Unlock Editor’s Digest Lock for Free

FT editor Roula Khalaf will select your favorite stories in this weekly newsletter.

India faced a balance of payment crisis in 1991 and was forced to undertake “Big Bang” reforms, which unleashed 20 years of rapid growth. Is there another external shock trying to get Indian economy into action?

Some Indians see similarities. With the death of Donald Trump’s 26% “mutual” tariffs, Narendra Modi’s government is moving quickly to negotiate a bilateral trade agreement with the US, covering everything from food to e-commerce and automobiles.

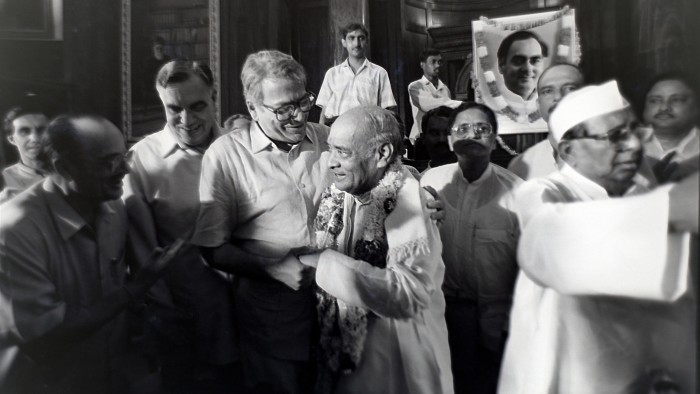

In 1991, the tariff reduction was a key element of the reforms pursued by PV Narasimha Rao, opening up the economy to investment and dismantling the web of bureaucracy that Indians called the “licensed Raj.”

Over 30 years later, India’s economy is more open to the world, but some tariffs are creeping up. Foreign direct investment is at a disastrous level compared to the size of India.

Red tapes are plaguing local and foreign businesses. Modi’s own peers acknowledge the need for structural reform, and in a recent report, Chief Economic Advisor v Anantha Nagewaran declared that the government needs to “out of the way” business.

Indian Business Briefing

Indian experts are a must-read on business and policy in the world’s fastest growing economy. Sign up for our newsletter here

Advocates of opening hope will see lower tariffs and other benefits from trade contracts (including elimination of non-tariff barriers that gum commercial transactions) bringing a surge in investment, requiring much needed new jobs in the world’s most populous countries.

“Now it’s clear that we have to do: it will be a tariff regulation and an unclosed economy,” says Surjit Bhalla, former director of the IMF. “That’s the jump start that the Indian economy can get.”

Indian officials said last week that both sides confirmed terms of mandate for US trade negotiations and began online consultations with the aim of launching face-to-face negotiations in May. India says it aims to close the first tranches of its trade agreements by September or October.

“There is a clear route that we have decided at the leadership level,” said Commerce Secretary Sunil Baswar. The Indian trade team was “really indicted,” Foreign Minister Jaishankar said last week.

With the push from Trump, Modi government has also urged it to quickly track trade talks between the EU and the UK.

But veterans of the 1991 reforms say the comparison is incomplete. India is now making its economy faster, which is growing more steadily. The rosy analysis also reduces Trump’s whimsicality and U-turn abilities.

“This is not a 1991 moment,” Montek Singh Ahlwalia, architect of the reforms that year, added that India is currently facing a “troubling situation” on the international front.

Recommended

“But it is likely that both the EU and the US will reduce their dependence on China,” he says. “This is a potential opportunity for India, but it requires us to be more open than we do.”

With China’s more competitive producers setting prices from the US market at a 145% tariff, Indian exporters believe that India’s top geopolitical and commercial rival China can benefit from the volatile trade environment that Trump’s main target.

In theory, you can step into industries such as apparel and textiles, jewelry and jewelry, smartphones. Thanks to Apple, smartphone exports rose from $4.7 billion to more than $7 billion on March 31, according to data released last week.

“Many of our companies that wanted to expand in China will leave China,” says Ajay Sahai, CEO of the Indian Export Aircraft Association. “We have the opportunity to put them in India now.”

Despite Delhi’s optimism mood, there is reason to doubt India will emerge from Trump’s trade war relatively unharmed.

India is a negotiator of trade talks, including the UK and Europe (some say it is incompatible).

India’s combat minister, Piyush Goyal, recently declared that New Delhi “will not negotiate at the muzzle.” This is a clear reference to the United States. Politically sensitive products such as dairy products, wheat, rice and corn will be removed from the table, according to people close to the discussion.

With Trump’s unpredictable US partner, 2025 promises to be a turbulent year for India’s trade policy, whether it is transformative or not.