US stocks fell sharply, turning early rally around after the White House said Donald Trump would push for his threat of attacking China with more than 100% duties.

The Benchmark S&P 500 Index closed 1.6%. This was a massive drawback from the 4.1% profit early on the trading day. Nasdaq Composite lost more than 2%.

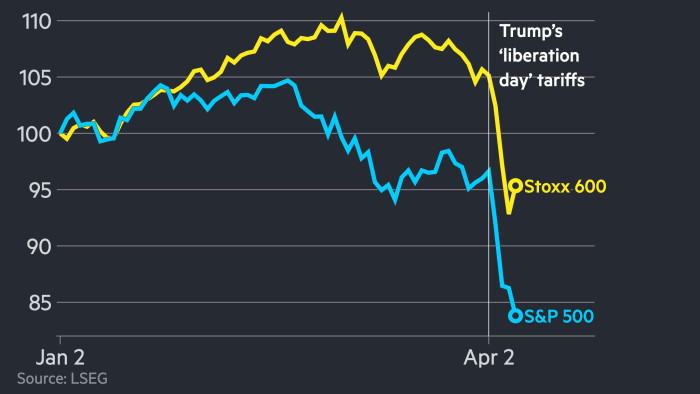

Tuesday’s fluctuations were the latest match in turbulent US stocks after Trump last week announced plans to impose sharp tariffs on dozens of countries and threaten to spark an all-out trade war.

The White House said Tuesday that a 50% tariff on Chinese goods would come into effect shortly after midnight in Washington. This exceeds 104% of total duties, in addition to the “mutual” measures and other taxation announced last week.

Earlier Tuesday, the White House had shown a growing willingness to negotiate with US trading partners about reducing taxes, but as the day went on there was a mixed signal.

Washington agreed to hold talks with Japan, and US Treasury Secretary Scott Bescent said on Monday that Tokyo will be “a top priority as they move forward so quickly.”

Trump posted on his true social platform that he spoke to the South Korean representative president, adding that “there are many ranges and odds in both countries.”

In contrast, tensions between the US and China ratcheted up on Tuesday as Beijing vowed to “a fight” if the US advances with the country’s sharp tariffs.

A day ago, Trump threatened to attack China for an additional 50% charge after saying last week that Beijing coincided with his “mutual” obligations of 34%.

The region-wide Stoxx Europe 600, FTSE 100 and Germany’s DAX rose by around 2.3% on Tuesday.

In the currency market, the US dollar fell 0.3% against its basket of trading partners.

Oil prices fell, with international benchmark Brent falling 3.8% in the afternoon in New York to below $62 per barrel, while US marker WTI fell 3.7% to $58.46 per barrel.

U.S. oil prices are now below the level where many American producers need to break even their wells.