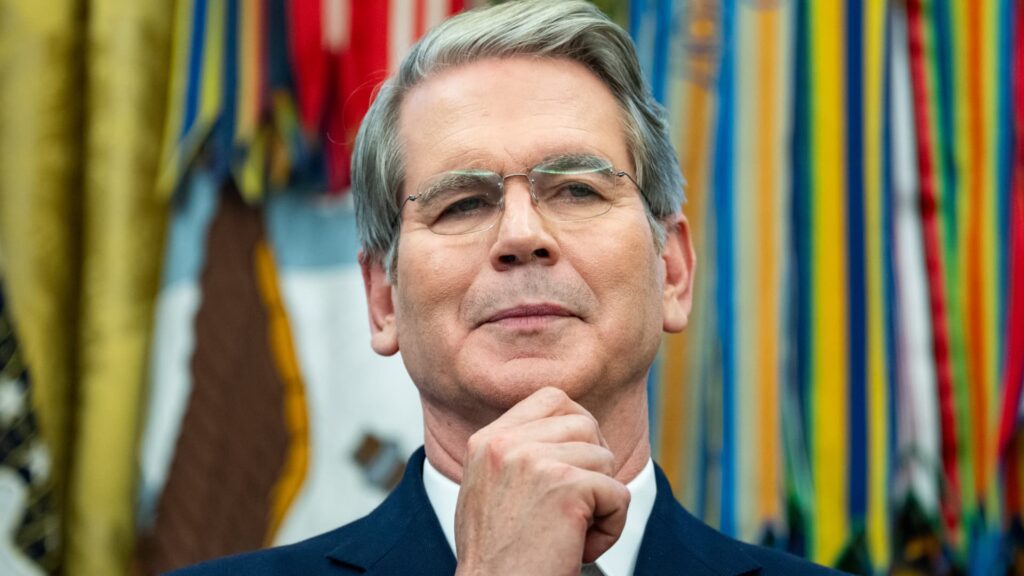

On August 6, 2025, U.S. Treasury Secretary Scott Bescent, located at the White House Oval Office in Washington, DC.

Bonnie Cash | Bloomberg | Getty Images

The search for the next Federal Reserve Chairman continues, showing that Treasury Secretary Scott Bescent has met several candidates on President Donald Trump’s shortlist.

Recently, Bescent met with former Fed officials Lawrence Lindsay, Kevin Warsh and James Bullard. Lindsay and Worsh both served as governors, and Bullard was president of the federal government of St. Louis.

Bessent will wait until the blackout period surrounding the federal government’s open market committee meeting ends next weekend.

The goal is to add one or two names to Trump candidates, including Wash and Director of the National Economic Council Kevin Hassett and current Christopher Waller, but there is a broader group under Bescent’s consideration, including former and current central bankers and 11 economists, including a few market strategies.

In addition to interviewing candidates, Bessent is driving the Fed’s reform agenda. He hopes central banks will organically reduce their balance sheet’s large bond portfolio, sources said. The key is to reduce holdings of $6 trillion Treasury and mortgage-backed securities in a way that doesn’t destroy the markets and the economy.

Additionally, Bessent is trying to reduce the Fed’s economic footprint, sources said.

The news comes with the Fed under the White House microscope.

Trump and several other executives are pushing the Fed to cut interest rates, something that hasn’t happened since December 2024. The market is actually widely anticipating that it will approve a quarter-per-point cut when it takes place next week.

In last week’s Wall Street Journal Opinion Piece, Bescent laid out his own vision for the Fed. He rejected what was called “functional benefits” activities. There, central banks repeatedly strode the narrow targets allocated for low unemployment and inflation.

“The Fed has to change courses,” wrote Bessent. “That standard toolkit is too unmanageable due to the uncertainty of the theoretical foundation.”

The Fed’s complexion could change significantly over the next year.

Chairman Jerome Powell’s term expired in May 2026 and allowed him to remain as governor for another two years, but he is certainly replaced by the current post. At the same time, the Senate is expected to vote for candidate Stephen Milan on Monday for a vacant seat on the committee.

Trump has also pushed Governor Lisa Cook to get rid of her with mortgage fraud accusations, but the court has prevented him from doing so up until now.