Let us know about free updates

Simply sign up for US Inflation Myft Digest and it will be delivered directly to your inbox.

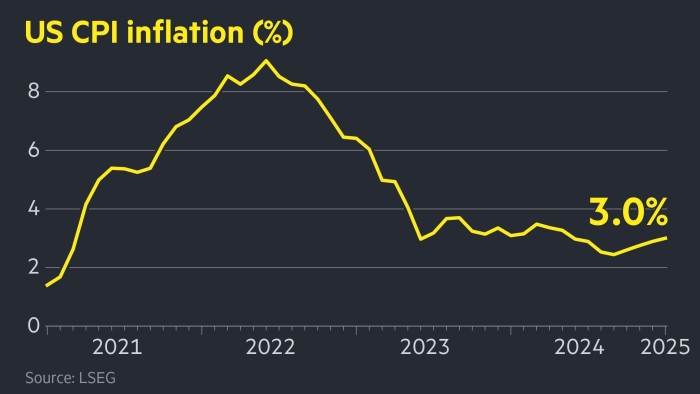

U.S. inflation unexpectedly rose to 3% in January, strengthening lawsuits to help the Federal Reserve slow down interest rates and slower conflicts between stocks and government bonds.

Wednesday’s consumer price index figures exceeded expectations of economists voted by Reuters. Reuters predicted that inflation would remain steadily at 2.9% in December.

The monthly increase in January was also better than expected, at 0.5% compared to the forecast of 0.3%.

The major contributor to the rise was a surge in egg prices, rising 15.2% that month and 53% in a year.

Labor Statistics Bureau figures bet on investors that investors would cut interest rates only once this year. Before the data was released, the futures market expected the first cut to arrive by September, so there was a 40% chance of a second cut by the end of the year.

“The market is not sure we’ll see divergence later this year, and today’s data certainly doesn’t provide evidence of that,” said Eric Winograd, Chief Economist at Alliancebernstein. , the Fed won’t cut interest rates at all.”

After the data was published, the two-year yield on US Treasury debt, which tracks interest rate forecasts and moves backwards to prices, rose 0.06 percentage points to 4.35 percent.

US stocks fell sharply, with the S&P 500 down 1%, and the high-tech NASDAQ composite losing 1.1%, while the dollar gauge against the other six currencies rose 0.3%.

Wednesday’s inflation data also showed that the core CPI, which removes changes in food and energy prices, rose to 3.3% in January, from 3.2% in December.

It came after the Fed defied a call from President Donald Trump, rushing to cut borrowing costs and instead held its main rate at 4.25% to 4.5%.

On Tuesday, Federal Reserve Chairman Jay Powell told Congress that the central bank continues to “do our work and move away from politics.”

But on Wednesday, Trump updated his demands for his true social platform. “We need to lower interest rates. This is something we’ll be holding hands with future tariffs!!!” posted by the US President. “Rock and roll, America, America!!”

CPI data has made the world’s biggest economy surge once again as Trump plans to wipe out tariffs, crack down on immigration, and many economists are moving forward with plans for a major tax cut that could lead to new increases inflation It promotes concern among economists that it is.

Since returning to the White House on January 20th, Trump has begun implementing massive deportations of already undocumented immigrants, imposing a 10% tariff on Chinese imports.

He also announced that nearly all imports from Canada and Mexico, as well as all steel and aluminum imports, will be effective in March.

Powell says this depends on the details of taxation and is too early to determine the impact of tariffs on economic and monetary policy.

Whitney Watson of Goldman Sachs Asset Management said Wednesday’s inflation figures are likely to bolster the Fed’s “cautious approach to easing,” along with the robustness of the US job market. She added: