Let us know about free updates

Simply sign up for US stock Myft Digest and it will be delivered directly to your inbox.

U.S. stocks recovered on Friday, wiping out sharp losses following Donald Trump’s “liberation day” tariff announcement a month ago, after labor market data surpassed expectations.

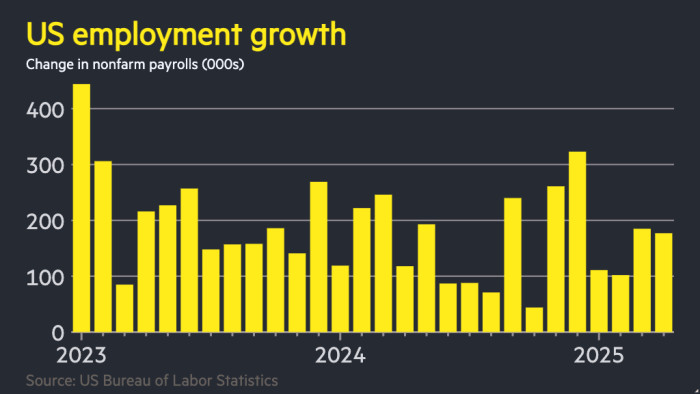

According to the Bureau of Labor Statistics, 177,000 jobs were added in April, exceeding the 135,000 economists predicted by Bloomberg voted for, but that number has fallen since March.

The S&P 500 rose 1.5% on Friday, surpassing closure levels since April 2, when the US president announced “mutual tariffs.” Friday’s advancement is the S&P 500’s nine consecutive day-to-day gains, the longest winning streak since 2004 and the longest win on record, according to an analysis by the Financial Times.

The Wall Street benchmark share index plunged by 15% in turbulent trading days after Trump’s announcement, causing a stir across global financial markets.

But global stocks have since recovered largely, aided by signs of possible melting trade tensions, including comments by China’s Commerce Ministry on Friday.

“The rally seems to expect that the worst has passed in regards to tariffs,” said Ajay Rajadhiyaksha, global chair of Barclays’ research. However, he added: “In fact, it’s the exact opposite. The worst is not shown in the data yet. There’s nothing in the data yet.”

The Wall Street recovery has been reflected in several other countries as the early wave of global stock market volatility subsided after Trump’s “liberation day” tariff plans subsided. The Asia-Pacific and European indexes have made profits for several days.

Most notably, the UK’s FTSE 100 added 1.2% on Friday, rising in 15 consecutive sessions, marking the longest winning streak on record.

Despite the stock market recovery, the dollar is nearly 4% below the “liberation date” level.

Following employment data on Friday, the Treasury yield, which tracks interest rate forecasts and moves backwards to prices, rose 0.13 percentage points to 3.83 percent as investors bet that the US Federal Reserve will maintain borrowing costs for longer.

“We are pleased to announce that we are committed to providing a range of services to our customers,” said My Cridel, Fund Manager at Fidelity International.

Traders continue to forecast at least three interest rate cuts this year, but the fourth chance has been halved from about 60% of employment to about 30%.

Goldman Sachs said it has pushed back expectations for the next rate, which was cut by a month from June to July.

“The Fed needs to lower that rate!!!” Trump posted on his Truth Social Network shortly after Jobs Data was released.

Job counts on Friday came after mass shootings of thousands of federal employees due to Elon Musk’s so-called government efficiency. Data shows federal employment fell 9,000 in April, down 26,000 since January.

In addition to the headline figures for 177,000 new employment in April, the total number in March was revised from 228,000 to 185,000.

The unemployment rate has remained unchanged at 4.2% since March.

Claudia Sahm, chief economist at New Century Advisors, said Trump’s economic policy was “not subtle,” while the initial impact was “relatively small.”

She added that the policy “means that the Fed will wait because it takes time to work through the system” took time and likely cuts later in the year rather than in the next two months.

Official data this week showed the first decline in GDP for three years, but domestic demand remains strong, skewed by a surge in imports ahead of Trump’s tariff announcement.

Many economists expect the job to serve as a fundamental growth resistance for the second quarter of the year.

“Overall, this indicates that the labor market has not yet deteriorated,” Gennadiy Goldberg, TD Securities’ US fare strategy, said of job data on Friday. “But investors are still nervous about another shoe falling off. We don’t know when.”

Additional Reports by Ian Smith of London