Unlock the White House Watch newsletter for free

A guide to what the 2024 US election means for Washington and the world.

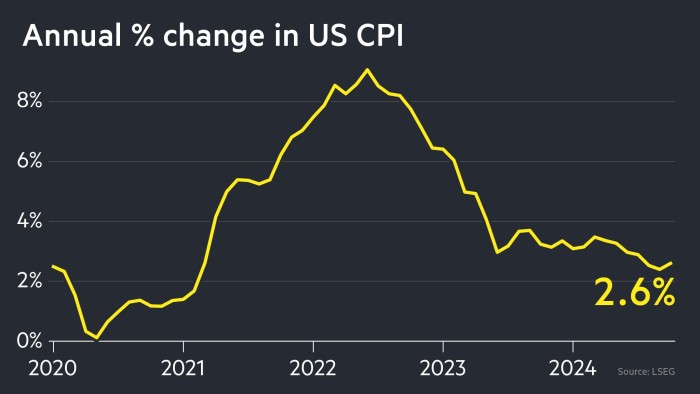

US inflation rose to 2.6% in October as the Federal Reserve debated whether to cut interest rates in its final meeting before President-elect Donald Trump takes office.

Wednesday’s numbers released by the U.S. Bureau of Labor Statistics were in line with economists’ expectations for growth of 2.6%, up from 2.4% in September.

Once volatile food and energy prices were removed, the “core” CPI stabilized at 3.3% on an annual basis. However, monthly core prices rose by 0.3% for the third consecutive month, indicating that underlying inflation has not yet been completely contained.

St. Louis Fed President Alberto Moussallem said in a speech Wednesday that while the risk of inflation stalling or rising above 2% has increased, the risk of a rapid deterioration in the labor market is “likely decreasing.” I warned you.

He renewed his call for a “gradual” reduction in interest rates.

Sarah House, senior economist at Wells Fargo, said Wednesday’s numbers show that “it will be difficult to squeeze out the last bit of inflation,” as the impact of the COVID-19 pandemic and the service sector’s He pointed to the “long tail” of continued price pressure. .

The US central bank has been closely monitoring inflation statistics, and the bank cut its benchmark interest rate by 0.75 percentage point for the second consecutive meeting, setting a new target range of 4.5% to 4.75%.

Fed officials are trying to reach a “neutral” interest rate setting that curbs inflation without suppressing demand, in order to achieve a so-called soft landing that avoids a recession.

Following the election of President Trump, the market is concerned about a resurgence in inflation, and U.S. bond yields are rising. The index dipped slightly after Wednesday’s economic data release as investors believed the Fed was more likely to cut interest rates next month.

Futures markets suggest the probability of a rate cut in December is about 80%, up from 60% before the inflation data was released.

The yield on two-year U.S. Treasuries, which is linked to interest rate forecasts, fell 0.06 percentage point to 4.28%.

“I think people are relieved that (the inflation numbers) weren’t an upside surprise, and they’re relieved that they were in line with expectations,” Prime Minister House said.

U.S. stocks stalled, with the S&P 500 index closing less than 0.1% higher and the Nasdaq Composite index down 0.3%.

Most indicators suggest the U.S. economy is in good shape, and recent retail sales statistics suggest consumers are still spending. The labor market is also strong, despite last month’s employment report being weak due to hurricanes and the Boeing strike.

Inflation has fallen significantly from its peak of over 9% in 2022, but progress has slowed in recent months.

On a monthly basis, prices increased by 0.3%, similar to the last three reports. The BLS said Wednesday that half of the increase was due to a 0.4% increase in an index that tracks housing-related costs.

Energy prices were flat for the month, following a 1.9% decline in September. Further increases in airfares were offset by lower prices for clothing and furniture.

In a press conference last week after the Fed’s recent quarter-point rate cut, Chairman Jay Powell predicted “a bumpy road for the next few years” until inflation settles around the central bank’s 2% target. He said he is doing so.

Recommended

Minneapolis Fed President Neel Kashkari told Bloomberg on Wednesday that he believes “inflation is heading in the right direction.”

But with President Trump’s victory, that path could become even more uncertain. The president-elect has promised sweeping tariffs, deportations and tax cuts. Economists have warned that such policies could fuel price pressures and create uncertainty that could hinder growth.

Mark McCormick, head of foreign exchange and emerging markets strategy at TD Securities, believes that Trump’s second term in office, combined with recent relatively strong economic data, will likely push inflation to a comfortable 2% rate in the near term. “I’m cautious about thinking there’s a chance we’ll go back to that.” ”.

Chairman Powell said last week that the Fed is not “speculating” on the timing or content of future policy changes. As a result, he said, “in the short term, elections will not affect our policy decisions.”