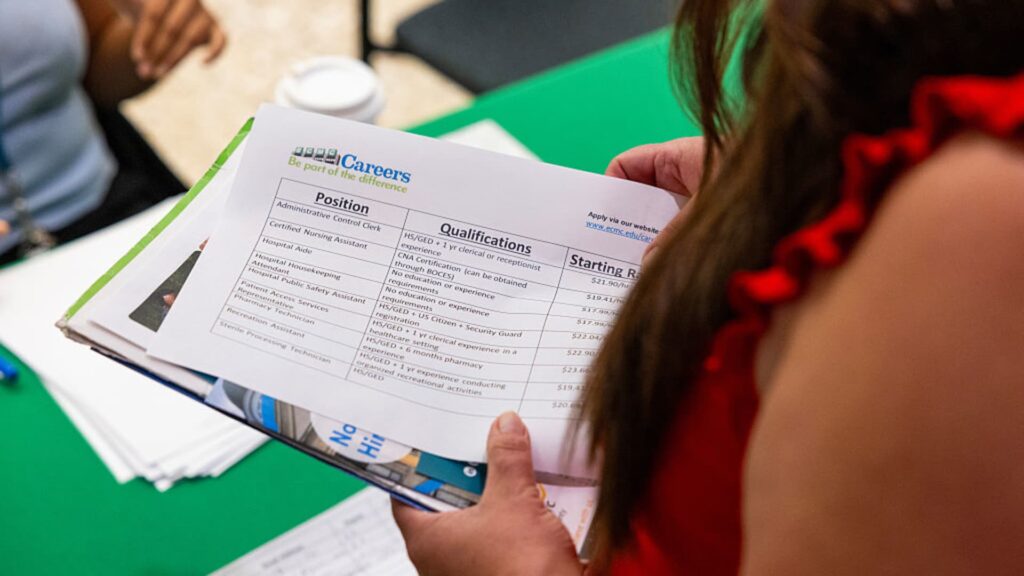

A job seeker holds a brochure at the New York State Department of Labor Job Fair held at the Downtown Central Library on Wednesday, August 27, 2025 in Buffalo, New York, USA.

Lauren Petracca Bloomberg | Getty Images

As October draws to a close and the government shutdown drags on, job opportunities have hit the lowest level in more than 4-1/2 years, according to data from job site Indeed.

The company’s jobs index fell to 101.9 as of Oct. 24, the latest point for which data is available. This is the lowest level since early February 2021 for an index that uses February 2020 as the base value of 100.

That level is down 0.5% since the beginning of the month and about 3.5% since mid-August, the latest point for which Bureau of Labor Statistics data is available.

Under normal circumstances, the BLS would have reported its monthly Recruitment and Turnover Survey on Tuesday, a measure that Federal Reserve officials are closely monitoring for signs of slack in the job market. As the government shutdown approaches the longest on record, economists and policymakers are having to turn to alternative data for a broader picture.

The latest JOLTS report (August) also shows a continued decline in the number of job openings. The BLS reported 7.23 million job openings, about the same level as July but down 7% from January.

Indeed’s metrics dashboard also shows a decline in salary offers due to fewer job ads. Year-over-year wages, as determined by salaries posted on Indeed, rose 2.5% in August, down from 3.4% in January.

The softening labor market is worrying Fed officials. The central bank’s Federal Open Market Committee voted 10-2 last week to cut interest rates by a quarter of a percentage point to a target range of 3.75-4%.

Officials said rising risks to the labor market outweighed continued concerns that inflation is nearly a full percentage point above the Fed’s 2% target.

“Hiring is slowing, and you can see that in Indeed and in job postings,” Federal Reserve President Lisa Cook said Monday. “We’re looking at a lot of data, and it’s real-time. We’re not waiting for the unemployment report. We’ve seen a slight increase in the unemployment rate over the summer, so there’s reason to be concerned.”

The nonfarm payrolls report, normally released on Friday, will not be released either. Economists surveyed by Dow Jones expect payrolls to fall by 60,000 in October and the unemployment rate to rise to 4.5%, according to BLS data.