Unlock the White House Watch newsletter for free

A guide to what the 2024 US election means for Washington and the world.

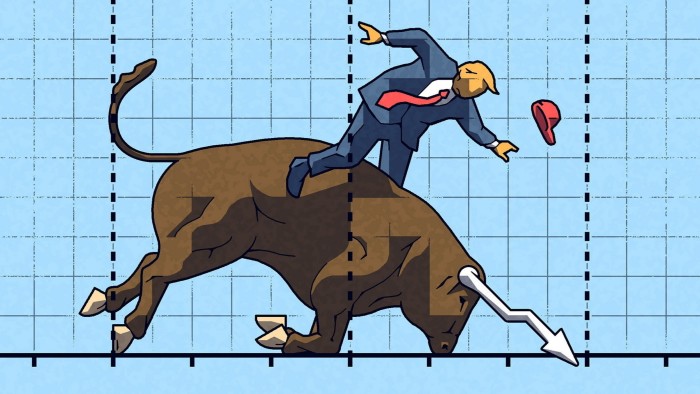

Please call me Cassandra. Many people do. But I’m already fearful of a recession that will surely come at some point during President Donald Trump’s term. Yes, the short-term sugar fix of deregulation and tax cuts is already here. But history tells us that the US is premature in both recessions and major market corrections, and President Trump’s risk vectors make that more likely.

Why do we need to be so negative so early on? One could easily argue that there are many reasons to be optimistic that the strong economy that President Joe Biden has built and that President Trump will inherit will continue to expand. At present, in addition to positive growth in real incomes, we can expect productivity gains, a recovery in global manufacturing, and, of course, interest rate cuts.

Add to this factors such as President Trump’s upcoming budget deficits and President Biden’s rollback of antitrust policies, and there is no doubt that we will see a merger and acquisition boom, with ample evidence for another year or two of growth in U.S. assets. It will be done. This includes technology, finance (banks are gearing up for all kinds of deals), cryptocurrencies (which get excited every time billionaire investor Elon Musk tweets about Dogecoin), private equity, private credit. This seems to be especially true in areas such as

Still, even if Democrat Kamala Harris wins the White House, I would think carefully about what is driving this market. As TS Lombard put it in a recent client note, “This business cycle always appears to be ‘artificial’ and is driven by a series of temporary or one-off events, such as a resurgence of the pandemic, fiscal stimulus, excessive savings, retaliation, etc. spending that has been driven by force, and more recently (increased) immigration and labor force participation. ”

Indeed, some might argue that the market conditions of the past 40 years, with their downward trend in interest rates following the Great Financial Crisis and massive monetary stimulus and quantitative easing, are man-made. Our generation of traders has no idea what a true high interest rate environment is like. A few years ago, interest rates rose even slightly and we saw a domino effect. Think of the bailout of Silicon Valley banks or the spike in bond yields during the crisis that ended Liz Truss’ very short term as chancellor.

I actually don’t think President Trump is going to add fuel to the fires of inflation with massive across-the-board tariffs (although the Trump administration’s Wall Street faction won’t tolerate the resulting market collapse); You probably get the idea. He uses the US consumer market as a kind of chit to exchange for various economic and geopolitical interests. Does Germany not agree with America’s China policy? What about increased tariffs on European cars? This type of trading itself carries risks.

I highly doubt President Trump will deport millions of immigrants as he promised. Once again, the Wall Street crowd will push back on the inflationary effects. But this fundamental tension between what the Maga crowd wants and what private equity and Big Tech want is itself dangerous. That inevitably creates volatility and unpredictability that can move the market in one direction or another.

Unexpected policy divergences can easily combine with more general sources of financial risk to trigger major market events.

It makes sense, given that President Trump will likely roll back an already lax regulatory environment, as highly leveraged lending and private equity investments have become a large part of pension and individual investor portfolios. However, it is dangerous.

This, along with expected reductions in bank capital increases, is one of the concerns of Better Markets President Dennis Kelleher. “I think we’re going to see a two-year high in sugar prices under the Trump administration, but there could be a catastrophic correction in the future, and it’s going to be much worse than the 2008 (financial crisis). , because our financial system is extractive in nature.”

Cryptocurrency can also be a trigger. Although they may have no intrinsic value, Jeffrey Gordon, a law professor at Columbia University, worries that as more and more real-world assets and liabilities become virtualized, cryptocurrencies could spill over into the real economy. are. “Stablecoins can be worth significantly less than their face value,” Gordon says. “We’ve seen this movie before at Prime Money Market Fund.”

However, in the event of a cryptocurrency liquidity crisis, there is no lender of last resort. A lot of imaginary value disappears, leaving only real world collateral claims and funding shortfalls.

As another financial risk factor, I’d put Mr. Musk himself up there. Electric car maker Tesla is in crisis due to the tech giant’s relationship with President Trump. But at some point the market will realize that China can make its own electric cars at a much lower cost than Tesla. Furthermore, tensions between the US and China could affect Musk’s ability to produce green cars in China. I would also be surprised if America’s big oil tycoons, a real force in the Republican Party, didn’t resist Mr. Musk’s influence. Either way, Tesla’s stock price could take a big hit, and with it drag large bubbles in areas like artificial intelligence.

As someone who is still heavily invested in US stocks, I don’t want this to happen. But I don’t mean to downplay it either. There’s a very Roaring Twenties vibe to Washington these days.

rana.foroohar@ft.com