As we enter the final months of 2025, Disney is inching closer to making the announcement the entire entertainment industry has been waiting for: who will succeed Bob Iger as the company’s next CEO.

disney has publicly announced that it will name a successor to Mr. Iger in early 2026. Two internal candidates stand out as the frontrunners: Disney Entertainment Co-Chairman Dana Walden and Disney Experience Chairman Josh D’Amaro. Walden brings decades of Hollywood expertise. D’Amaro worked in consumer products before being promoted to the theme parks division and before former leader Bob Chapek was named Disney’s CEO in 2020 to run the division.

Given the complementary skill sets of Mr. Walden and Mr. D’Amaro, and given the recent momentum behind co-CEO appointments within and outside the media, the Disney board may choose to jointly select them to succeed Mr. Iger.

is a strategic rival Netflix It has been used similarly and effectively since 2020, when Reed Hastings named Ted Sarandos co-CEO. Three years later, Hastings stepped down from his post to become executive chairman of the company and promoted Greg Peters to co-CEO.

Last year, Mr. Iger called Mr. Sarandos and asked about the Netflix co-CEO model, CNBC confirmed, based on interviews with people familiar with the matter. The call was first reported by Wall Street.

Netflix’s success has contributed to the recent wave of co-CEOs. last month, spotify The company has appointed Alex Norström and Gustav Soderström as co-CEOs, replacing founder Daniel Ek. oracle Clay Magouyrk and Mike Sicilia have been appointed as co-managers. and comcast President Mike Kavanaugh has nominated longtime CEO Brian Roberts to serve as chief executive.

But while a dual CEO structure may make sense on the surface for Disney, company insiders and corporate governance experts warn there are Mouse House-specific considerations that make such a dynamic unwise.

Netflix’s strategy

Netflix has certain circumstances that make the co-CEO structure work.

First of all, Sarandos and co-CEO Peters have different passions, said a person familiar with Netflix’s leadership styles, who asked not to be named because the details are private. This enabled the two leaders to make decisions without stepping into each other’s shoes.

If Sarandos and Peters disagree about something, they resolve it by deferring to the leader who is more passionate about the answer. This usually means Sarandos wins if the decision is about content or creative, and Peters wins if it’s a decision based on product or technology. A Netflix spokesperson declined to comment.

When there are gray areas, the co-CEOs can always turn to Hastings, the company’s co-founder and CEO for 25 years. Peters and Sarandos have worked together under Hastings for years. Sarandos told Iger that that comfort level and Netflix’s famously non-hierarchical culture helped it maintain a dual CEO structure while serving shareholders without creating turf wars, according to people familiar with the matter.

Netflix stock has risen about 275% since Peters became co-CEO in January 2023.

disney’s choice

At first glance, Walden and D’Amaro exhibit a similar dynamic to Sarandos and Peters. Walden’s specialty is Hollywood, and D’Amaro’s specialty is parks and consumer products. Mr. Iger could theoretically be promoted to chairman in a similar manner to Mr. Hastings.

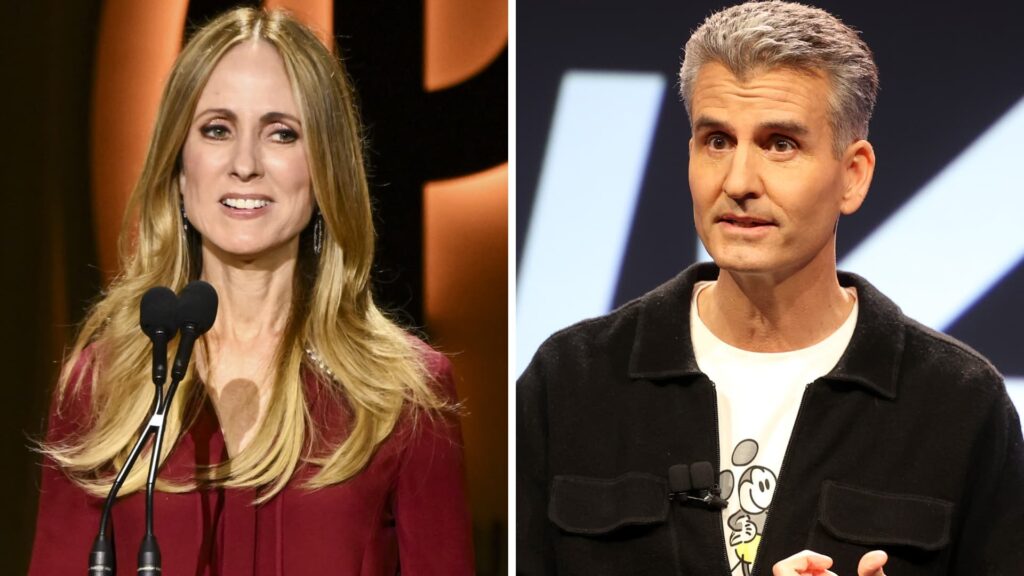

Dana Walden and Josh D’Amaro.

Michael Buckner | Erich Petersen | Getty Images

Selecting Walden and D’Amaro as Iger’s long-awaited successors could allow Disney to keep both leaders at the company. If the board chooses one over the other, Disney risks losing top executives who may want a chance to become CEO elsewhere. This happened to Disney in 2020 when head of streaming Kevin Mayer left to replace Chapek as CEO of TikTok.

But Disney’s co-CEO arrangement also comes with a number of red flags that don’t exist at other companies.

First, even if Mr. Iger remains on the board, some employees and outside partners may still view him as CEO. This could undermine the power-sharing structure between the two CEOs, especially given Iger’s reputation for wanting to remain the company’s No. 1 leader.

While Mr. Hastings has turned his attention to hobbies such as skiing since stepping down as CEO, Mr. Iger has developed a reputation for wanting to hang out as Disney’s chief executive. He postponed his retirement five times to remain in charge, returning in 2022 as his chosen successor to Capek.

Second, during Mr. Capek’s tenure, Mr. Iger did not immediately completely relinquish management responsibilities, instead choosing to lead the company’s “creative efforts” for more than a year. As CNBC detailed in 2023, that led to an ugly power-sharing situation between Iger and Capek. Even if Mr. Walden and Mr. D’Amaro have different strengths in their fields, choosing a co-CEO model after suffering through a recent period of blurred lines of control may be a case of not learning from one’s mistakes.

Third, Walden and D’Amaro have not worked together as long as Peters and Sarandos (or other co-leadership agreements that have had long-term success, such as the CAA co-chairmanship agreements with Brian Lard, Richard Lovett, and Kevin Huvene). Walden, a longtime Fox TV executive who worked with Gary Numan in a co-chair arrangement, has proven capable of succeeding in such an arrangement, but it’s unclear whether she would appreciate the chance to team up again.

Fourth, Disney’s corporate culture is famously political. The company has gone through several painful succession processes with Mr. Iger and former Disney CEO Michael Eisner. While Netflix has been largely immune to M&A, Disney is an amalgamation of many acquisitions and divisions over the years, including ABC, ESPN, Fox, Pixar, Marvel, and Lucasfilm. As a result, rather than fostering a unified corporate mindset since its founding, the company has brought together employees from a variety of cultures.

“It’s not going to work out well for Disney,” a media executive privately told CNBC. “There’s going to be a lot of backbiting. That’s the way it’s always been.”

A Disney spokesperson declined to comment.

Netflix vs. Tradition

In addition, traditional corporate governance experts have widely rejected co-CEO arrangements as suboptimal.

The Wall Street Journal reported last month, citing data from Equilar, that about 1.2% of companies in the Russell 3000 have consistently employed co-CEO structures in recent years.

“Creating two sources of authority within an organization is never a good thing,” Charles Elson, founding director of the University of Delaware’s Weinberg Center for Corporate Governance, said in an interview. “Two people in charge means no one in charge.”

Still, there are mitigating factors that could make a co-CEO arrangement more palatable, Elson said. Having Hastings as executive chairman is likely important to Netflix, as he could act as a de facto tiebreaker in a co-CEO arrangement.

Similarly, a co-CEO structure could work if it was explicitly done for longer-term succession planning, such as Comcast’s decision to promote Cavanagh to co-CEO alongside Roberts, Elson said.

When push comes to shove, Hastings and Roberts can make the biggest decisions, Elson said. Mr. Roberts is Comcast’s controlling shareholder. Similarly, Oracle has co-founder Larry Ellison as its controlling shareholder.

As executive chairman, Mr. Iger could help break the tie at Disney, but he is not the company’s founder and owns less than 1% of the company’s outstanding shares. As a result, he has less stake in Disney’s future than someone like Roberts or Ellison, Elson noted.

Elson said it may be presumptuous for Disney’s board to choose just one CEO, but it’s better than creating instability.

“Inevitably, one CEO will take over and the other will leave,” he said. “That’s human nature.”

Disclosure: Comcast is the parent company of NBCUniversal, which owns CNBC. With Comcast’s planned Versant spinoff, Versant will become CNBC’s new parent company.