Unlock Editor’s Digest for free

FT editor Roula Khalaf has chosen her favorite stories in this weekly newsletter.

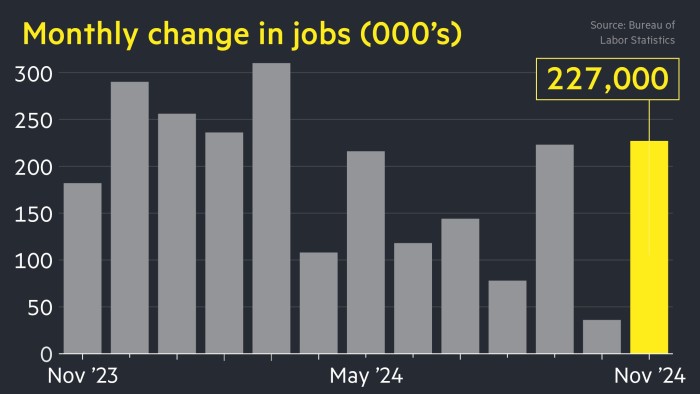

The U.S. economy added 227,000 jobs in November, a sharp rebound after the previous month’s payrolls were depressed by hurricanes and the Boeing Co. strike.

The figure released by the Bureau of Labor Statistics on Friday exceeded the consensus estimate of 200,000 jobs among economists polled by Reuters. The unemployment rate rose 0.1 percentage point to 4.2%.

November’s job growth was a sharp increase from October’s 12,000 new jobs, the weakest jobs report of the Biden administration. That figure was revised to 36,000 in Friday’s data release.

The jobs report is one of the last big data releases before the Federal Reserve meets on December 17-18 to decide whether to proceed with its third consecutive rate cut.

Although Friday’s data was better than expected, analysts said it was not strong enough to undermine the case for a final rate cut this year.

“This announcement does not prevent the (Federal Open Market Committee) from cutting interest rates (this month),” said Ian Lingen, head of U.S. rates strategy at BMO.

“From the Fed’s perspective, labor market momentum has moderately decelerated and inflationary pressures from the labor market are not significant yet,” added Gregory Daco, chief economist at EY.

“Therefore, I think we will proceed with further rate cuts.”

U.S. Treasury yields fell as investors bet the Fed was slightly more likely to cut interest rates this month. Trading in U.S. futures markets showed investors now have about an 85% chance of a rate cut later this month, up from 70% just before the data was released.

The yield on the two-year note, which reflects interest rate expectations, fell 0.05 percentage point in late afternoon trading on Friday to 4.1%, its lowest level in five weeks. Wall Street’s S&P 500 stock index rose one-quarter of a percent to close at a record high.

Recent data suggests the U.S. economy remains strong and inflation is at risk of settling above the Fed’s 2% target, making policymakers wary of cutting interest rates too quickly. There is.

Federal Reserve Chairman Jay Powell said this week that the U.S. economy is in “very good shape” and inflation is slightly higher than initially expected, so the Fed “can afford to be a little more cautious” in cutting interest rates. said.

Powell’s colleague, Governor Christopher Waller, added that he supported a December rate cut, but warned that progress in curbing inflation “may be stalled.” Governor Michelle Bowman, who opposed the Fed’s decision to cut interest rates by a massive 0.5 percentage points in September, echoed those concerns in remarks Friday, saying the upside risks to inflation were significant.

Beth Hammack, the Cleveland Fed’s new president and a voting member of this year’s FOMC, said the Fed is “at or near the point where it makes sense to slow the pace of rate cuts.”

“If we proceed slowly, given the underlying strength of the economy, we will be able to adjust policy to the appropriate level of restrictions over time,” he added in a speech on Friday.

Still, the rise in the unemployment rate in Friday’s report suggests a softening job market, which will likely prompt the Fed to cut rates this month, said Andrew Hollenhorst, chief U.S. economist at Citigroup. .

“Chairman Powell has been quite optimistic in recent months after the strong September jobs report, but I think he will be a little less optimistic after this report,” he added.

The December rate cut will lower the federal funds rate to 4.25% to 4.5%. The Fed is planning a “soft landing” in which inflation moves toward the central bank’s goal without causing a recession or a significant increase in unemployment.

Recommended

Over the past year, the U.S. economy added an average of about 180,000 jobs each month. Sectors that reported the biggest gains in November included healthcare, leisure, hospitality, and government.

Employment in the transportation equipment manufacturing industry increased by 32,000, helped by the end of the Boeing strike.

Along with the upward revision of October’s employment statistics, the number of employees in September also increased to 255,000. In total, job growth over the two-month period was 56,000 more than previously reported.