Therefore, shifting production takes years, if not decades-old, if not decades-adjusted investment in automation, tools, infrastructure and training. Encouraging foreign component manufacturers to build facilities in the US is also a challenge.

“If you’re a Chinese supplier who makes certain types of components that can also be used on Huawei or Xiaomi phones, there’s leverage,” says Mohan. “The incentive to separate these factories is low because you’re gaining scale and efficiency in China that you can’t get, even if Apple is your only supplier.”

According to Tsay, policy uncertainty is another issue. “The American system, where everything can flip-flop completely every four years, doesn’t encourage corporate investment. When people and businesses invest, they need to have a longer horizon.”

Mark Randall was senior vice president at Motorola while he was considering building a smartphone factory in the US, owned by Google. The idea wasn’t impossible, but “I realized it would be incredibly difficult,” he says.

He says the US labor costs required to convert raw materials into finished products are “significantly higher” than elsewhere. For example, the United States lacks mechanical touring engineers. “We’re talking about tens of thousands of people,” due to the massive shift in electronics manufacturing.

Tariffs create “nightmares” when modeling costs for new factories, adds Randall. “This is why most companies don’t respond to the type of change we see today. You’re very strategic and you need to know where you’re going in the long run.”

Is it made in America?

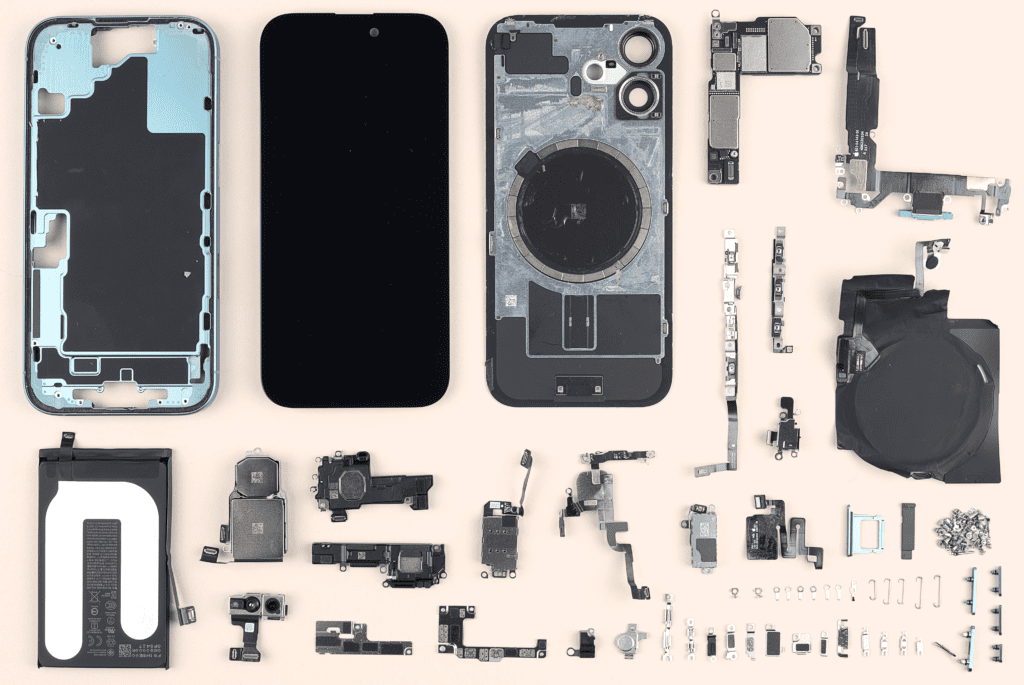

A deeper look into the supply chain of three parts of the latest iPhone model shows the complexity of moving manufacturing to the US. Incremental shift.

One component of the touchscreen, currently made in the US, is a cover manufactured by Corning, a longtime glass manufacturer from Apple in Kentucky, but the company also has facilities in China. And India.

However, the OLED display that helps maintain battery life and the integrated multi-touch layer that allows on-screen interactions are mainly produced by Samsung South Korea.

The core electronic components that make the screen work can be combined with the rest of the parts, before this component is transported to the Foxconn plant. iPhone.

Metal frames clearly capture the challenge of removing China from Apple’s supply chain. Most models use high-precision computer numerical control (CNC) machines to cut and shape the casing from the aluminum block.

TechInsights analyst Wayne Lam says the process relies on the “army” of these machines. This states that Apple vendors in China have accumulated over the years and are currently unable to replicate elsewhere. “If Apple produces iPhones on land, there are no sufficient CNC machines to buy to meet the scale of the Chinese ecosystem.” He says.

Lamb adds: “This is a special skill that is no longer possible to replicate outside of China.”

Even the simplest components of the iPhone are complex, even its miniature screws. They are made from different materials depending on their role and have many heads: Philips, Flats, Tri-Tip, Pentalobe, Especially.

However, if iPhone production moves to the US, it is process screwing that sums up the challenges facing companies. Apple’s design, which differs from many other smartphone brands, does not use adhesive to connect the frame. Analysts say that hiring screws to hire users is now more cost-effective than investing in robotic solutions.